Blockchain

Maximizing ROI in iGaming: A Deep Dive into Non-Standard Geo-Targeting Through Influencer Marketing (Part 1/2)

Here’s a quick take on influencer marketing in iGaming: it’s all about making waves in the digital world. Popular social media stars teaming up with iGaming brands make them not only well-known, but also more trustworthy. Influencers have got the followers, the trust, and the know-how to get people excited about gambling and betting online. In this article, Anna Zhukova, Team Lead of iGaming vertical at Famesters will delve deeply into smart influencer marketing strategies for this business vertical.

Here are some of the key components of influencer marketing for iGaming brands:

- Engaging the Crowd: Influencers are superstars at grabbing the attention of different players – from those who play just for fun to the serious high rollers.

- Building Trust: When an influencer gives a thumbs-up to a game or a particular online casino, their followers listen. It’s like having a friend recommend your favorite new game.

- Finding the Right Fit: Picking the perfect influencer is key. They need to align with what the iGaming brand is all about.

- Staying in the Lines: iGaming has got rules. Influencers need to play by them to keep things cool and compliant.

- Performance Metrics and ROI: Tracking the success of influencer campaigns through metrics like reach, engagement, and conversions is crucial. This data helps in refining strategies and ensuring a high return on investment.

In short, influencer marketing in the iGaming industry is a trust-building powerhouse: it is a nuanced and effective approach, leveraging the power of influential personalities to build brand trust, engage diverse audiences, and drive business success within a regulated framework.

And here’s another great power that influences the final results of an influencer marketing campaign: geo-targeting. It’s about hitting the right audience, in the right place, at the right time. Here’s why you can’t do iGaming marketing without geo-targeting:

- Audience Segmentation: It’s all about hitting the sweet spot with each region’s unique gaming tastes and cultural vibes. Tailoring content to specific areas means more impact and appeal.

- Regulatory Compliance: Different areas, different rules. Geo-targeting keeps campaigns on the right side of the law, dodging legal headaches.

- Localized Content: This is where you speak their language, literally. You have to adapt to local dialects, cultural hooks, and region-favorite games to ramp up engagement and conversions.

- Cost Efficiency: It’s about smart spending. Better focus your efforts where they count, avoid wasting resources, and watch your marketing budget deliver more.

- Data-Driven Decisions: You can use geo-targeting data to get the lowdown on what works where. This insight sharpens resource allocation, boosting your ROI.

Understanding the iGaming Industry

The iGaming industry, encompassing online gaming and betting platforms, has witnessed exponential growth in recent years. A surge in digital technology adoption and the rise of mobile gaming have been pivotal. The industry’s growth trajectory is marked by technological advancements, expanding into new markets, and an increasing acceptance of online gaming as a mainstream entertainment option. This evolution has opened doors to vast opportunities but also posed unique challenges.

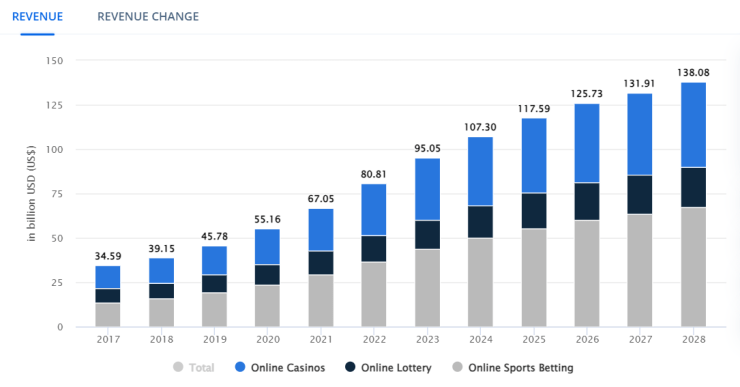

According to Statista, the global iGaming market is expected to reach a revenue of more than $107 billion in 2024.

Traditional marketing methods in iGaming face several hurdles. The biggest is the evolving regulatory landscape, with different countries imposing varied restrictions on gaming advertising. Additionally, the traditional one-size-fits-all approach struggles in a market where gamers’ preferences are as diverse as their geographical locations. There’s also the challenge of ad fatigue, where conventional advertising methods no longer capture the audience’s attention as effectively.

To navigate these challenges, the iGaming industry is turning towards more innovative, targeted, and engaging marketing strategies. Personalization and use of data analytics are becoming increasingly important. Brands are now focusing on creating more immersive and interactive marketing experiences that resonate with their audience on a deeper level.

Influencer marketing is now one of the most powerful tools in the iGaming industry. It leverages social media influencers’ reach and credibility to promote betting and gambling platforms and products. This approach taps into the influencers’ engaged audiences, offering a more authentic and trustworthy promotion method than traditional advertising. Influencers can create content that resonates with their followers, whether it’s through live-streaming games, tutorials, or reviews, thus providing a more organic and engaging way to introduce products to potential customers.

Statistics underscore the impact of influencer marketing. For instance, 66% of marketers using it say that influencer-generated content performs equally or better than branded content. Also, on average, brands earn $5.78 for every dollar spent on influencer marketing.

Understanding the iGaming industry today means recognizing the shift towards more innovative, personalized, and influencer-driven marketing strategies. The industry’s growth is paralleled by the evolution of marketing techniques, with influencer marketing standing out as a key player in engaging and expanding the iGaming audience.

Non-Standard Geo-Targeting

First, you need to understand the tiers in global market segmentation. There are three of them. Understanding the economic and audience characteristics of different tiers is crucial for effective global marketing. Each tier offers unique opportunities and challenges, and selecting the right one depends on a company’s budget, target audience, and industry regulations.

Tier-1 Countries: The Premium Market

- Characteristics: These are the most developed countries with strong economies and a wealthy audience.

- Why They’re Attractive: Businesses target these regions due to the high purchasing power of the audience. This means greater potential for sales and revenue.

- Consideration: Advertising in these countries can be quite expensive. Brands should be prepared for higher marketing costs.

Tier-2 Countries: The Balanced Choice

- Characteristics: These are developing countries. Their economies are well-developed, but the audience’s purchasing power isn’t as high as in Tier-1 countries.

- Why They’re Attractive: They’re a strategic choice for businesses seeking a solvent audience without the high costs associated with Tier-1 markets.

- Ideal for Certain Industries: Tier-2 countries are particularly suitable for advertising sectors like betting, forex, and binaries, which might be restricted in Tier-1 countries.

Tier-3 Countries: High Reach, Low Cost

- Characteristics: Often referred to as ‘third world countries,’ these nations have weaker economies and lower-income populations.

- Advantages: Advertising costs are low, allowing for broad coverage even with smaller budgets.

- Target Audience: These regions are often targeted by industries like gambling, forex, and betting. These sectors appeal to audiences seeking opportunities for ‘easy’ income.

Now let’s take a closer look at the peculiarities of each tier and the countries in it.

High Costs in Tier-1 Markets: A Matter of Solvency

- User Solvency and Payback: In Tier-1 markets, users generally have higher purchasing power, which can lead to better payback for businesses. However, this comes with its own set of challenges.

- Regulatory Hurdles: A significant issue in these markets is the stringent regulation around gambling products. While launching campaigns on platforms like Facebook may not require a license, working with influencers often does.

- Licensing Complexities: Licenses such as MGA (Malta Gaming Authority) or Curacao are necessary for simply working in European countries. However, they don’t authorize advertising in these geographies and targeting users in them. Plus, obtaining advertising permissions is a very complex process.

- Influencer Marketing Challenges: Tier-1 influencers, earning well from less risky advertising options, often steer clear of gambling promotions. Finding one willing to collaborate without a license is rare.

Businesses eyeing Tier-1 markets need to be prepared for higher costs and stringent regulations, especially when incorporating influencer marketing into their strategies. While the financial returns can be significant due to the high solvency of users, navigating the regulatory and licensing requirements adds complexity.

In contrast, Tier-2 markets offer a more accessible and flexible environment for certain types of promotions, including those in the gambling sector. Transitioning from the complex landscape of Tier-1 markets, Tier-2 geographies present a different potential. The regulatory environment is typically less stringent, and the cost of marketing is more manageable compared to Tier-1.

In the next article, we will make it clearer how the countries from different tiers can be connected, what role influencers play in this, and most importantly – how exactly non-standard geo-targeting can be used to reach more solvent audiences with cost-effective strategies. Stay tuned!

Author: Anna Zhukova, Team Lead (iGaming) at Famesters

The post Maximizing ROI in iGaming: A Deep Dive into Non-Standard Geo-Targeting Through Influencer Marketing (Part 1/2) appeared first on Hipther Alerts.

Blockchain

Glidelogic Corp. Announces Revolutionary AI-Generated Content Copyright Protection Solution

Blockchain

Ethereum ETFs Aren’t Blockchain But Is A Revolutionary Tech: Top 6 Amazing Reasons To Invest In Them

The financial landscape is rapidly evolving, with the integration of blockchain technology and cryptocurrencies becoming more prominent. Among these, Ethereum ETFs (Exchange-Traded Funds) have emerged as a significant investment vehicle, offering exposure to the Ethereum blockchain’s native cryptocurrency, Ether (ETH), without requiring direct ownership. However, it’s crucial to understand that Ethereum ETFs are distinct from the blockchain itself and serve different purposes in the investment world.

Understanding Ethereum and ETFs

Ethereum: A decentralized platform that enables the creation and execution of smart contracts and decentralized applications (dApps). It operates using its cryptocurrency, Ether (ETH), which fuels the network.

ETF (Exchange-Traded Fund): A type of investment fund that holds a collection of assets and is traded on stock exchanges. ETFs can include various asset classes, such as stocks, commodities, or bonds.

Ethereum ETFs: The Intersection of Traditional Finance and Cryptocurrency

An Ethereum ETF provides a way for investors to gain exposure to the price movements of Ether without directly purchasing the cryptocurrency. This is achieved through an ETF structure, where the fund holds assets linked to the value of Ether, and investors can buy shares of the ETF on traditional stock exchanges.

Key Features of Ethereum ETFs:

- Indirect Exposure: Investors gain exposure to Ether’s price changes without needing to manage or store the cryptocurrency themselves.

- Regulatory Compliance: Unlike the relatively unregulated cryptocurrency market, ETFs operate under the oversight of financial regulators, offering a layer of investor protection.

- Accessibility: Ethereum ETFs are available through traditional brokerage platforms, making them accessible to a broader range of investors.

Why Invest in an Ethereum ETF?

- Diversification: Including an Ethereum ETF in a portfolio can provide exposure to the cryptocurrency market, potentially enhancing diversification beyond traditional assets.

- Convenience and Familiarity: ETFs are a familiar investment product, simplifying the process of investing in cryptocurrencies.

- Professional Management: ETF managers handle the investment decisions, including the buying and selling of assets, which can be advantageous for those less familiar with the cryptocurrency space.

- Regulatory Oversight: ETFs are subject to regulatory scrutiny, potentially offering more safety and transparency compared to direct cryptocurrency investments.

- Potential for Growth: As the cryptocurrency market grows, ETFs linked to assets like Ether may benefit from rising prices.

Key Differences Between Ethereum and Ethereum ETFs

While both are related to the Ethereum blockchain, Ethereum itself and Ethereum ETFs represent different forms of investment:

- Ethereum (ETH):

- Direct ownership of the cryptocurrency.

- Full exposure to Ethereum’s features, including staking and network participation.

- Traded on cryptocurrency exchanges.

- Highly volatile and largely unregulated.

- Ethereum ETF:

- Indirect exposure through shares representing Ether’s value.

- Traded on traditional stock exchanges under regulatory oversight.

- Offers a more stable and familiar investment structure.

- Typically lower volatility compared to direct cryptocurrency ownership.

Future Considerations for Ethereum ETFs

The approval and launch of Ethereum ETFs mark a significant milestone in bringing cryptocurrencies closer to mainstream finance. They offer a convenient and regulated means for investors to gain exposure to the growing digital assets market. However, they also come with limitations, such as not allowing direct participation in the Ethereum ecosystem’s innovations, like dApps and smart contracts.

As the market evolves, we may see more sophisticated financial products that better capture the full potential of the Ethereum ecosystem. For now, Ethereum ETFs provide a balanced option for those interested in cryptocurrency exposure within the framework of traditional finance.

In conclusion, while Ethereum ETFs offer a gateway into the world of digital assets, they should be viewed as complementary to, rather than a replacement for, direct investment in the underlying blockchain technologies. Investors should carefully consider their investment goals, risk tolerance, and the unique attributes of both Ethereum and Ethereum ETFs when making investment decisions.

Source: blockchainmagazine.net

The post Ethereum ETFs Aren’t Blockchain But Is A Revolutionary Tech: Top 6 Amazing Reasons To Invest In Them appeared first on HIPTHER Alerts.

Blockchain

Nexo Reaffirms Commitment to Data Protection with SOC 3 and SOC 2 Compliance

Nexo, a leading institution in the digital assets industry, has reinforced its commitment to data security by renewing its SOC 2 Type 2 audit and attaining a new SOC 3 Type 2 assessment without any exceptions. This rigorous audit process, conducted by A-LIGN, a respected independent auditor specializing in security compliance, confirms Nexo’s adherence to stringent Trust Service Criteria for Security and Confidentiality.

Key Achievements and Certifications

- SOC 2 and SOC 3 Compliance:

- SOC 2 Type 2: This audit evaluates and reports on the effectiveness of an organization’s controls over data security, particularly focusing on the confidentiality, integrity, and availability of systems and data.

- SOC 3 Type 2: This public-facing report provides a summary of SOC 2 findings, offering assurance to customers and stakeholders about the robustness of Nexo’s data security practices.

- Additional Trust Service Criteria:

- Nexo expanded the scope of these audits to include Confidentiality, showcasing a deep commitment to protecting user data.

- Security Certifications:

- The company also adheres to the CCSS Level 3 Cryptocurrency Security Standard, and holds ISO 27001, ISO 27017, and ISO 27018 certifications, awarded by RINA. These certifications are benchmarks for security management and data privacy.

- CSA STAR Level 1 Certification:

- This certification demonstrates Nexo’s adherence to best practices in cloud security, further solidifying its position as a trusted partner in the digital assets sector.

Impact on Customers and Industry Standards

Nexo’s rigorous approach to data protection and compliance sets a high standard in the digital assets industry. By achieving these certifications, Nexo provides its over 7 million users across more than 200 jurisdictions with confidence in the security of their data. These achievements not only emphasize the company’s dedication to maintaining top-tier security standards but also highlight its proactive stance in fostering trust and transparency in digital asset management.

Nexo’s Broader Mission

As a premier institution for digital assets, Nexo offers a comprehensive suite of services, including advanced trading solutions, liquidity aggregation, and tax-efficient credit lines backed by digital assets. Since its inception, the company has processed over $130 billion, showcasing its significant impact and reliability in the global market.

In summary, Nexo’s successful completion of SOC 2 and SOC 3 audits, along with its comprehensive suite of certifications, underscores its commitment to the highest standards of data security and operational integrity. This dedication positions Nexo as a leader in the digital assets space, offering unparalleled security and peace of mind to its users.

Source: blockchainreporter.net

The post Nexo Reaffirms Commitment to Data Protection with SOC 3 and SOC 2 Compliance appeared first on HIPTHER Alerts.

-

Blockchain5 days ago

Blockchain5 days agoBinance Cleared to Invest Customer Assets in US Treasury Bills: What It Means for Crypto and Dollar Dominance

-

Blockchain5 days ago

Blockchain5 days agoDeep Custodian Limited Obtains Hong Kong TCSP License, Authorized to Provide Compliant Crypto Asset Custody Services

-

Blockchain Press Releases2 days ago

Blockchain Press Releases2 days agoBybit Web3 Livestream Explores Cultural Meme Coins and Other Trends

-

Blockchain Press Releases2 days ago

Blockchain Press Releases2 days agoBybit Surges to Second Place in Derivatives Market, Solidifying Position as Global Crypto Trading Leader

-

Blockchain3 days ago

Blockchain3 days agoBlockchain Intelligence Group adds additional modules and launches its Certified Cryptocurrency Investigator – Advanced Series

-

Blockchain2 days ago

Blockchain2 days agoKevin O ‘Leary Addresses Crypto Investing, Ethereum ETFs, and SEC Chair in Recent Interview

-

Blockchain4 days ago

Blockchain4 days agoBitAngels Network Hosts Blockchain Pitch Competition in Nashville

-

Blockchain4 days ago

Blockchain4 days agoCoinW Continues Expedition Trek And Double Down On Presence At ETH-Native Events