Blockchain

DIFX Cross Asset Digital Exchange grows to 550 million USD in assets under Management with FireBlocks

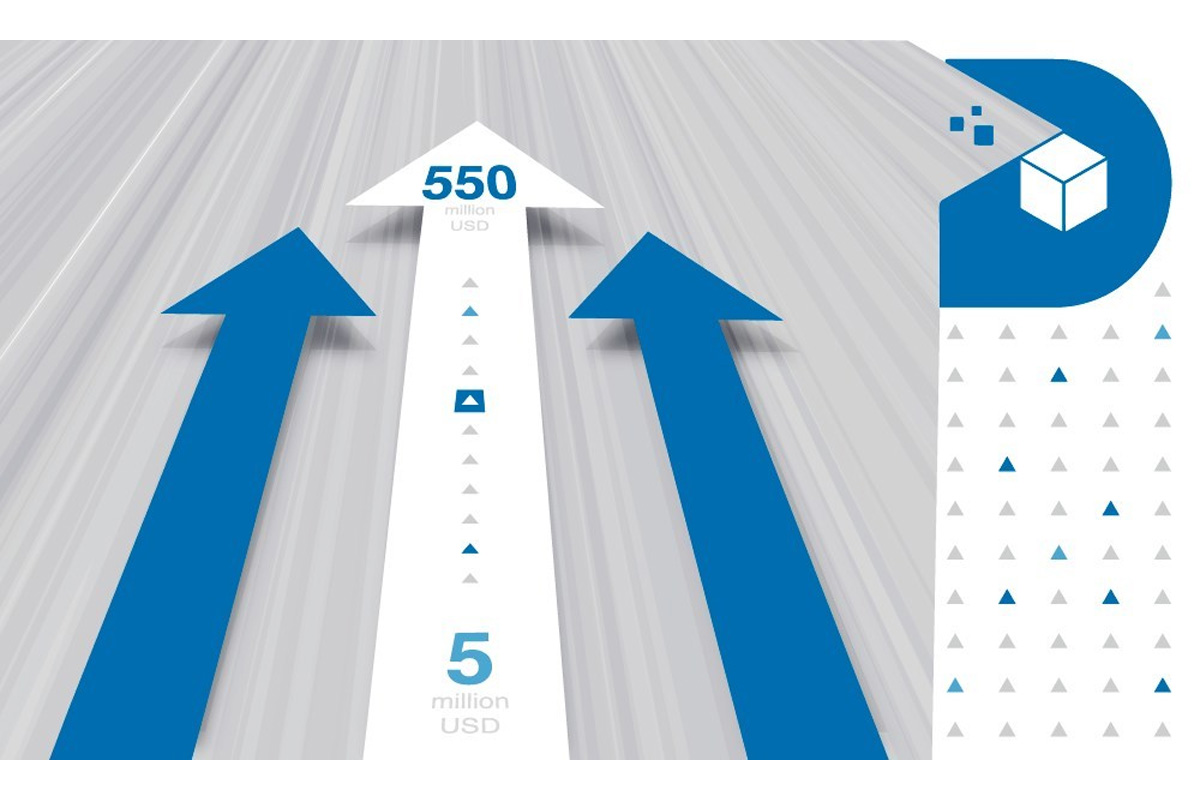

Digital Financial Exchange (DIFX), a centralized cross-asset digital exchange, grows its assets under management from 5 million USD to 550 million USD after integration with award-winning digital asset and crypto technology platform, Fireblocks.

Jeetu Kataria CEO of DIFX states, “I knew since our launch in 2020 that choosing the right crypto custody infrastructure partner was essential to our success and that achieving a strong return on investment was critical for our new trading platform. With Fireblocks, our team can focus on serving clients instead of manually managing digital assets.”

Thousands of crypto businesses use Fireblocks’ platform to access DeFi and Web3 applications and leverage the company’s suite of tools for securing custody of funds, managing their crypto and digital asset operations, tokenizing assets and building new Web3-compatible products and services.

In 2020, Fireblocks launched MPC-CMP, an open and free-to-use MPC protocol to improve the transaction speed for secure digital asset transfer by 800%.

After three months of intense research, DIFX chose Fireblocks because it was the only end-to-end solution that offered a secure direct custody technology alongside tools for increasing trading efficiency and automating operational processes and policy workflows. For example, the Ethereum Gas station utilized by DIFX sets gas fee limits by automating and batching ETH transactions to minimize fees and manual refuelling.

Furthermore, both the DIFX Spot exchange and MT5 platform leverage Fireblock’s direct custody technology to ensure the safety and security of both traditional and digital assets. The implementation serves as an additional bridge in connecting the digital and traditional assets as per the mission of DIFX and gives that extra layer of security desired by millions of traders across the globe.

The results speak for themselves. Since rolling out Fireblocks, DIFX has scaled at a remarkable rate. As Kataria explains, “We grew from 5 million USD assets in custody in 2020 to 550 million assets in custody today after rolling out Fireblocks in Spring of 2021. This is an increase of 10,900 per cent. In addition, we are saving around 100,000 USD per year in operational expenses using Fireblock’s policy engine and authorization workflows and 40,000 USD yearly in ERC-20 gas fees.” DIFX noted that many clients prefer to transact on DIFX because it is secured by Fireblocks MPC Wallet.

Michael Shaulov, CEO and Co-Founder, of Fireblocks, said, “We are always pleased to see clients such as DIFX benefit and grow from the products and services we offer. At the end of the day, we strive to provide clients like DIFX with the flexibility to adapt and scale their businesses and enable them to easily and securely bring digital asset products to market. We look forward to working alongside DIFX as they continue to adapt and innovate in this fast-paced industry.”

Blockchain

Blocks & Headlines: Today in Blockchain – May 14, 2025

Blockchain’s evolution continues at breakneck speed, shifting from niche applications into mainstream finance, supply-chain integrity, and social impact initiatives. Today’s briefing spotlights five stories that illustrate this maturation: Cardano’s seamless asset integration in the privacy-focused Brave browser; a strategic partnership between Cokeeps and Maybank Trustees to bring tokenized wealth management to institutional clients; Ripple’s leadership framing blockchain as the dismantler of traditional banking silos; the UNDP’s pilot using distributed ledgers to improve HIV treatment tracking across Eurasia; and a novel IoT-blockchain collaboration to authenticate fine wines end-to-end. In this op-ed–style roundup, we analyze not only the mechanics of each announcement but also their broader implications for Web3’s scaling, DeFi’s credibility, and blockchain’s social-good potential.

1. Cardano Integrates Native Blockchain Assets into Brave Browser

What Happened

On May 13, Cardano foundation engineers unveiled a collaboration with Brave Software to natively support Cardano blockchain assets—ADA tokens and native tokens—within Brave’s wallet panel. Users can now view balances, send ADA, stake directly, and interact with back-end metadata for Cardano NFTs, all without leaving the Brave interface. This move follows Brave’s earlier Ethereum and Solana integrations, signaling a multi-chain future for privacy-centric browsers.

Analysis & Implications

-

User Experience Leap: By embedding Cardano functionality at the browser level, Brave eliminates friction for onboarding new users who would otherwise juggle external wallets or browser extensions. Easier access to staking and NFT markets could drive stronger engagement for Cardano’s ecosystem.

-

Multi-Chain Convergence: Brave’s strategy underscores the shift from siloed blockchain apps toward unified, chain-agnostic user experiences. As Web3 users demand seamless access across protocols, wallets and browsers will compete to offer the most inclusive multi-chain dashboards.

-

Cardano’s Market Position: For Cardano, this integration is a validation of its low-fee, high-throughput value proposition. While Ethereum remains dominant in DeFi and NFTs, Cardano’s energy efficiency and growing dApp roster may attract users seeking alternatives—especially if wallet UX barriers continue to fall.

Opinion

Brave’s embrace of Cardano assets exemplifies the coming era of “wallet-agnostic” access, where the browser becomes the front door to multiple blockchains. For Cardano, it’s a critical trust signal that boosts on-ramps and could accelerate liquidity in its DeFi protocols. Yet success hinges on robust in-browser security and responsive UI design—any wallet bugs or performance lags will erode the trust this collaboration seeks to build.

Source: CoinDesk

2. Cokeeps & Maybank Trustees Develop Blockchain Asset-Management Solutions

What Happened

Malaysia’s Cokeeps, a digital-asset custody pioneer, has partnered with Maybank Trustees to design and deploy tokenized asset-management platforms for institutional investors. The joint solution leverages a permissioned blockchain to record ownership of tokenized bonds, real-estate funds, and alternative-assets, while integrating smart-contract–driven compliance checks and real-time audit trails.

Analysis & Implications

-

Institutional Adoption: By combining Cokeeps’s custody technology with Maybank’s regulatory expertise and trustee services, the duo addresses two perennial barriers to institutional crypto investment: custody risk and compliance certainty. This model could serve as a blueprint for other Asia-Pacific custodians.

-

Tokenization Benefits: Tokenized securities on a shared ledger can reduce settlement times from days to seconds, lower transaction costs, and open fractional-ownership models—broadening access to asset classes historically reserved for high-net-worth individuals.

-

Regulatory Alignment: Embedding KYC/AML logic into smart contracts ensures that every token transfer automatically enforces jurisdictional rules. As regulators worldwide demand transparent on-chain auditability, such integrated controls will become table stakes for institutional offerings.

Opinion

This collaboration exemplifies how established financial institutions can embrace blockchain without ceding control. Rather than disrupting Maybank’s trustee role, tokenization enhances it—transforming trustees from manual record-keepers into guardians of programmable assets. The real test will be scale: can the platform handle high-volume trading with uncompromised security and consistency? If so, we may see a wave of legacy banks repackaging their services through blockchain rails.

Source: The Star

3. Ripple Board Member: “Blockchain Is Unbundling Banks”

What Happened

On May 14, Stuart Alderoty, a board member at Ripple Labs, declared in an industry webcast that blockchain technology is fundamentally “unbundling” traditional banking services—payments, settlements, custody, and compliance are each evolving into modular, chain-native offerings. He argued that banks will increasingly source best-of-breed infrastructure from fintech and blockchain providers rather than maintain monolithic, in-house systems.

Analysis & Implications

-

Modular Finance: Alderoty’s vision anticipates a composable finance ecosystem: banks orchestrate various on-chain services—liquidity pools, cross-border rails, automated KYC—via APIs, akin to how e-commerce platforms integrate third-party payment gateways and fraud-prevention tools today.

-

Competitive Pressure: Incumbent banks face competition not only from neobanks but also from protocol-level service providers (e.g., on-chain oracles, decentralized exchanges). To retain clients, banks must either build or partner to offer seamless, blockchain-enhanced products.

-

Industry Collaboration: Ripple itself underscores this shift: its On-Demand Liquidity service unbundles foreign-exchange and settlement from legacy correspondent banking, delivering real-time cross-border payments at reduced cost.

Opinion

The unbundling thesis places a premium on interoperability and standards. Without common protocols, financial services risk siloed “rails” that mimic today’s fragmented SWIFT-based processes. Collaborative industry consortia—like the U.K.’s Project Rosalind or Japan’s mHUB—will be crucial to define shared messaging formats and governance frameworks. For blockchain to truly disaggregate banking, ecosystem players must coalesce around open, secure standards.

Source: U.Today

4. UNDP’s Big Ideas: Using Blockchain to Fight HIV in Eurasia

What Happened

The United Nations Development Programme (UNDP) launched its “Big Ideas” pilot in Eurasia, deploying a blockchain-enabled platform to manage HIV treatment data across multiple countries. The solution uses a hybrid public-private ledger to ensure patient anonymity while providing authorized clinics and NGOs with secure, immutable access to treatment adherence records and drug-dispensation logs.

Analysis & Implications

-

Data Privacy & Integrity: The hybrid architecture combines zero-knowledge proofs on a public chain—verifying treatment events without exposing personal health information—with a consortium chain that controls participant permissions. This dual model balances transparency and confidentiality.

-

Cross-Border Collaboration: HIV programs often span regions with varying healthcare regulations. A shared blockchain registry simplifies data exchange, reducing duplication and ensuring each patient’s history is up to date, even when they move between clinics or countries.

-

Scalability & Sustainability: Running on energy-efficient proof-of-stake networks and leveraging off-chain data storage for sensitive medical records, the platform minimizes transaction costs while maintaining high throughput—essential for scaling across thousands of patients.

Opinion

UNDP’s blockchain pilot represents a maturation of social-impact use cases—from proof-of-concepts to production-grade systems. By prioritizing patient privacy and regulatory alignment, this model could extend to other health-data challenges, such as vaccine distribution or epidemic tracking. The key will be forging long-term partnerships between multilateral organizations, local health authorities, and blockchain providers to sustain and expand the network beyond the pilot phase.

Source: UNDP

5. Identiv, ZaTap & Genuine Analytics Digitally Authenticate Fine Wines

What Happened

Identiv, ZaTap, and Genuine Analytics have unveiled a joint solution that employs specialized IoT tags and blockchain to verify the provenance of fine wines. Each bottle is fitted with a tamper-evident sensor that records temperature, humidity, and location data onto a permissioned ledger. Consumers can scan an NFC-enabled label to view the wine’s end-to-end history—from vineyard pressing to cellar aging and global shipping.

Analysis & Implications

-

Counterfeit Mitigation: The fine-wine market suffers from widespread fraud, with counterfeit bottles estimated to comprise up to 20% of high-end sales. Immutable provenance records and sensor-backed condition reports significantly raise the bar for authenticity verification.

-

Consumer Trust & Engagement: Beyond security, the solution enhances the collector experience—buyers gain confidence in their purchase and a richer narrative around each vintage’s journey, potentially commanding higher resale values on secondary markets.

-

Cross-Industry Potential: This IoT-blockchain fusion can be adapted for other luxury goods—artworks, haute horlogerie, or premium spirits—where provenance and condition are paramount.

Opinion

By blending real-world data streams with ledger immutability, this collaboration exemplifies blockchain’s most compelling value proposition: trusted digital twins of physical assets. However, the system’s integrity depends on robust IoT security—if sensors are spoofed or tampered with, the chain of trust breaks. Stakeholders must therefore enforce secure tag provisioning, periodic audits, and tamper detection measures to uphold the solution’s credibility.

Source: PR Newswire

Conclusion

Today’s blockchain dispatch underscores a pivotal shift: decentralized ledgers are weaving into the fabric of finance, social impact, and supply-chain integrity. From Brave’s browser-level Cardano support to tokenized asset platforms, from the unbundling of banking services to health-data pilots and luxury-goods authentication, blockchain is proving its versatility and maturing beyond speculative markets. As on-chain and off-chain worlds converge, interoperability, security, and standards will determine which projects scale and which falter. For stakeholders across Web3, DeFi, and enterprise IT, the imperative is clear: embrace modular architectures, uphold rigorous governance, and focus on real-world value—only then will blockchain realize its promise of trust, transparency, and transformative efficiency.

The post Blocks & Headlines: Today in Blockchain – May 14, 2025 appeared first on News, Events, Advertising Options.

Blockchain

Investview, Inc. (“INVU”) Reports Financial Results and Current Operational and Financial Highlights for the First Quarter Ended March 31, 2025

Blockchain

CapitalRevo Reveals Powerful AI-Driven Features Ushering in a New Era of Smart Trading

CapitalRevo AI

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days agoHTX and Justin Sun Launch $6M Mars Program Special Edition, Offering One User a Historic Space Journey

-

Blockchain6 days ago

Blockchain6 days agoBitget Blockchain4Youth sostiene l’innovazione del Web3 e dell’IA all’hackathon “Build with AI” di Google Developer Group

-

Blockchain Press Releases6 days ago

Blockchain Press Releases6 days agoBybit Surpasses 70 Million Users, Reinforces Commitment to Transparency and Institutional Growth

-

Blockchain6 days ago

Blockchain6 days agoBlocks & Headlines: Today in Blockchain – May 9, 2025 | Robinhood, Solana, Tether, China, Women in Web3

-

Blockchain2 days ago

Blockchain2 days agoBlocks & Headlines: Today in Blockchain – May 12, 2025 | Rootstock, Zimbabwe Carbon Registry, Fastex, 21Shares, The Blockchain Group

-

Blockchain Press Releases2 days ago

Blockchain Press Releases2 days agoBullish partners with the Gibraltar Government and GFSC to pioneer world’s first crypto clearing regulation

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days agoMEXC Lists USD1, Accelerating Global Stablecoin Innovation with World Liberty Financial

-

Latest News6 days ago

Latest News6 days agoCasino Kings Knocks Out Partnership with Boxing Powerhouse BoxNation