Blockchain

Bitcoin SV payment processor Centi closes funding round headlined by Dr. Jürg Conzett & Calvin Ayre

Centi, the Switzerland-based Bitcoin SV payments processor, today announces that it has closed its first funding round headlined by Dr. Jürg Conzett, founder of Zurich’s MoneyMuseum & technology entrepreneur Calvin Ayre, founder of the Ayre Group and CoinGeek.

Founded by long-time Bitcoin advocate Bernhard Müller, Centi is a system that enables merchants to accept digital currency payments through existing Point of Sale (POS) infrastructure. By integrating with existing POS systems and acquirers and avoiding the need for additional hardware, Centi offers a streamlined solution for businesses to begin accepting Bitcoin SV payments, which attract much lower fees for merchants compared with traditional payment networks.

With Centi, from a merchant’s perspective, nothing changes. Because the product integrates into existing POS systems, no additional hardware is required, nor is additional staff training necessary. Payments are made by customers in BSV, but received by merchants in their local fiat currency, eliminating issues associated with accepting and accounting for digital currencies.

The first merchants utilising the Centi system for payments will be online and available for use later this year, with an initial rollout planned with retail partners across Switzerland.

The Centi payments platform is built for use exclusively with Bitcoin SV – its blockchain being the only solution that offers the fast processing times, predictable low fees, and unbounded scaling required to compete with traditional providers in the space. The Bitcoin SV network enjoys transaction fees as low as 1/100 of a U.S. cent, in contrast to transaction fees on the BTC network which are expensive and unpredictable (average BTC fees ranged wildly from USD $.55 to $6.64 over the past 3 months). Even with service fees charged by Centi, its system will cost less for merchants than payment cards.

In keeping with the wider mission of Bitcoin SV to operate an ecosystem that maintains lawful conduct and is regulation friendly, Centi has become a member of the Financial Services Standards Association (VQF), a self-regulatory organization focused on AML for financial intermediaries in Switzerland.

Centi Founder Bernhard Müller, commenting on the close of the funding round, said:

“I feel privileged to work with two such experienced investors – Calvin Ayre and Dr Jürg Conzett – on creating the digital cash register of the 21st century. At this stage, expertise and business connections are just as important as the investment money. It humbles me to be able to work with top tier business professionals who recognize the commercial value of our ideas and placed their trust in Centi to realize and extend our vision.”

Dr Jürg Conzett commented on his decision to support Centi:

“I have invested in Centi because of the excellence and commitment of the founder, the scaling ability of BSV and the wish to support a commercial Bitcoin product. Centi is well prepared to take advantage of combining blockchain with an efficient, low cost payment system. Further it has potential to add features no other payments system has today.”

Calvin Ayre pointed to Centi’s potential to quickly drive usage of BSV payments as motivating his decision to invest:

“In the digital currency space, we need to reframe thinking so that value is derived from real utility. Centi’s technology offers a breakthrough solution for the easy adoption of Bitcoin SV by merchants. The innovative technology developed by Centi coupled with a blockchain that can scale makes for an exciting combination, one that I’m confident will prove a pivotal step in Bitcoin SV’s evolution as the digital currency of choice.”

Centi’s emergence reflects Switzerland’s rise as a hub for Bitcoin SV business, as other BSV companies also look to expand presence in the European country.

Blockchain

39% of Canada’s institutional investors have exposure to crypto: KPMG

According to a report from CoinTelegraph, nearly forty percent of institutional investors in Canada have exposure to cryptocurrency, as revealed by KPMG. This finding underscores the growing acceptance and adoption of digital assets among institutional investors in the country.

The report indicates that a significant portion of institutional investors in Canada are actively investing in or exploring opportunities in the cryptocurrency market. This trend reflects a shift in sentiment towards digital assets, with more investors recognizing the potential for long-term growth and diversification offered by cryptocurrencies.

KPMG’s findings highlight the increasing mainstream acceptance of cryptocurrencies among traditional investors, as well as the growing interest in blockchain technology and its potential applications across various industries. As institutional investors continue to enter the cryptocurrency market, they are expected to bring additional capital and liquidity, further fueling the growth and maturation of the digital asset ecosystem.

Overall, KPMG’s report signals a significant milestone in the adoption of cryptocurrencies in Canada, indicating that institutional investors are increasingly recognizing the value proposition of digital assets and integrating them into their investment portfolios. This trend is likely to accelerate the broader adoption and mainstream acceptance of cryptocurrencies in the country and beyond.

Source: cointelegraph.com

The post 39% of Canada’s institutional investors have exposure to crypto: KPMG appeared first on HIPTHER Alerts.

Blockchain

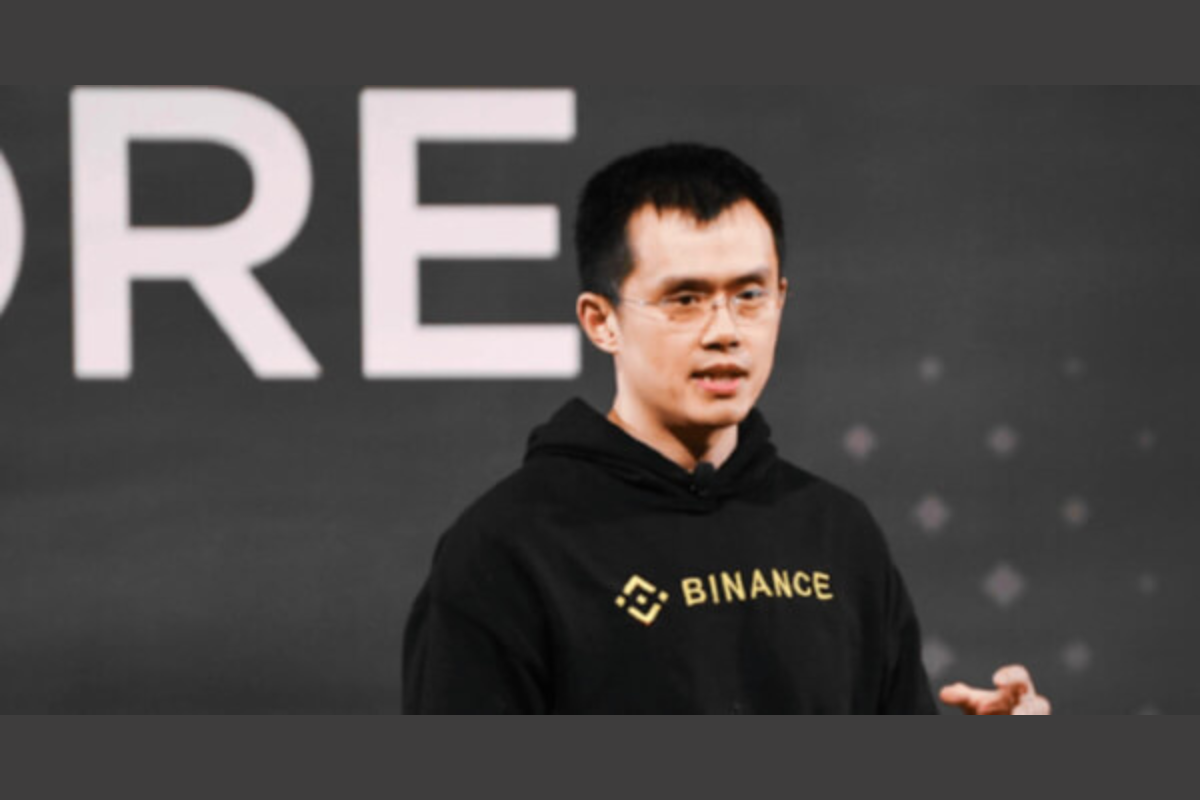

BounceBit (BB) Megadrop Now Open: Participate by Subscribing to BNB Locked Products or Completing Web3 Quests

The BounceBit (BB) Megadrop is now open for participation, as announced by Blockchain.News. This event presents an exciting opportunity for users to earn BB tokens by engaging in various activities, including subscribing to BNB locked products and completing Web3 quests.

Participants can join the BB Megadrop by subscribing to BNB locked products or completing Web3 quests, both of which offer different avenues for earning BB tokens. By participating in these activities, users have the chance to accumulate BB tokens and potentially benefit from the rewards associated with the Megadrop.

Subscribing to BNB locked products allows users to earn BB tokens by locking their BNB assets for a specified period. This not only provides users with an opportunity to earn rewards but also contributes to the liquidity and stability of the BounceBit ecosystem.

Additionally, completing Web3 quests offers users an alternative way to earn BB tokens by engaging in various tasks and challenges related to Web3 technology. These quests provide users with a fun and interactive way to learn about blockchain and cryptocurrency while earning rewards in the form of BB tokens.

Overall, the BB Megadrop presents an exciting opportunity for users to participate in the BounceBit ecosystem and earn rewards by engaging in activities that contribute to the growth and development of the platform. As the Megadrop progresses, participants can look forward to additional opportunities to earn BB tokens and potentially benefit from the rewards associated with this event.

Source: blockchain.news

The post BounceBit (BB) Megadrop Now Open: Participate by Subscribing to BNB Locked Products or Completing Web3 Quests appeared first on HIPTHER Alerts.

Blockchain

Cronos collaborates with KYVE to revolutionize Blockchain Data

Cronos, a prominent blockchain platform, has announced a collaboration with KYVE aimed at revolutionizing blockchain data, as reported by CryptoNewsZ. This partnership represents a significant step forward in enhancing the efficiency and scalability of blockchain data storage and retrieval.

The collaboration between Cronos and KYVE seeks to leverage KYVE’s decentralized data storage and retrieval solution to enhance the capabilities of the Cronos blockchain platform. By integrating KYVE’s technology, Cronos aims to address the challenges associated with storing and accessing large volumes of data on the blockchain, such as scalability and cost-effectiveness.

KYVE’s decentralized data storage solution utilizes a network of distributed nodes to store and retrieve data, ensuring high availability and reliability. This approach not only improves the efficiency of data storage and retrieval but also enhances the security and resilience of the blockchain network.

The partnership between Cronos and KYVE is expected to unlock new possibilities for decentralized applications (dApps) and smart contracts built on the Cronos platform. By providing a more efficient and scalable solution for blockchain data management, Cronos aims to attract developers and enterprises seeking to leverage blockchain technology for a wide range of applications.

Overall, the collaboration between Cronos and KYVE represents a significant development in the blockchain industry, highlighting the importance of innovation and collaboration in driving the evolution of decentralized technologies. As the partnership progresses, it is poised to deliver transformative benefits for blockchain data management and accelerate the adoption of decentralized applications and services.

Source: cryptonewsz.com

The post Cronos collaborates with KYVE to revolutionize Blockchain Data appeared first on HIPTHER Alerts.

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days agoDWF Labs joins the Klaytn Governance Council

-

Blockchain7 days ago

Blockchain7 days agoPhoenix Group Engages BHM Capital as Liquidity Provider to Boost ADX Liquidity and Enhance Market Dynamics

-

Blockchain7 days ago

Blockchain7 days agoCrypto fans count down to bitcoin’s ‘halving’

-

Blockchain7 days ago

Blockchain7 days agoTether USDT stablecoin goes live on TON blockchain

-

Blockchain Press Releases3 days ago

Blockchain Press Releases3 days agoDeFi Lens builds advanced Generative AI for Technical Analysis

-

Blockchain2 days ago

Blockchain2 days agoVenezuela’s Oil Giant Turns to Crypto as US Sanctions Bite Again

-

Blockchain2 days ago

Blockchain2 days agoHalving weakness sees $206 million exit crypto funds, Bitcoin miners pivot to AI

-

Blockchain6 days ago

Blockchain6 days agoSupply Chain Finance Market Forecast to Reach $9.4 Billion by 2029: Increasing Emphasis on Sustainable Sourcing