Blockchain

Goldman Sachs Sees Ethereum Rallying by 80% Within the Next Two Months

October saw the popular cryptocurrency Ethereum notch 40% in gains, and hit a market cap six times the size of the second-largest altcoin, Binance Coin. Now, analysts from Goldman Sachs are predicting that Ethereum could rally by 80% within the next two months to reach $8,000. Ethereum has far outperformed Bitcoin this year thanks to surging retail and institutional investor interest in the altcoin, which is causing companies to race to mine more of it as well. WonderFi Technologies (NEO:WNDR) (OTCPK:WONDF), is one of the blockchain companies growing its DeFi portfolio with Ethereum at the centre of its strategy. Other big names like Marathon Digital Holdings, Inc. (NASDAQ:MARA), Mobilum Technologies Inc. (CSE:MBLM) (OTCPK:MBLMF), HUT 8 Mining Corp. (NASDAQ:HUT), and DMG Blockchain (TSX-V:DMGI) (OTCQB:DMGGF) continue to move toward a decentralized finance future that includes Ethereum as one of the key cryptocurrencies.

WonderFi Technologies (NEO:WNDR) (OTC:WONDF) took a step toward opening up opportunities with its product offerings as it announced that it had established and deployed additional proof of stake (PoS) validator nodes on the Ethereum network. In total, WonderFi has 10 full Ethereum nodes. These validator nodes play a critical role in securing the network and validating transactions for blockchain protocols that use PoS consensus mechanisms. This is aimed at developing a more secure system for transactions and accuracy for the Ethereum network.

This will allow WonderFi Technologies to continue to grow its infrastructure. Another major benefit includes that 6% APY on staked assets that users can earn when staking Ethereum through a validator node. The announcement came at an ideal time, as Ethereum just reached an all-time high of US$4,507.

Earlier this week, WonderFi also announced it had received approval from its Board of Directors to purchase up to C$10 million in digital assets, which will be weighted across key assets that drive and enhance value in the DeFi sector. This is in line with WonderFi’s strategy of adding to its existing balance of long-term holdings.

This news follows the closing of a bought deal financing of approximately C$26.4 million led by Canaccord Genuity Corp. with the majority of the proceeds to go toward the product development roadmap and another portion allocated to growing WonderFi‘s digital asset portfolio.

For more information on WonderFi Technologies, please visit this link.

Crypto Companies Continue Gaining Traction in the Booming Market

Technology-driven Payment Service Provider (PSP) Mobilum Technologies Inc. (CSE:MBLM) (OTC:MBLMF) has continued toward its goal of making traditional finance accessible through digital payment infrastructure and digital asset management technologies. On October 25, the company announced the launch of its updated over-the-counter crypto trading desk. Mobilum‘s OTC trading desk, which is designed exclusively for high net-worth individuals and institutions looking to execute large-volume orders of Bitcoin and other cryptocurrencies for transactions above $50,000, has generated approximately C$20 million in transaction volume to date. The company also recently appointed well-known Bicoin pioneer and CEO of Coinstream, Michael Vogel as Chief Executive Officer and CEO of Mobilum OÜ Wojciech Kaszycki as President.

Last month, Marathon Digital Holdings, Inc. (NASDAQ:MARA), one of the largest enterprise Bitcoin mining companies in North America, announced that it had produced 1,252.4 new-minted Bitcoins during Q3 2021. That represents a 91% increase quarter-over-quarter that reflects an increased interest in growing its holdings of cryptocurrencies. To accelerate its growth, the company obtained a $100 million revolving line of credit from Silvergate Bank. The line of credit is secured by Bitcoin and USD.

On September 9, DMG Blockchain (TSX-V:DMGI) (OTCQB:DMGGF) announced that it will become the first North American Bitcoin miner to join Marathon Digital’s mining pool, MaraPool. DMG began pointing 100% of its hash rate towards the US-based Bitcoin mining pool on September 13, as the pool opened to additional Bitcoin mining companies. DMG went on to announce on October 20 that using a testnet environment, it had initiated a new function called Petra. This gives subscribers more optionality for initiating cryptocurrency transactions, providing subscribers with more choice with respect to how they proceed with transactions.

Leading digital currency miner HUT 8 Mining Corp. (NASDAQ:HUT) announced that it has purchased 12,000 new MicroBT Miners for delivery starting in January 2022. This is to increase the company’s mining capacity. With first deliveries beginning in January 2022 at a rate of approximately 1,000 machines per month, the company expects full deployment to be achieved by December 2022. HUT 8 also recently announced that the development of its third mining site was underway in North Bay, Ontario. The site, which is expected to be online by the end of 2021, will enable the company to generate power using a blend of by-product steam, hydrogen and natural gas in conjunction with a geothermal system.

DISCLAIMER: Microsmallcap.com (MSC) is the source of the Article and content set forth above. References to any issuer other than the profiled issuer are intended solely to identify industry participants and do not constitute an endorsement of any issuer and do not constitute a comparison to the profiled issuer. FN Media Group (FNM) is a third-party publisher and news dissemination service provider, which disseminates electronic information through multiple online media channels. FNM is NOT affiliated with MSC or any company mentioned herein. The commentary, views and opinions expressed in this release by MSC are solely those of MSC and are not shared by and do not reflect in any manner the views or opinions of FNM. Readers of this Article and content agree that they cannot and will not seek to hold liable MSC and FNM for any investment decisions by their readers or subscribers. MSC and FNM and their respective affiliated companies are a news dissemination and financial marketing solutions provider and are NOT registered broker-dealers/analysts/investment advisers, hold no investment licenses and may NOT sell, offer to sell or offer to buy any security.

The Article and content related to the profiled company represent the personal and subjective views of the Author (MSC), and are subject to change at any time without notice. The information provided in the Article and the content has been obtained from sources which the Author believes to be reliable. However, the Author (MSC) has not independently verified or otherwise investigated all such information. None of the Author, MSC, FNM, or any of their respective affiliates, guarantee the accuracy or completeness of any such information. This Article and content are not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action; readers are strongly urged to speak with their own investment advisor and review all of the profiled issuer’s filings made with the Securities and Exchange Commission before making any investment decisions and should understand the risks associated with an investment in the profiled issuer’s securities, including, but not limited to, the complete loss of your investment. FNM was not compensated by any public company mentioned herein to disseminate this press release but was compensated twenty five hundred dollars by MSC, a non-affiliated third party to distribute this release on behalf of WonderFi Technologies Inc.

FNM HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. “Forward-looking statements” describe future expectations, plans, results, or strategies and are generally preceded by words such as “may”, “future”, “plan” or “planned”, “will” or “should”, “expected,” “anticipates”, “draft”, “eventually” or “projected”. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a company’s annual report on Form 10-K or 10-KSB and other filings made by such company with the Securities and Exchange Commission. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and MSC and FNM undertake no obligation to update such statements.

Blockchain

39% of Canada’s institutional investors have exposure to crypto: KPMG

According to a report from CoinTelegraph, nearly forty percent of institutional investors in Canada have exposure to cryptocurrency, as revealed by KPMG. This finding underscores the growing acceptance and adoption of digital assets among institutional investors in the country.

The report indicates that a significant portion of institutional investors in Canada are actively investing in or exploring opportunities in the cryptocurrency market. This trend reflects a shift in sentiment towards digital assets, with more investors recognizing the potential for long-term growth and diversification offered by cryptocurrencies.

KPMG’s findings highlight the increasing mainstream acceptance of cryptocurrencies among traditional investors, as well as the growing interest in blockchain technology and its potential applications across various industries. As institutional investors continue to enter the cryptocurrency market, they are expected to bring additional capital and liquidity, further fueling the growth and maturation of the digital asset ecosystem.

Overall, KPMG’s report signals a significant milestone in the adoption of cryptocurrencies in Canada, indicating that institutional investors are increasingly recognizing the value proposition of digital assets and integrating them into their investment portfolios. This trend is likely to accelerate the broader adoption and mainstream acceptance of cryptocurrencies in the country and beyond.

Source: cointelegraph.com

The post 39% of Canada’s institutional investors have exposure to crypto: KPMG appeared first on HIPTHER Alerts.

Blockchain

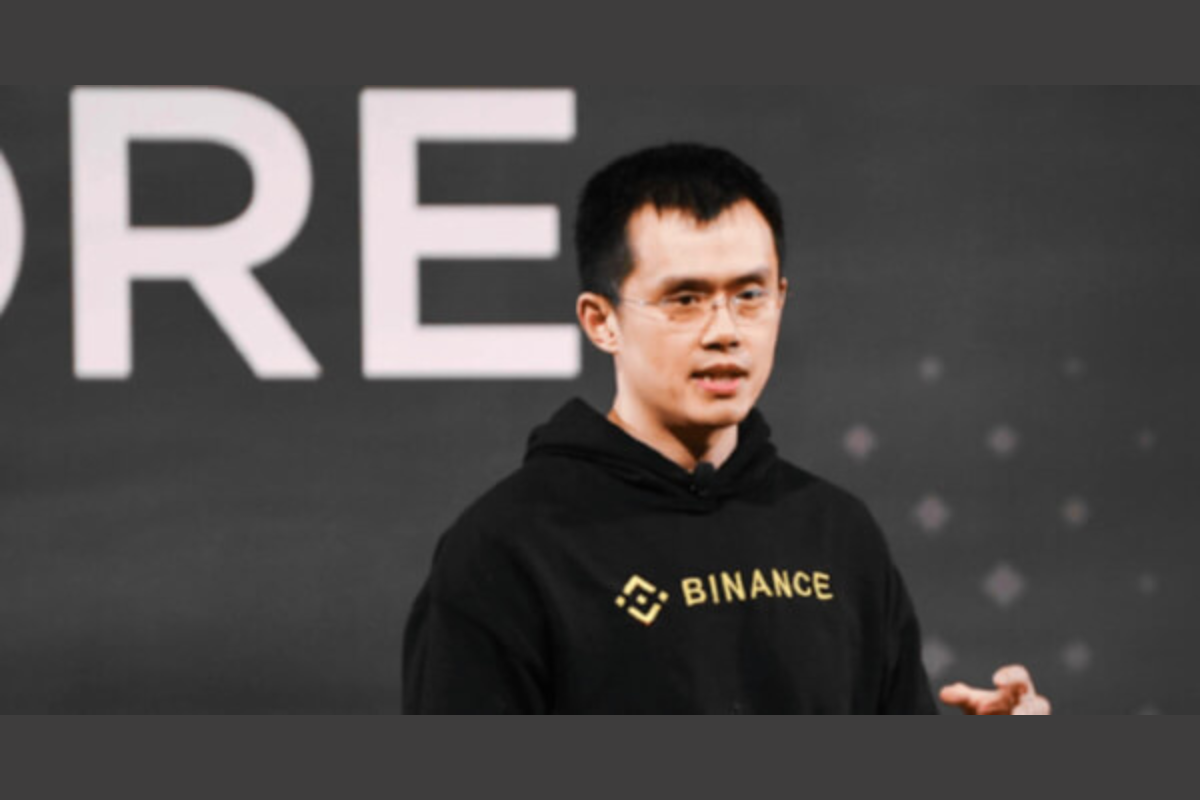

BounceBit (BB) Megadrop Now Open: Participate by Subscribing to BNB Locked Products or Completing Web3 Quests

The BounceBit (BB) Megadrop is now open for participation, as announced by Blockchain.News. This event presents an exciting opportunity for users to earn BB tokens by engaging in various activities, including subscribing to BNB locked products and completing Web3 quests.

Participants can join the BB Megadrop by subscribing to BNB locked products or completing Web3 quests, both of which offer different avenues for earning BB tokens. By participating in these activities, users have the chance to accumulate BB tokens and potentially benefit from the rewards associated with the Megadrop.

Subscribing to BNB locked products allows users to earn BB tokens by locking their BNB assets for a specified period. This not only provides users with an opportunity to earn rewards but also contributes to the liquidity and stability of the BounceBit ecosystem.

Additionally, completing Web3 quests offers users an alternative way to earn BB tokens by engaging in various tasks and challenges related to Web3 technology. These quests provide users with a fun and interactive way to learn about blockchain and cryptocurrency while earning rewards in the form of BB tokens.

Overall, the BB Megadrop presents an exciting opportunity for users to participate in the BounceBit ecosystem and earn rewards by engaging in activities that contribute to the growth and development of the platform. As the Megadrop progresses, participants can look forward to additional opportunities to earn BB tokens and potentially benefit from the rewards associated with this event.

Source: blockchain.news

The post BounceBit (BB) Megadrop Now Open: Participate by Subscribing to BNB Locked Products or Completing Web3 Quests appeared first on HIPTHER Alerts.

Blockchain

Cronos collaborates with KYVE to revolutionize Blockchain Data

Cronos, a prominent blockchain platform, has announced a collaboration with KYVE aimed at revolutionizing blockchain data, as reported by CryptoNewsZ. This partnership represents a significant step forward in enhancing the efficiency and scalability of blockchain data storage and retrieval.

The collaboration between Cronos and KYVE seeks to leverage KYVE’s decentralized data storage and retrieval solution to enhance the capabilities of the Cronos blockchain platform. By integrating KYVE’s technology, Cronos aims to address the challenges associated with storing and accessing large volumes of data on the blockchain, such as scalability and cost-effectiveness.

KYVE’s decentralized data storage solution utilizes a network of distributed nodes to store and retrieve data, ensuring high availability and reliability. This approach not only improves the efficiency of data storage and retrieval but also enhances the security and resilience of the blockchain network.

The partnership between Cronos and KYVE is expected to unlock new possibilities for decentralized applications (dApps) and smart contracts built on the Cronos platform. By providing a more efficient and scalable solution for blockchain data management, Cronos aims to attract developers and enterprises seeking to leverage blockchain technology for a wide range of applications.

Overall, the collaboration between Cronos and KYVE represents a significant development in the blockchain industry, highlighting the importance of innovation and collaboration in driving the evolution of decentralized technologies. As the partnership progresses, it is poised to deliver transformative benefits for blockchain data management and accelerate the adoption of decentralized applications and services.

Source: cryptonewsz.com

The post Cronos collaborates with KYVE to revolutionize Blockchain Data appeared first on HIPTHER Alerts.

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days agoDWF Labs joins the Klaytn Governance Council

-

Blockchain7 days ago

Blockchain7 days agoPhoenix Group Engages BHM Capital as Liquidity Provider to Boost ADX Liquidity and Enhance Market Dynamics

-

Blockchain Press Releases3 days ago

Blockchain Press Releases3 days agoDeFi Lens builds advanced Generative AI for Technical Analysis

-

Blockchain7 days ago

Blockchain7 days agoCrypto fans count down to bitcoin’s ‘halving’

-

Blockchain7 days ago

Blockchain7 days agoTether USDT stablecoin goes live on TON blockchain

-

Blockchain3 days ago

Blockchain3 days agoVenezuela’s Oil Giant Turns to Crypto as US Sanctions Bite Again

-

Blockchain3 days ago

Blockchain3 days agoHalving weakness sees $206 million exit crypto funds, Bitcoin miners pivot to AI

-

Blockchain7 days ago

Blockchain7 days agoSupply Chain Finance Market Forecast to Reach $9.4 Billion by 2029: Increasing Emphasis on Sustainable Sourcing