Blockchain

Maximizing ROI in iGaming: A Deep Dive into Non-Standard Geo-Targeting Through Influencer Marketing (Part 1/2)

Here’s a quick take on influencer marketing in iGaming: it’s all about making waves in the digital world. Popular social media stars teaming up with iGaming brands make them not only well-known, but also more trustworthy. Influencers have got the followers, the trust, and the know-how to get people excited about gambling and betting online. In this article, Anna Zhukova, Team Lead of iGaming vertical at Famesters will delve deeply into smart influencer marketing strategies for this business vertical.

Here are some of the key components of influencer marketing for iGaming brands:

- Engaging the Crowd: Influencers are superstars at grabbing the attention of different players – from those who play just for fun to the serious high rollers.

- Building Trust: When an influencer gives a thumbs-up to a game or a particular online casino, their followers listen. It’s like having a friend recommend your favorite new game.

- Finding the Right Fit: Picking the perfect influencer is key. They need to align with what the iGaming brand is all about.

- Staying in the Lines: iGaming has got rules. Influencers need to play by them to keep things cool and compliant.

- Performance Metrics and ROI: Tracking the success of influencer campaigns through metrics like reach, engagement, and conversions is crucial. This data helps in refining strategies and ensuring a high return on investment.

In short, influencer marketing in the iGaming industry is a trust-building powerhouse: it is a nuanced and effective approach, leveraging the power of influential personalities to build brand trust, engage diverse audiences, and drive business success within a regulated framework.

And here’s another great power that influences the final results of an influencer marketing campaign: geo-targeting. It’s about hitting the right audience, in the right place, at the right time. Here’s why you can’t do iGaming marketing without geo-targeting:

- Audience Segmentation: It’s all about hitting the sweet spot with each region’s unique gaming tastes and cultural vibes. Tailoring content to specific areas means more impact and appeal.

- Regulatory Compliance: Different areas, different rules. Geo-targeting keeps campaigns on the right side of the law, dodging legal headaches.

- Localized Content: This is where you speak their language, literally. You have to adapt to local dialects, cultural hooks, and region-favorite games to ramp up engagement and conversions.

- Cost Efficiency: It’s about smart spending. Better focus your efforts where they count, avoid wasting resources, and watch your marketing budget deliver more.

- Data-Driven Decisions: You can use geo-targeting data to get the lowdown on what works where. This insight sharpens resource allocation, boosting your ROI.

Understanding the iGaming Industry

The iGaming industry, encompassing online gaming and betting platforms, has witnessed exponential growth in recent years. A surge in digital technology adoption and the rise of mobile gaming have been pivotal. The industry’s growth trajectory is marked by technological advancements, expanding into new markets, and an increasing acceptance of online gaming as a mainstream entertainment option. This evolution has opened doors to vast opportunities but also posed unique challenges.

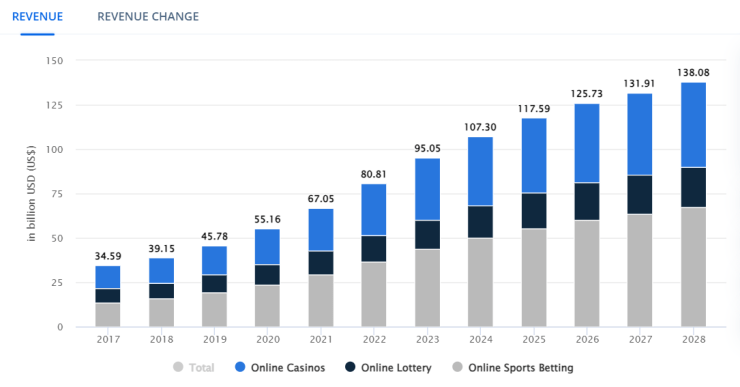

According to Statista, the global iGaming market is expected to reach a revenue of more than $107 billion in 2024.

Traditional marketing methods in iGaming face several hurdles. The biggest is the evolving regulatory landscape, with different countries imposing varied restrictions on gaming advertising. Additionally, the traditional one-size-fits-all approach struggles in a market where gamers’ preferences are as diverse as their geographical locations. There’s also the challenge of ad fatigue, where conventional advertising methods no longer capture the audience’s attention as effectively.

To navigate these challenges, the iGaming industry is turning towards more innovative, targeted, and engaging marketing strategies. Personalization and use of data analytics are becoming increasingly important. Brands are now focusing on creating more immersive and interactive marketing experiences that resonate with their audience on a deeper level.

Influencer marketing is now one of the most powerful tools in the iGaming industry. It leverages social media influencers’ reach and credibility to promote betting and gambling platforms and products. This approach taps into the influencers’ engaged audiences, offering a more authentic and trustworthy promotion method than traditional advertising. Influencers can create content that resonates with their followers, whether it’s through live-streaming games, tutorials, or reviews, thus providing a more organic and engaging way to introduce products to potential customers.

Statistics underscore the impact of influencer marketing. For instance, 66% of marketers using it say that influencer-generated content performs equally or better than branded content. Also, on average, brands earn $5.78 for every dollar spent on influencer marketing.

Understanding the iGaming industry today means recognizing the shift towards more innovative, personalized, and influencer-driven marketing strategies. The industry’s growth is paralleled by the evolution of marketing techniques, with influencer marketing standing out as a key player in engaging and expanding the iGaming audience.

Non-Standard Geo-Targeting

First, you need to understand the tiers in global market segmentation. There are three of them. Understanding the economic and audience characteristics of different tiers is crucial for effective global marketing. Each tier offers unique opportunities and challenges, and selecting the right one depends on a company’s budget, target audience, and industry regulations.

Tier-1 Countries: The Premium Market

- Characteristics: These are the most developed countries with strong economies and a wealthy audience.

- Why They’re Attractive: Businesses target these regions due to the high purchasing power of the audience. This means greater potential for sales and revenue.

- Consideration: Advertising in these countries can be quite expensive. Brands should be prepared for higher marketing costs.

Tier-2 Countries: The Balanced Choice

- Characteristics: These are developing countries. Their economies are well-developed, but the audience’s purchasing power isn’t as high as in Tier-1 countries.

- Why They’re Attractive: They’re a strategic choice for businesses seeking a solvent audience without the high costs associated with Tier-1 markets.

- Ideal for Certain Industries: Tier-2 countries are particularly suitable for advertising sectors like betting, forex, and binaries, which might be restricted in Tier-1 countries.

Tier-3 Countries: High Reach, Low Cost

- Characteristics: Often referred to as ‘third world countries,’ these nations have weaker economies and lower-income populations.

- Advantages: Advertising costs are low, allowing for broad coverage even with smaller budgets.

- Target Audience: These regions are often targeted by industries like gambling, forex, and betting. These sectors appeal to audiences seeking opportunities for ‘easy’ income.

Now let’s take a closer look at the peculiarities of each tier and the countries in it.

High Costs in Tier-1 Markets: A Matter of Solvency

- User Solvency and Payback: In Tier-1 markets, users generally have higher purchasing power, which can lead to better payback for businesses. However, this comes with its own set of challenges.

- Regulatory Hurdles: A significant issue in these markets is the stringent regulation around gambling products. While launching campaigns on platforms like Facebook may not require a license, working with influencers often does.

- Licensing Complexities: Licenses such as MGA (Malta Gaming Authority) or Curacao are necessary for simply working in European countries. However, they don’t authorize advertising in these geographies and targeting users in them. Plus, obtaining advertising permissions is a very complex process.

- Influencer Marketing Challenges: Tier-1 influencers, earning well from less risky advertising options, often steer clear of gambling promotions. Finding one willing to collaborate without a license is rare.

Businesses eyeing Tier-1 markets need to be prepared for higher costs and stringent regulations, especially when incorporating influencer marketing into their strategies. While the financial returns can be significant due to the high solvency of users, navigating the regulatory and licensing requirements adds complexity.

In contrast, Tier-2 markets offer a more accessible and flexible environment for certain types of promotions, including those in the gambling sector. Transitioning from the complex landscape of Tier-1 markets, Tier-2 geographies present a different potential. The regulatory environment is typically less stringent, and the cost of marketing is more manageable compared to Tier-1.

In the next article, we will make it clearer how the countries from different tiers can be connected, what role influencers play in this, and most importantly – how exactly non-standard geo-targeting can be used to reach more solvent audiences with cost-effective strategies. Stay tuned!

Author: Anna Zhukova, Team Lead (iGaming) at Famesters

The post Maximizing ROI in iGaming: A Deep Dive into Non-Standard Geo-Targeting Through Influencer Marketing (Part 1/2) appeared first on Hipther Alerts.

Blockchain

Blocks & Headlines: Today in Blockchain – April 30, 2025

Today’s blockchain ecosystem is defined by soaring ambitions, regulatory crosswinds, and an ever-evolving tapestry of decentralized applications. In this edition of Blocks & Headlines: Today in Blockchain – April 30, 2025, we cover five pivotal developments shaping Web3’s next chapter:

-

Telegram’s TON Factory Launch – A breakthrough in on-chain scalability.

-

EU Data-Protection Ruling Threatens Full Blockchain Histories – The fight between GDPR and immutability.

-

One Championship MMA Game Debuts on Sui – A major Web3 foray into mobile gaming.

-

U.S. Senate Eyes New Blockchain Act – Bipartisan push to regulate digital assets.

-

DMG Blockchain’s AI Data-Center Investment – Convergence of crypto mining and AI infrastructure.

Below, we deliver concise yet detailed analyses of each story, infused with expert commentary on their strategic significance. Read on to understand how these trends will influence protocol adoption, developer incentives, regulatory frameworks, and the future of decentralized networks.

1. Telegram’s TON Factory Boosts On-Chain Scalability

What happened:

Telegram’s Open Network (TON) team officially unveiled TON Factory, a novel toolkit designed to streamline the deployment and scaling of decentralized applications. Built atop TON’s sharded architecture, TON Factory enables developers to spin up isolated “factories”—subnets that can host smart contracts, NFTs, and DeFi modules—while sharing security guarantees with the main chain. According to the announcement, early tests show that each factory can process up to 15,000 transactions per second (TPS) in isolation, with near-instant finality.

Why it matters:

Scalability remains blockchain’s Achilles’ heel. TON Factory’s factory-of-subnets approach promises to lower the barrier to entry for high-throughput dApps—everything from micro-payment systems to real-time gaming. By offering elastic compute and fee-optimization mechanisms, Telegram aims to undercut legacy Layer-1 networks and attract a new generation of builders.

Opinion & Implications:

-

Developer Experience: Abstractions like preconfigured factories could accelerate time-to-market for teams lacking deep consensus expertise.

-

Network Effects: If TON’s UX outpaces rivals (e.g., Ethereum’s zk-rollups or Solana’s Turbine), we may see a migration of liquidity and talent.

-

Security Trade-Offs: Isolating factories can mitigate cross-dApp failures, but adds complexity to transaction routing and dispute resolution. Audits will be essential to validate this novel model.

Source: Cointelegraph – Telegram TON Factory Launch

2. EU Regulators Propose Deleting Entire Blockchains for GDPR

What happened:

European data-protection authorities have floated a radical interpretation of GDPR: the “right to erasure” could extend to purging entire on-chain histories containing personal data. Under this view, controllers operating within the EU must either anonymize linked data or entirely delete chain segments—potentially forcing chains to implement selective pruning or permissions.

Why it matters:

Blockchain’s immutability ethos directly clashes with GDPR’s erasure mandate. If regulators enforce selective deletion, networks may need to retrofit privacy-preserving layers (e.g., zero-knowledge proofs, chameleon hashes) or risk noncompliance fines up to 4% of global turnover.

Opinion & Implications:

-

Protocol Evolution: Expect a surge in privacy-by-design protocols that segregate PII off-chain while anchoring proofs on-chain.

-

Jurisdictional Fragmentation: Projects may geo-fence EU users or spawn EU-compliant forks—fracturing unified global ledgers.

-

Commercial Impact: Exchanges and custodians face urgent deadlines to audit on-chain data holdings and deploy erasure tools—or face hefty penalties.

Source: Daily Hodl – EU Blockchain Erasure

3. One Championship’s MMA Game Launches on Sui for iOS/Android

What happened:

One Championship, Asia’s premier martial-arts league, has partnered with Mysten Labs to release “ONE Fight Manager”—a play-to-earn mobile title powered by the Sui blockchain. Available now on iOS and Android, the game lets users train NFT fighters, compete in PvP leagues, and earn SUI tokens through ranked matches. Mysten Labs touts sub-two-second transaction finality and near-zero gas fees, enabling seamless gameplay even for on-chain microtransactions.

Why it matters:

Gaming remains the killer app for mass blockchain adoption. By leveraging Sui’s Move VM and object-centric model, ONE Fight Manager addresses two critical pain points: UX friction and cost barriers. Real-time, feeless interactions are vital to onboard traditional gamers accustomed to instant feedback loops.

Opinion & Implications:

-

User Acquisition: High-profile IP like One Championship can drive millions of installs—and funnel new users into the broader Sui ecosystem.

-

Economics & Tokenomics: Careful tuning of token emission and NFT scarcity will determine whether the game sustains long-term engagement or succumbs to “play-to-earn” collapse.

-

Cross-Chain Synergy: Success here may inspire similar partnerships on Aptos, Ethereum, or emerging Layer-1s, intensifying competition for flagship gaming titles.

Source: Decrypt – ONE Championship Sui Game

4. Ohio Senator Leads Push for U.S. Blockchain Act

What happened:

Senator J.D. Kerns (R-OH) has introduced the Blockchain Innovation and Consumer Protection Act, aiming to create a federal framework for digital-asset oversight. Key provisions include:

-

Defined Classifications: Differentiating between payment tokens, security tokens, and utility tokens.

-

Licensing Regime: Establishing a “Digital Asset Services Commission” to grant interstate licenses for exchanges and custodians.

-

Consumer Safeguards: Mandatory proof of reserves, clear disclosure requirements, and dispute-resolution protocols.

Why it matters:

After years of fragmented state laws and agency turf wars, this Act represents Congress’s first cohesive effort to legislate blockchain. By preempting state-level divergence, it could streamline compliance for businesses—provided it balances innovation with investor protection.

Opinion & Implications:

-

Regulatory Clarity: Clear definitions can foster institutional entry, reducing legal ambiguity that stifles corporate treasuries from adopting crypto.

-

Unintended Consequences: Overly stringent licensing could entrench incumbents and erect high barriers for startups.

-

Global Competitiveness: U.S. leadership in blockchain law may influence other jurisdictions—critical as Asia and Europe race to craft their own regulatory regimes.

Source: The Street – Blockchain Act Proposal

5. DMG Blockchain Solutions Invests in 2MW of AI Data-Center Gear

What happened:

DMG Blockchain Solutions Inc. has announced the acquisition of two megawatts of high-density GPU infrastructure, repurposed for both crypto-mining and AI-model training workloads. Housed in a new Quebec data center, the multi-use clusters will dynamically allocate capacity between proof-of-work operations and commercial AI clients—leveraging off-peak pricing to optimize ROI.

Why it matters:

The convergence of crypto-mining and AI training infrastructure underscores growing synergies between two of the most compute-hungry industries. By offering GPUs for rent during mining downtimes, DMG anticipates 30% higher utilization rates compared to mono-purpose facilities.

Opinion & Implications:

-

Revenue Diversification: Dual-use data centers can hedge against crypto price swings and tap into booming AI-as-a-service demand.

-

Energy Efficiency: High-efficiency GPUs paired with Quebec’s hydroelectric power may set new benchmarks for sustainable compute.

-

Competitive Landscape: Other mining operators may follow suit, catalyzing a wave of AI-crypto hybrid hosting providers.

Source: GlobeNewswire – DMG AI Infrastructure Purchase

Conclusion

April 30, 2025, illuminated blockchain’s boundless dynamism: scalability breakthroughs at Telegram’s TON Factory; privacy versus immutability in the EU’s GDPR debate; mass-market gaming on Sui; legislative clarity from Capitol Hill; and the AI-crypto infrastructure nexus in Quebec. These stories reveal an industry simultaneously innovating at the protocol layer, grappling with regulation, and exploring cross-sector partnerships. For developers, investors, and policymakers alike, the imperative is clear: build resilient architectures that anticipate regulatory shifts, prioritize user experience, and harness synergies across emerging technologies. Stay tuned to Blocks & Headlines tomorrow for your next daily briefing on the pulse of blockchain’s evolving frontier.

The post Blocks & Headlines: Today in Blockchain – April 30, 2025 appeared first on News, Events, Advertising Options.

Blockchain

From Sydney to the World – Valueex (VUEE) Exchange Announces Entry into the U.S. Market

Blockchain

DIFY Announces Return to MENA with Dubai Blockchain Night 2025

Following a series of successful global editions, DIFY is making a highly anticipated return to the innovation capital of the world — Dubai. The Dubai Blockchain Night 2025, organized by DIFY, took place on 29 April 2025, delivering an electrifying evening of networking, discovery, and gamified engagement right at the iconic doorstep of Palace Downtown.

We are proud to introduce our Title Sponsor – STIQY, the trusted growth and loyalty tool crafted for rising Web3 projects. Attendees experienced live interactive CTA campaigns powered by STIQY’s customizable, white-label solutions—designed to drive scalable engagement and long-term user retention.

Building on the momentum of past editions in Singapore, South Korea, Malaysia, Vietnam, Thailand and previous Dubai showcases, this year’s Dubai Blockchain Night featured a gamified experience where participants dive into real-time activation challenges onsite — gaining first-hand exposure to how STIQY’s dynamic tools operate.

Event Highlights:

-

Title Sponsor: STIQY

-

Co-hosts: EMERGE Group, DTC Group, 9 Cat Group

-

Date: 29 April 2025

-

Location: Palace Downtown

Sponsors include Verrefin, Rapidz, Sei and Avocado Guild.

Highly Curated Networking

The event brought together over 500 participants, including top Web3 stakeholders and decision-makers from the MENA and APAC regions. It served as an exclusive, invite-only gathering for founders, builders, venture capitalists, and media to connect and collaborate.

The post DIFY Announces Return to MENA with Dubai Blockchain Night 2025 appeared first on News, Events, Advertising Options.

-

Blockchain5 days ago

Blockchain5 days agoBlocks & Headlines: Today in Blockchain – April 25, 2025 | BitNile, Dutch Blockchain Week, Citigroup, Philippine Blockchain Week, D.O.G.E Foundation

-

Blockchain6 days ago

Blockchain6 days agoBlaqclouds Board Approves 30-Day Revenue Acceleration and Ecosystem Monetization Plan

-

Blockchain6 days ago

Blockchain6 days agoBlocks & Headlines: Today in Blockchain – April 24, 2025 (Decrypt, CoinDesk, Cointelegraph, 80 Level, UNDP/BGA)

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days ago10% Rebate: Bybit Card Introduces USDC Cashback

-

Blockchain Press Releases5 days ago

Blockchain Press Releases5 days agoBybit Exchange Gold & FX Trading Hits All-Time-High As Gold Prices Soar

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days agoBlockchain for Good Alliance Launches Global Accelerator and Fund with UNDP

-

Blockchain Press Releases3 days ago

Blockchain Press Releases3 days agoBTC Pricing Alert: Bitcoin Rebounds as Trump’s Trade War Comments Ignite Market Rally – Bybit x Block Scholes Report

-

Blockchain1 day ago

PFM Disrupts Wealth Management in 2025: Earn Digital Assets Risk-Free with Zero Fees