Blockchain

WaykiChain (WICC) Attends the 20th China Development Forum (CDF)

Reading Time: 1 minute

Reading Time: 1 minute

WaykiChain (WICC), a third-generation blockchain company, was recently invited to attend the 20th China Development Forum (CDF) at Diaoyutai State Guesthouse in Beijing from March 23 to 25, 2019. WaykiChain CEO Hang Gao, along with other WaykiChain team members, represented the blockchain industry at the Forum. As a pivotal platform for government institutions, the global business community, multilateral international organizations, and academia, the Forum serves to provide focus on important global and business trends. This year’s Forum revolved around supply-side structural reform, free-trade zones and free-trade ports, 5G technology, WTO reform and international financial architecture.

The Forum offered the WaykiChain team the opportunity to further introduce itself and its services to an international audience. Hang Gao communicated the potential blockchain has to offer in areas like finance and business with leaders in these fields from various countries. He also explained the future benefits of blockchain technology to enterprise innovation.

“Blockchain has a bright future and can bring benefits to every part of a person’s life,” Hang Gao told them. “I believe the next bull market will be triggered by some killer-level Dapps, and hopefully, WaykiChain’s products will be one of them.”

WaykiChain’s product offerings are constantly growing. WaykiChain has rolled out its Developer Incentive Program between January and March of 2019, aiming at enriching and promoting the development of the WaykiChain ecology with developers. On March 22, 2019, WaykiChain also officially launched its DApp, WaykiTime 1.2.0. The management and technical team continues to develop the product line thanks to its rich experience and international background. After the CDF, WaykiChain hopes to further extend its international market and create closer ties with overseas partners.

SOURCE WaykiChain

Blockchain

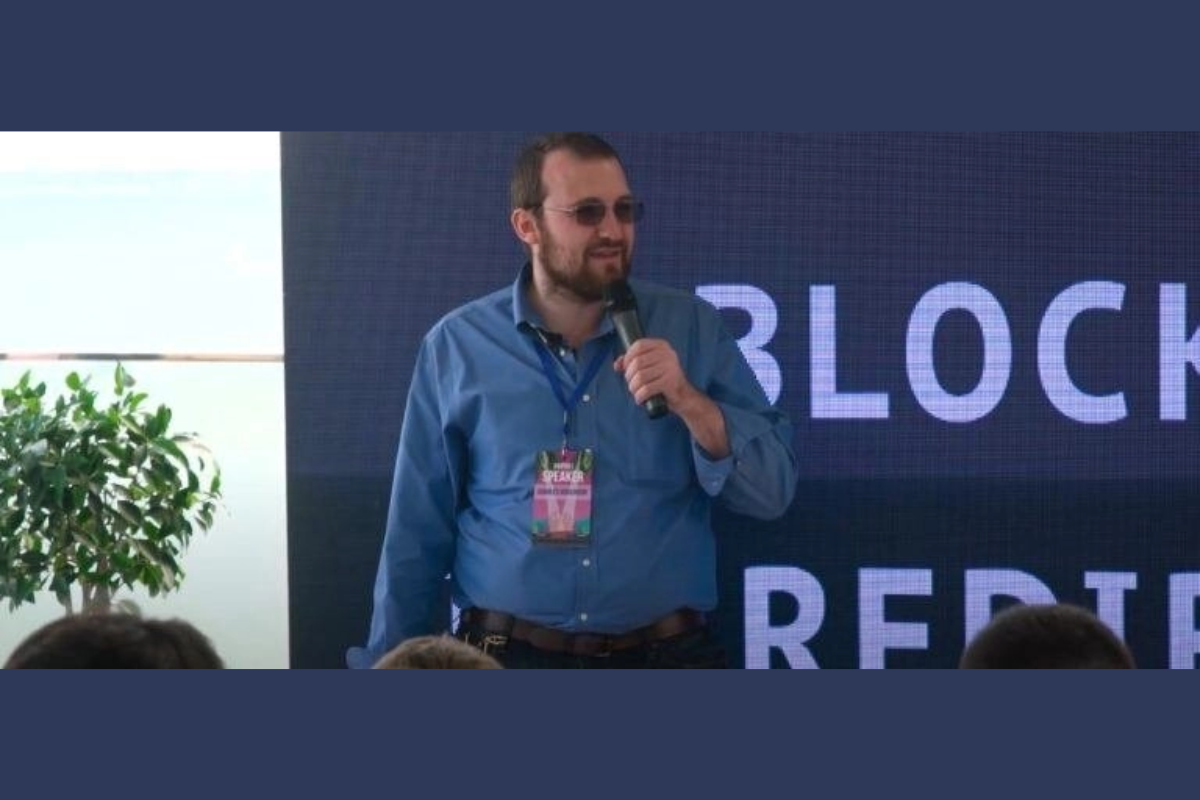

Cardano Founder Says “Crypto Doesn’t Want To Set The World On Fire”

According to a report from Crypto Daily, the founder of Cardano, Charles Hoskinson, expressed a sentiment that the cryptocurrency industry does not aim to “set the world on fire.” This statement reflects a broader perspective on the role of cryptocurrency and blockchain technology in the global economy and society.

Hoskinson’s remark suggests that the cryptocurrency industry is not solely focused on disruptive or revolutionary change but rather on providing innovative solutions to existing challenges and improving upon traditional systems. This viewpoint underscores the belief that cryptocurrencies and blockchain technology can coexist and collaborate with established financial and technological infrastructures, rather than seeking to replace them entirely.

By emphasizing a collaborative approach, Hoskinson highlights the potential for cryptocurrencies like Cardano to complement existing financial systems and contribute to positive developments in various sectors. This includes areas such as finance, governance, healthcare, and supply chain management, where blockchain technology can offer enhanced security, transparency, and efficiency.

Overall, Hoskinson’s statement reflects a pragmatic and inclusive perspective on the role of cryptocurrency in society, emphasizing the importance of cooperation and collaboration in driving meaningful progress and innovation. As the cryptocurrency industry continues to evolve, this mindset is likely to shape its trajectory and impact on the broader economy and society.

Source: cryptodaily.co.uk

The post Cardano Founder Says “Crypto Doesn’t Want To Set The World On Fire” appeared first on HIPTHER Alerts.

Blockchain

Pantera Capital Targets $1 Billion for New ‘All-in-One’ Blockchain Fund Set for 2025 Launch

Pantera Capital aims to raise $1 billion for its new all-in-one blockchain fund, slated for launch in 2025, as reported by Bitcoin.com. This ambitious fundraising goal underscores Pantera’s confidence in the potential of blockchain technology and its commitment to supporting innovative projects in the space.

The new blockchain fund from Pantera Capital is designed to be a comprehensive investment vehicle, providing exposure to a wide range of blockchain-related assets and opportunities. By offering a diversified portfolio of investments, the fund aims to capitalize on the growth and development of the blockchain ecosystem while managing risk effectively.

Pantera Capital’s decision to launch a new blockchain fund reflects its bullish outlook on the long-term prospects of the blockchain industry. With increasing mainstream adoption and institutional interest in cryptocurrencies and blockchain technology, Pantera sees significant opportunities for growth and value creation in the coming years.

The $1 billion fundraising target for the new blockchain fund is indicative of Pantera’s confidence in its ability to attract capital from investors seeking exposure to the burgeoning blockchain market. As one of the leading blockchain-focused investment firms, Pantera Capital is well-positioned to capitalize on the growing demand for blockchain-related investment opportunities.

Overall, the launch of Pantera Capital’s new all-in-one blockchain fund represents a significant development in the blockchain investment landscape, offering investors a comprehensive vehicle for gaining exposure to the rapidly evolving blockchain industry. As the fund prepares for its launch in 2025, it is poised to play a key role in shaping the future of blockchain investment and innovation.

Source: news.bitcoin.com

The post Pantera Capital Targets $1 Billion for New ‘All-in-One’ Blockchain Fund Set for 2025 Launch appeared first on HIPTHER Alerts.

Blockchain

Exverse debuts its token on Bybit ahead of the FPS game’s launch

Exverse, a free-to-play game bringing a fresh take on AAA first-person-shooters to Web3, announces the launch of its native $EXVG token on ByBit, a top-three crypto exchange by volume with over 20 million users. The ByBit launch will be followed by spot listings on the MEXC and Gate exchanges. Ahead of its full alpha launch in mid-May, Exverse hosted a soft-launch tournament for 5,000 early registrees on April 15 with cash rewards for top performers.

During the last bull run, Web3 games rose to prominence under the play-to-earn mechanism that made games like “Axie Infinity” so popular. As this model became widely replicated, many of these blockchain-based games prioritized the crypto elements at the expense of the actual game aspects. This trend could be seen in practice by many titles opting to undergo a token launch before even having a working demo, disincentivizing developers to build a quality game, and leaving users with no ecosystem or functioning game to play and spend or the native currency in.

With Exverse approaching its full launch, players can earn $EXVG by performing well while using the native token to enter matches, purchase premium items, and more. The $EXVG token builds on Exverse’s extensive beta and serves as the ecosystem’s currency while the game’s community witnessed a 20 percent growth in verified signups within a month. Supporting Exverse in their token launch are prominent launchpads and incubators that include Seedify, ChainGPT, and GameFi.

To build momentum for its upcoming alpha launch in mid-May, Exverse showcased its game by holding an exclusive deathmatch-style tournament for 5,000 early wait listers on April 15. The five-day tournament, which took place on the game’s ‘Battle Planet,’ gives players a chance to demonstrate their skills and win rewards via stablecoins and tokens. With $50,000 in total up for grabs, the top 100 performers earned at least $200. Top five finishers earnings were dispersed accordingly:

1st place: $4,000

2nd place: $2,000

3rd place: $1,500

4th and 5th place: $1,000

Built using Epic’s Unreal Engine 5, Exverse utilizes blockchain technology to strike a balance between enjoyable, realistic, and immersive real-time gameplay. The game prioritizes skill over pay-2-win mechanics, enabling players to earn rewards by staking tokens before a season’s kickoff. Top performers receive a share of profits from in-game NFTs such as cosmetics and skins.

To support the ecosystem’s development, expansion, and growth while rewarding the team and its early supporters, 400 million $EXVG will be minted.

“We are extremely excited about our token launch and proud to work with a great partner like ByBit to make it happen,” says Fei Ooi Hoong, CEO of Exverse. “We worked tirelessly to develop a diverse, engaging, and intuitive first-person shooter capable of revolutionizing how the public views blockchain-based gaming. Our talented team tapped into its background in traditional gaming to develop a rich and immersive gaming experience and then strategically implemented the NFT elements and in-game economics to enhance the user experience.”

The post Exverse debuts its token on Bybit ahead of the FPS game’s launch appeared first on HIPTHER Alerts.

-

Blockchain Press Releases3 days ago

Blockchain Press Releases3 days agoDeFi Lens builds advanced Generative AI for Technical Analysis

-

Blockchain3 days ago

Blockchain3 days agoVenezuela’s Oil Giant Turns to Crypto as US Sanctions Bite Again

-

Blockchain3 days ago

Blockchain3 days agoHalving weakness sees $206 million exit crypto funds, Bitcoin miners pivot to AI

-

Blockchain2 days ago

Blockchain2 days agoGlobal Payment Gateway Industry Report 2024: Seamless Integration with In-Game Virtual Currency Systems Enables Payment Gateways to Contribute to the Monetization Strategies of Game Developers

-

Blockchain4 days ago

PairedWorld Earns Blockchain Award Nomination, Secures $1.5 Million in Private Token Sales, and Welcomes BlackRock Venture Partner to Advisory Board

-

Blockchain1 day ago

Blockchain1 day agoBounceBit (BB) Megadrop Now Open: Participate by Subscribing to BNB Locked Products or Completing Web3 Quests

-

Blockchain3 days ago

PairedWorld Earns Nomination for Best Blockchain Project for Social Impact, Secures $1.5 Million in Private Token Sales, and Welcomes Paul Taylor Who Is a Venture Partner at BlackRock to its Advisory Board

-

Blockchain4 days ago

Blockchain4 days agoDeFi Technologies to Present at the Blockchain & Digital Asset Virtual Investor Conference April 25th