Blockchain

New seed-stage VC fund from Finland secures €6 million in initial close for €30 million blockchain fund

Helsinki-based Equilibrium Ventures (EQV), a new seed-stage venture capital fund focused on the crypto sector, has successfully closed the first round of its €30 million fund, raising €6 million from limited partners (LPs). This milestone highlights growing interest in blockchain startups and a promising future for the European crypto ecosystem.

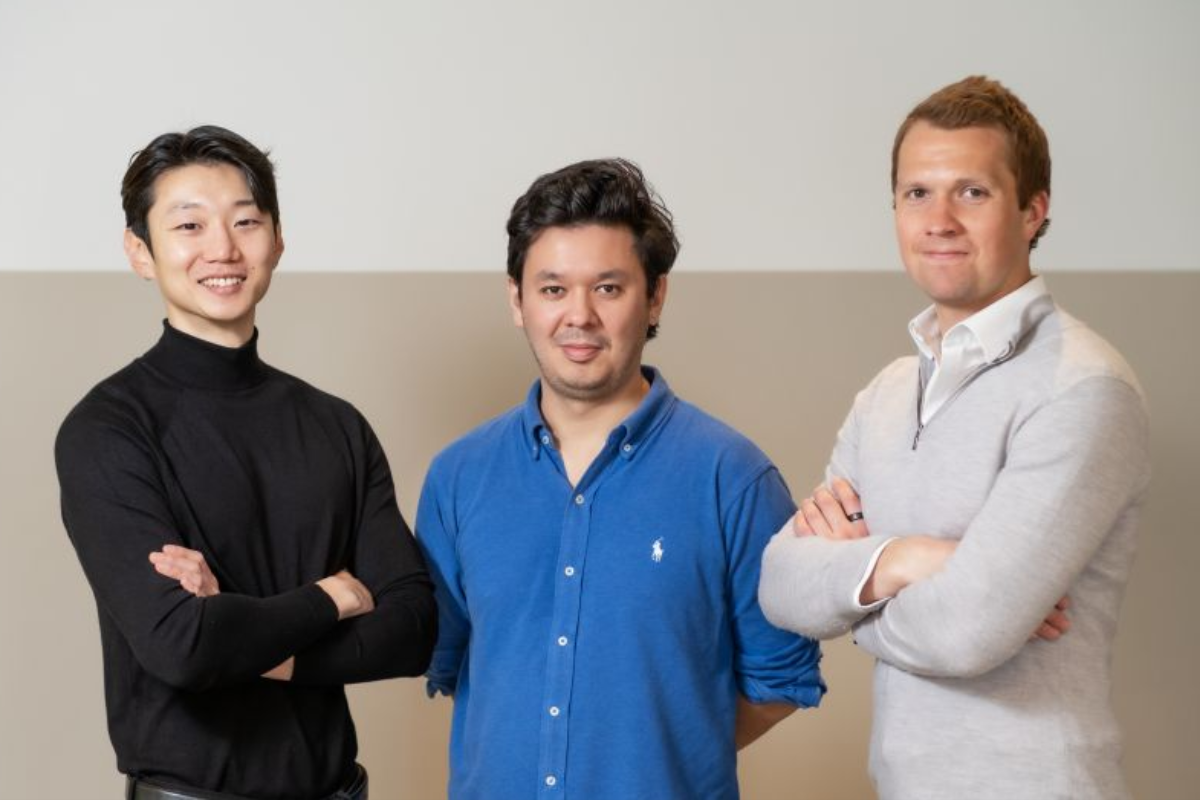

The fund is led by an experienced team of partners: Mika Honkasalo, Henrik Sundvik (formerly of Bain & Company), and Christopher Ahn (ex-Molten Ventures investor). Equilibrium Ventures aims to attract and support founders with deep technical expertise in blockchain technologies, covering areas such as zero-knowledge proofs and smart contracts, essential for developing advanced blockchain solutions.

Equilibrium Ventures has attracted a diverse group of backers, including strategic investors, family offices, and notable LPs like Sebastien Borget, co-founder of the metaverse platform The Sandbox. This support underscores the fund’s credibility and signals growing confidence in crypto investments despite recent market challenges.

Dedicated to crypto infrastructure, Equilibrium Ventures emphasizes rigorous technical due diligence and value addition for pre-seed and seed engineering firms. With a network of about 70 blockchain engineers, mainly based in Europe, the fund is well-positioned to help startups develop robust blockchain technologies.

The renewed interest in venture capital investment in blockchain, bolstered by evolving regulatory landscapes in the US and Europe, is expected to increase investor confidence in the crypto sector. Equilibrium Ventures, with its technical expertise and strategic support, is poised to become a significant player in Europe’s crypto venture scene.

Looking ahead, Equilibrium Ventures aims for a second close by the end of this summer, targeting 80% of the total fund. This progress indicates strong momentum and the potential for significant contributions to the European blockchain ecosystem.

Source: arcticstartup.com

The post New seed-stage VC fund from Finland secures €6 million in initial close for €30 million blockchain fund appeared first on HIPTHER Alerts.

Blockchain

Blocks & Headlines: Today in Blockchain – May 12, 2025 | Rootstock, Zimbabwe Carbon Registry, Fastex, 21Shares, The Blockchain Group

Welcome to Blocks & Headlines, your daily op-ed style deep dive into the most pivotal blockchain and crypto stories shaping today’s market. In this edition—May 12, 2025—we cover:

-

Bitcoin DeFi Security Strengthens as Rootstock garners 81% of Bitcoin’s hashrate

-

Zimbabwe’s Blockchain Carbon Credit Registry aims to restore investor trust

-

Token2049 Dubai Highlights spotlight Fastex’s Web3 innovations

-

21Shares’ New ETP for Cronos (CRO) bridges traditional finance and DeFi

-

The Blockchain Group’s €9.9 M Capital Raise fuels its Bitcoin treasury strategy

Below, each story is summarized with key takeaways and opinion-driven context.

Introduction

Today’s blockchain landscape is defined by two contrasting forces: institutional maturation—as legacy players and governments adopt tokenized assets and infrastructure—and startup-driven innovation—where Web3 pioneers push boundaries in DeFi, NFTs, and on-chain governance. Major trends include:

-

Security & Scalability: Layer-2 solutions and cross-chain bridges are gaining traction to secure and scale Bitcoin and Ethereum ecosystems.

-

Transparency & Trust: From carbon credits to capital markets, blockchain is repeatedly chosen to enhance auditability and investor confidence.

-

Mainstream Access: Crypto ETPs and regulated token offerings are lowering barriers for retail and institutional investors.

-

Treasury Management: Public companies are increasingly using Bitcoin and token holdings as strategic assets to hedge against macro volatility.

Let’s unpack today’s five developments and their broader implications.

1. Bitcoin DeFi Security Strengthens with Rootstock’s Hashrate Share

What happened: A new Messari report finds that Rootstock (RSK), Bitcoin’s oldest layer-2 smart-contract platform, now commands 81% of Bitcoin’s total hashrate, up from 56% before major mining pools Foundry and SpiderPool onboarded in February. Transactions on Rootstock are 95% cheaper than on-chain Bitcoin and 55% cheaper than Ethereum, positioning RSK for sustained DeFi growth in 2025.

Source: CoinDesk

Analysis & commentary:

Rootstock’s dominant hashrate share underscores two key shifts:

-

Security by Convergence: By leveraging Bitcoin’s massive mining network, RSK mitigates the common 51% risk faced by smaller chains.

-

Cost-Efficiency for DeFi: Lower fees make RSK an attractive alternative to Ethereum for yield protocols, lending markets, and decentralized exchanges.

However, challenges remain. Smart-contract developers must integrate robust cross-chain bridges—Rootstock’s partnership with LayerZero is a start—to attract liquidity. Moreover, regulatory scrutiny of DeFi is rising; RSK’s governance will need transparent on-chain dispute resolution and compliance tooling to win institutional adoption.

2. Zimbabwe’s Blockchain Carbon Credit Registry to Revive Investor Confidence

What happened: In Harare on May 9, the Zimbabwean government launched the world’s first blockchain-enabled carbon credit registry, developed by Dubai’s A6 Labs. The immutable ledger will record issuance, trading, and retirement of credits, addressing the fallout from 2023’s abrupt project cancellations and a 50% revenue levy that spooked developers. The new Zimbabwe Carbon Markets Authority (ZCMA) will oversee licensing via the zicma.org.zw portal.

Source: Bloomberg

Analysis & commentary:

Zimbabwe’s registry is an instructive case study in how blockchain can restore transparency and rebuild market trust:

-

Immutable Audits: Every credit’s provenance is verifiable on-chain, deterring double-counting and fraud.

-

Regulatory Framework: A dedicated authority streamlines approvals, balancing market access with environmental integrity.

-

Investor Reassurance: By codifying rules in smart contracts, Zimbabwe signals that future policy shifts will be governed by code, not sudden ministerial edict.

Nonetheless, blockchain is not a panacea. Effective enforcement still depends on reliable on-the-ground measurement and reporting. The real test will be whether smaller African producers—Kenya, Zambia—adopt interoperable registries, creating a pan-continental carbon marketplace.

3. Web3 Innovation Takes Center Stage at Token2049 Dubai

What happened: Between April 30 and May 1, Token2049 Dubai convened industry leaders in the Emirates. Fastex, a platinum sponsor, showcased its Bahamut blockchain (PoSA consensus), the YoWallet custodial solution, and a wave of new apps—YoHealth, YoPhone/YoSIM, YoBlog—all designed to expand Web3 use cases beyond finance. Fastex also co-hosted regulatory forums with Solidus Labs and launched the Bahamut Grants program to seed developer innovation.

Source: Cointelegraph

Analysis & commentary:

Token2049’s Dubai edition highlights an ecosystem maturation where:

-

Compliance & Growth Coexist: Legal breakfasts signaled that self-regulation and layered oversight can lower entry barriers without stifling ingenuity.

-

Beyond Finance: By unveiling telecom and health apps, Fastex challenges the notion that blockchain is niche—real-world use cases can drive mainstream adoption.

-

Brand Ambassadors: Football legend Patrice Evra’s presence at YoHealth’s booth illustrates how cultural icons can amplify blockchain’s reach.

Moving forward, projects must demonstrate measurable end-user utility and scalable infrastructure to avoid the “pilot-only” trap. Dubai’s supportive regulatory sandbox remains an ideal proving ground.

4. 21Shares Launches ETP for Cronos (CRO) – Bridging TradFi and DeFi

What happened: Swiss issuer 21Shares listed a new ETP (CRON) on May 12, offering direct exposure to CRO, the native token of Cronos—a Layer 1 chain built for DeFi, NFTs, and cross-chain interoperability with Ethereum and Cosmos. Investors can now trade CRO through regular brokerages without managing private keys or wallets.

Source: The Paypers

Analysis & commentary:

Tokenizing blockchain assets into regulated ETPs remains one of the most powerful drivers of institutional capital inflows:

-

Familiar Interfaces: By packaging CRO as a ticker, 21Shares lowers the learning curve for asset managers and pension funds.

-

Regulatory Alignment: ETPs fall under securities law, offering clear governance compared to unregulated spot tokens.

-

Ecosystem Growth: Cronos stands to benefit from increased liquidity and brand recognition, which in turn fuels DeFi activity on its network.

ETPs also invite scrutiny: fees, redemption mechanics, and underlying custodial risks must be transparent to preserve investor trust. As competition heats up—with products for BTC, ETH, SOL, and more—issuers will vie on pricing, ease of access, and institutional credibility.

5. The Blockchain Group’s €9.9 M Capital Raise Advances Bitcoin Treasury Strategy

What happened: Europe’s first Bitcoin Treasury Company, The Blockchain Group (ALTBG), completed a €9.888 million capital increase at €1.0932 per share on May 7, 2025. Proceeds will bolster its strategy to accumulate Bitcoin per fully diluted share while expanding consulting and AI-driven blockchain services.

Source: ActusNews via MarketScreener

Analysis & commentary:

The Blockchain Group’s financing round underscores a new corporate paradigm where holding BTC is core to the business model:

-

Shareholder Alignment: By tethering equity value to Bitcoin accumulation, management and investors share upside in crypto markets.

-

Operational Synergies: Subsidiaries in data intelligence and decentralized consulting can monetize both service fees and on-balance-sheet Bitcoin appreciation.

-

Regulatory Compliance: As a publicly listed entity on Euronext Growth Paris, ALTBG navigates EU financial rules, offering a transparent vehicle for crypto exposure.

Yet this approach carries volatility risk: sudden BTC price swings can compress earnings per share and spur shareholder activism. Mitigation strategies—such as hedged derivatives and staggered BTC purchases—will be critical to sustain growth without alarming investors.

Conclusion

Today’s highlights reveal a blockchain industry at once foundational and frontier:

-

Security & Scale: Rootstock’s hashrate gains fortify Bitcoin DeFi’s underpinnings.

-

Transparent Markets: Zimbabwe’s carbon registry sets a template for blockchain-backed commodity markets.

-

Web3 Diversification: Token2049 Dubai shows that true mass adoption demands real-world applications in health, telecom, and beyond.

-

Institutional Access: ETPs like CRON democratize token ownership for mainstream investors.

-

On-Balance-Sheet Crypto: The Blockchain Group exemplifies the rising class of publicly traded crypto-native firms.

As blockchain extends into supply chains, tokenized securities, and identity, the winners will be those who blend innovative protocol design with pragmatic regulatory alignment. Keep tuning into Blocks & Headlines for tomorrow’s top stories.

The post Blocks & Headlines: Today in Blockchain – May 12, 2025 | Rootstock, Zimbabwe Carbon Registry, Fastex, 21Shares, The Blockchain Group appeared first on News, Events, Advertising Options.

Blockchain

Astra Fintech Announces Establishment of Korea HQ, Strengthening Commitment to Solana Ecosystem and Regional Expansion

Astra Fintech

Blockchain

Blocks & Headlines: Today in Blockchain – May 9, 2025

Welcome to Blocks & Headlines, your daily deep-dive into the most impactful movements in blockchain technology and the cryptocurrency sector. In today’s edition, we unpack five major stories that illuminate trends in funding, sustainability, payment innovation, banking collaborations, and technical interoperability—all vital signposts for developers, investors, and Web3 enthusiasts. Here’s what’s on the docket:

-

Camp Network’s New IP-Focused Testnet

-

Blockchain for Sustainable Packaging

-

Meta’s Blockchain-Based Payment System Plans

-

Mocse Credit Union Joins Metal Blockchain’s Innovation Program

-

Apex Fusion on the Urgency of Blockchain Defragmentation

Through concise reporting, opinion-driven analysis, and SEO-optimized insights—featuring keywords like blockchain, cryptocurrency, Web3, DeFi, and NFTs—we’ll explore how these developments shape the next wave of decentralized finance, enterprise adoption, and mass onboarding.

1. Camp Network Launches Testnet for IP-Focused Blockchain

What Happened:

Camp Network has unveiled its long-anticipated testnet following a $30 million funding round led by leading crypto VCs. This new network is tailored for intellectual property (IP) asset tokenization, aiming to streamline rights management and royalty payments via smart contracts.

-

Technical Highlights:

-

Modular Consensus: Hybrid PoS/PoA consensus that allows IP rightsholders to validate transactions.

-

On-Chain Licensing: Smart contracts enabling programmable licensing terms, automated royalty splits, and revocable access controls.

-

Interoperability: Bridges to Ethereum and Polygon enable seamless asset transfers and liquidity provisioning.

-

Analysis & Implications:

By focusing on IP tokenization, Camp Network addresses a glaring gap in current NFT platforms, which often lack robust legal-framework integration. This specialization could catalyze:

-

New Revenue Models: Musicians, authors, and inventors can fractionalize royalties, unlocking liquidity and democratizing investment in creative works.

-

Institutional Adoption: Traditional publishers and studios may pilot tokenized licensing, accelerating blockchain’s entrée into regulated industries.

-

Secondary Markets: With on-chain licensing data, marketplaces can enforce provenance and anti-fraud measures more effectively.

Camp Network’s testnet success will hinge on developer tooling, legal partnerships, and gas-fee economics. Should it deliver a smooth UX and clear ROI for rightsholders, it could set a new standard for Web3 IP infrastructure.

Source: The Block

2. Blockchain as a Sustainable Packaging Game-Changer

What Happened:

A recent report explores how blockchain can revolutionize sustainable packaging by delivering end-to-end supply-chain transparency. The solution combines on-chain tracking of materials, IoT sensor data for carbon footprint measurement, and tokenized incentives for recycling.

-

Key Components:

-

Immutable Traceability: Each packaging component is logged on a public ledger, enabling consumers to verify sustainable sourcing.

-

Carbon Credit Tokens: Brands earn tokenized credits when they hit recycling targets, tradable on carbon-market DAOs.

-

Consumer-Facing Apps: QR-code scanning interfaces reveal environmental impact metrics and reward programs.

-

Analysis & Implications:

Integrating blockchain with sustainable packaging tackles greenwashing and fragmented reporting. The ability to tie physical materials to on-chain records introduces:

-

Enhanced Accountability: Brands face real-time public scrutiny of ESG claims, improving trust and regulatory compliance.

-

Market Mechanisms: Carbon credit tokens linking packaging to broader DeFi ecosystems incentivize circular economy behaviors.

-

Consumer Engagement: NFTs or loyalty tokens tied to sustainable purchases could accelerate brand loyalty in eco-conscious demographics.

This convergence of blockchain, IoT, and token economics exemplifies how decentralized technologies can underpin not only financial systems but also planetary stewardship.

Source: Yahoo Finance

3. Meta Plans New Blockchain-Based Payment System

What Happened:

Meta is reportedly developing a blockchain-powered payment network to underpin its digital wallet ambitions, aiming to facilitate low-fee remittances, in-app purchases, and peer-to-peer transfers across Facebook, Instagram, and WhatsApp.

-

Proposed Features:

-

Cross-Border Settlements: Utilizing stablecoins pegged to major fiat currencies to avoid volatility.

-

Layer-2 Scalability: Built atop an Ethereum Layer-2 or a proprietary chain to ensure sub-second confirmation times and minimal fees.

-

Regulatory Compliance: On-chain KYC/AML checks integrated via permissioned sidechains.

-

Analysis & Implications:

Meta’s push into blockchain payments could reshape the competitive landscape:

-

Crypto On-Ramp: With 3 billion+ monthly users, built-in wallet functionality could massively expand mainstream cryptocurrency adoption.

-

Disintermediation Risk: Traditional payment processors and remittance services face margin compression as Meta internalizes transaction flows.

-

Regulatory Scrutiny: Centralized control of a global payments network raises data-privacy and antitrust questions, likely attracting significant oversight.

If Meta balances decentralization ethos with compliance demands, it could serve as a blueprint for other Big Tech firms eyeing Web3 integration.

Source: Dig.watch

4. Mocse Credit Union Joins Metal Blockchain’s Banking Innovation Program

What Happened:

Mocse Credit Union has signed on to Metal Blockchain’s Banking Innovation Program, a consortium designed to accelerate pilot projects in tokenized lending, fractional deposits, and programmable savings accounts.

-

Program Benefits:

-

Sandbox Environment: Regulatory-compliant testbeds for tokenized asset experiments.

-

API Integrations: Plug-and-play modules for KYC, smart-contract auditing, and fiat-crypto on-ramps.

-

Co-Innovation Workshops: Joint labs with fellow financial institutions and DeFi projects.

-

Analysis & Implications:

This partnership signals the banking sector’s growing willingness to explore blockchain beyond hype:

-

Tokenized Deposits: By issuing interest-bearing stablecoin equivalents, credit unions can attract a new demographic of digitally native savers.

-

Risk Management: Sandboxed pilots allow institutions to evaluate smart-contract risks without exposing core systems.

-

Interoperable Finance: Aligning legacy banking with DeFi rails can unlock hybrid products—e.g., flash loans collateralized by insured deposits.

Such collaborations could spearhead a wave of embedded finance offerings, blurring the lines between centralized and decentralized banking infrastructures.

Source: Newswire

5. Apex Fusion: Defragmenting Blockchain for Mass Adoption

What Happened:

In an op-ed, Apex Fusion argues that blockchain interoperability and defragmentation are critical prerequisites for mainstream Web3 uptake. The piece advocates standardized cross-chain messaging protocols, unified identity layers, and aggregated liquidity pools.

-

Core Proposals:

-

Protocol Neutral Messaging: A universal middleware to transmit value and data across disparate chains.

-

Decentralized Identity (DID): A shared credential framework enabling seamless dApp logins without wallet-hopping.

-

Liquidity Hubs: Cross-chain Automated Market Makers (AMMs) that pool assets to reduce slippage and gas friction.

-

Analysis & Implications:

A fragmented blockchain ecosystem hinders user experience and developer efficiency:

-

Onboarding Friction: New users face wallet complexity, chain-switching hassles, and inconsistent UX across apps.

-

Capital Inefficiency: Isolated liquidity silos lead to higher trading costs and limit DeFi yield optimization.

-

Developer Overhead: Building multichain dApps requires fragmented toolkits and disparate security audits.

Solving these challenges through interoperable frameworks will be pivotal for DeFi, NFT, and enterprise Web3 solutions to scale beyond niche audiences. Apex Fusion’s recommendations may inform upcoming standards efforts by bodies like the Blockchain Governance Initiative Network (BGIN).

Source: Euro Weekly News

Conclusion

Today’s blockchain developments reflect a maturing industry at the crossroads of innovation and integration:

-

Specialized Networks: Camp Network’s IP testnet showcases niche use-cases driving targeted blockchain deployments.

-

Sustainability & Token Economics: Linking environmental impact to on-chain incentives demonstrates blockchain’s potential in non-financial arenas.

-

Big Tech Entry: Meta’s payment ambitions could accelerate global crypto adoption while raising regulatory stakes.

-

Banking Collaboration: Programs like Metal Blockchain’s underscore financial institutions’ appetite for safe, regulated Web3 experimentation.

-

Interoperability Imperative: As Apex Fusion highlights, defragmentation and cross-chain standards are essential for seamless UX and liquidity flow.

As blockchain weaves deeper into finance, supply chains, and digital ecosystems, the future hinges on striking the right balance between decentralization, compliance, and user-centric design. Stay tuned for tomorrow’s Blocks & Headlines where we continue to chronicle the pulse of Web3 innovation.

The post Blocks & Headlines: Today in Blockchain – May 9, 2025 appeared first on News, Events, Advertising Options.

-

Blockchain Press Releases6 days ago

Blockchain Press Releases6 days agoHTX Premieres USD1 Stablecoin Globally, Partnering with World Liberty Financial to Forge a New Era of Decentralized Economy

-

Blockchain5 days ago

Colb Asset SA Raises $7.3 Million in Oversubscribed Round to Bring Pre-IPO Giants to Blockchain

-

Blockchain Press Releases5 days ago

Blockchain Press Releases5 days agoHTX and Justin Sun Launch $6M Mars Program Special Edition, Offering One User a Historic Space Journey

-

Blockchain4 days ago

Blockchain4 days agoBitget Blockchain4Youth sostiene l’innovazione del Web3 e dell’IA all’hackathon “Build with AI” di Google Developer Group

-

Blockchain4 days ago

Blockchain4 days agoBlocks & Headlines: Today in Blockchain – May 9, 2025 | Robinhood, Solana, Tether, China, Women in Web3

-

Blockchain5 days ago

Blockchain5 days agoBlocks & Headlines: Today in Blockchain – May 7, 2025 | Coinbase, Riot Games, Curve DAO, Litecoin, AR.IO

-

Blockchain Press Releases4 days ago

Blockchain Press Releases4 days agoBybit Surpasses 70 Million Users, Reinforces Commitment to Transparency and Institutional Growth

-

Blockchain Press Releases6 days ago

Blockchain Press Releases6 days agoJuCoin made a global impact at TOKEN2049 Dubai, advancing its ecosystem with the “Peak Experience” vision and JuChain’s robust tech.