Blockchain

Wellfield Closes Acquisition of Tradewind Markets and Private Placement – Creates Transformational Platform for Precious Metals Investors and Producers

- Making precious metals holdings easier to manage for investors through blockchain-based solutions, fully backed by deliverable physical metal custodied at the Royal Canadian Mint – ultimate in security, fungibility, and efficiency.

- Transforming gold and silver into income-generating assets through the application of Wellfield’s proprietary IP, beginning with the decentralized fixed income and volatility products it launched in December 2022.

- Opportunity to create new distribution channels for precious metals producers by offering a direct investor to producer connection that aims to allocate producers a greater share of the value of the metals they produce, and for investors, confidence they are purchasing precious metals from leading North American producers.

Toronto, Ontario–(Newsfile Corp. – February 8, 2023) – Wellfield Technologies, Inc. (TSXV: WFLD) (OTCQB: WFLDF) (FSE: K8D) (the “Company” or “Wellfield“), today announced that further to its press release dated January 23, 2023, it has closed its acquisition of Tradewind Markets, Inc. (“Tradewind“), a US-based operator of a global digital precious metals platform (the “Acquisition“) for consideration equal to 15,166,667 units of the Company valued at US$5,795,000, and a non-brokered private placement of 15,000,000 units of the Company for gross proceeds of C$3,000,000 (the “Private Placement“).

Tradewind Acquisition

Tradewind offers blockchain based digital ownership of deliverable precious metals held in custody by the Royal Canadian Mint. It currently has C$176 million in AUM1 between its flagship VaultChain™ Gold and VaultChain™ Silver products, with retail channel distribution primarily by Kitco Metals Inc. (“Kitco“), one of North America’s largest online retailers and full-service providers of precious metals, and a leading global commodities media and information provider. Tradewind additionally operates an Electronic Request For Quote (“RFQ“) platform used by miners and refiners to streamline large scale trade execution of physical precious metals. During calendar 2022, the RFQ processed over C$825 million in transactions. Tradewind has attracted investments from several industry leaders, who will continue as shareholders of Wellfield, including: Sprott Inc., Agnico Eagle Mines Limited, Newmont Corporation, IAMGOLD Corporation, IEX Group, and Wheaton Precious Metals Corp.

Management Commentary

Levy Cohen, CEO of Wellfield, commented, “In many ways, today’s precious metals market still resembles the structure that has existed for decades, leaving persistent unmet needs for both investors and producers. For investors, the selection, purchase and storage of physical gold and silver products is confusing and comes with the expense of storing it safely. Digital solutions have emerged, however they do not serve the largest portion of the market, which is still focused on physical metals. Tradewind’s solution offers the convenience and cost advantage of a digital solution, with the unique assurance that each digital ounce is backed by physically deliverable metal.

“For producers, an antiquated market structure limits their distribution options and full value realization for their product, particularly for those with meaningful potential ESG attributes. The combination of Wellfield’s intellectual property and settlement capabilities with Tradewind’s precious metals trading and custody platform, will enable us to build a ground-breaking set of solutions targeted at these important investor and producer pain points.

“This is a highly scalable platform with compelling monetization opportunities when combined with our unique blockchain based IP. I would like to welcome the Tradewind team to Wellfield and reflect our excitement regarding the value we can bring to investors, producers and shareholders as we build a profitable global platform together.”

Ryan Graybill, Director of Tradewind said, “Tradewind was born of the idea that the marriage of physical precious metals and blockchain technology represents an unbeatable combination. Our VaultChain™ Gold and VaultChain™ Silver products have been successful, but we are barely scratching the surface of this opportunity. Wellfield’s technology and vision empowers us to expand our capabilities and leverage new opportunities that didn’t exist when Tradewind began its journey. We are excited about the possibilities to add new value for our investor and industry partners in the gold and silver markets and we look forward to continuing on our mission as part of the Wellfield team.”

Acquisition Execution Strategy

- Add Coinmama to VaultChain™ and expand the Institutional dealer network – Immediately opens access to VaultChain products for over 3.5 million registered users.

- Launch regulated blockchain-based spot market for gold and silver – Expected to draw liquidity into the ecosystem, which will support trading and facilitate a direct connection between producers and investors, where quality gold of strong provenance will receive the premium it deserves and where investors can have confidence they are purchasing precious metals that have been responsibly produced and sourced.

- Add institutional fixed income and volatility products to VaultChain™ suite – Leveraging the protocols Wellfield released in December 2022, the Company expects to offer investors in the ecosystem the ability to use their on-chain gold and silver holdings to generate income. The lack of income generating potential is currently one of the most cited reasons to not invest in precious metals.

Acquisition and Private Placement Terms

Pursuant to the definitive agreement for the Acquisition, the Company acquired all issued and outstanding securities of Tradewind in exchange for 15,166,667 units of the Company (the “Acquisition Units“). The valuation of Tradewind in the Acquisition, being US$5,795,000 (approximately C$7,754,869), and the number of Acquisition Units to be issued, was fixed through arms-length negotiations by the parties and implies a notional value of US$0.38 (approximately C$0.51) per Acquisition Unit.

Under the Private Placement, the Company issued 15,000,000 units (the “Placement Units“) at a price of C$0.20 per Placement Unit. The net proceeds from the Private Placement are intended to be used for general working capital purposes. All securities issued in connection with the Private Placement are subject to a statutory hold period of four months plus a day from the date of issuance in accordance with applicable securities legislation.

No finder’s fees were paid and no control person was created as a result of the Acquisition or the Private Placement.

Each Acquisition Unit and each Placement Unit consists of one common share without par value in the capital of the Company (the “Unit Shares“) and one purchase warrant (a “Warrant“) to purchase a common share (the “Warrant Shares“). Each Warrant is exercisable at any time for a period of three years from the date on which such Warrants are issued and at a price of C$0.45 per share. Under the terms of the Warrants, in the event that if the volume-weighted average price of its common shares over 10 consecutive days traded on the TSXV is at or more than C$0.75, the Company has the option to accelerate the expiration date of the warrants to a date that is not less than 30 days from the date of written notice from the Company to the Warrant holders.

A director of the Company acquired 650,000 Placement Units. As such, the issuance of the Placement Units is a “related-party transaction” within the meaning of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101“). The issuance is exempt from the valuation and the minority shareholder approval requirements of MI 61-101 under Section 5.5(b) and Section 5.7(1)(a), respectively, as the shares underlying the Placement Units are not listed on a market specified in MI 61-101, and the fair market value of the Placement Units does not exceed 25% of the Company’s market capitalization. The Company did not file a material change report more than 21 days before the expected closing as the details of participation by related parties were not settled and the Company wished to close on an expedited basis for sound business reasons.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any securities in the United States. The securities described herein have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”) or any state securities laws, and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available. This press release is not for distribution to U.S. newswire services nor for dissemination in the United States. Any failure to comply with this restriction may constitute a violation of U.S. securities laws.

About Wellfield Technologies (TSXV: WFLD) (OTCQB: WFLDF) (FSE: K8D)

Wellfield is an R&D focused Fintech company that operates on public blockchains including Bitcoin and Ethereum. The Company operates a regulated platform that onboards customers globally at scale, leveraging its proprietary decentralized technology to offer highly disruptive on-chain self-custody solutions. Wellfield operates through two brands: Coinmama, which with a growing base of more than 3.5 million registered users, is one of the most trusted and enduring global brands operating in the crypto space; and Wellfield Capital, which the Company announced in late 2022 to meet the needs of institutional users and professional investors.

Join Wellfield’s digital community on LinkedIn and Twitter, and for more details, visit wellfield.io.

About Tradewind Markets, Inc.

Tradewind has built a technology platform for digitizing the trading, settlement, and ownership of precious metals. The Tradewind solution combines world-class exchange technology with VaultChain™, Tradewind’s blockchain technology tailored for precious metals. Tradewind was formed in 2016 and is managed by a team of professionals with extensive experience in electronic trading, market structure, gold investment management, market operations, cryptography and blockchain technology. For more information, please visit https://tradewindmarkets.com/.

For further information contact:

Wellfield Technologies Inc.

Levy Cohen, CEO

[email protected]

Jonathan Ross, Investor Relations

[email protected]

(416) 283-0178

For media enquiries, please contact Kieran Lawler:

[email protected]

(416) 303-0799

Cautionary Notice on Forward-Looking Statements

This press release contains statements that constitute “forward-looking information” (“forward-looking information”) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking information and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information. Forward-looking information in this news release includes the anticipated strategic, operational and competitive benefits of the Acquisition, the development, growth and integration of Tradewind’s business; the abilities of management and other personnel of the Company to achieve the objectives believed to be required to meet such expectations; use of proceeds from the Private Placement; and final TSXV approvals associated therewith, which are based on the Company’s current internal expectations, estimates, projections, assumptions and beliefs, which may prove to be incorrect. These statements are not guarantees of future performance and undue reliance should not be placed on them. Such forward-looking information necessarily involves known and unknown risks and uncertainties, which may cause the Company’s actual performance and results to differ materially from any projections of future performance or results expressed or implied by such forward-looking information. These risks and uncertainties include, but are not limited to: the Company’s ability to achieve the synergies expected as a result of the Acquisition; the Company’s ability to meet the working capital requirements; material adverse changes in general economic, business and political conditions, including changes in the financial markets, changes in applicable laws; compliance with extensive government regulation, the ability of the Company to raise additional capital to fund future operations, compliance with extensive government regulations, domestic and foreign laws and regulations adversely affecting the Company, the impact of COVID-19, and the decentralized finance industry generally. There can be no assurance that forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated. Readers are cautioned that the foregoing list is not exhaustive and readers are encouraged to review the disclosure documents accessible on the Company’s SEDAR profile at www.sedar.com. Readers are further cautioned not to place undue reliance on forward-looking information as there can be no assurance that the plans, intentions or expectations upon which they are placed will occur. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking information.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) has approved nor disapproved the contents of this news release, nor do they. accept responsibility for the adequacy or accuracy of this release.

SOURCE Wellfield Technologies Inc.

1 Assets Under Management as of December 31, 2022

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/154061

Blockchain

Exverse debuts its token on Bybit ahead of the FPS game’s launch

Exverse, a free-to-play game bringing a fresh take on AAA first-person-shooters to Web3, announces the launch of its native $EXVG token on ByBit, a top-three crypto exchange by volume with over 20 million users. The ByBit launch will be followed by spot listings on the MEXC and Gate exchanges. Ahead of its full alpha launch in mid-May, Exverse hosted a soft-launch tournament for 5,000 early registrees on April 15 with cash rewards for top performers.

During the last bull run, Web3 games rose to prominence under the play-to-earn mechanism that made games like “Axie Infinity” so popular. As this model became widely replicated, many of these blockchain-based games prioritized the crypto elements at the expense of the actual game aspects. This trend could be seen in practice by many titles opting to undergo a token launch before even having a working demo, disincentivizing developers to build a quality game, and leaving users with no ecosystem or functioning game to play and spend or the native currency in.

With Exverse approaching its full launch, players can earn $EXVG by performing well while using the native token to enter matches, purchase premium items, and more. The $EXVG token builds on Exverse’s extensive beta and serves as the ecosystem’s currency while the game’s community witnessed a 20 percent growth in verified signups within a month. Supporting Exverse in their token launch are prominent launchpads and incubators that include Seedify, ChainGPT, and GameFi.

To build momentum for its upcoming alpha launch in mid-May, Exverse showcased its game by holding an exclusive deathmatch-style tournament for 5,000 early wait listers on April 15. The five-day tournament, which took place on the game’s ‘Battle Planet,’ gives players a chance to demonstrate their skills and win rewards via stablecoins and tokens. With $50,000 in total up for grabs, the top 100 performers earned at least $200. Top five finishers earnings were dispersed accordingly:

1st place: $4,000

2nd place: $2,000

3rd place: $1,500

4th and 5th place: $1,000

Built using Epic’s Unreal Engine 5, Exverse utilizes blockchain technology to strike a balance between enjoyable, realistic, and immersive real-time gameplay. The game prioritizes skill over pay-2-win mechanics, enabling players to earn rewards by staking tokens before a season’s kickoff. Top performers receive a share of profits from in-game NFTs such as cosmetics and skins.

To support the ecosystem’s development, expansion, and growth while rewarding the team and its early supporters, 400 million $EXVG will be minted.

“We are extremely excited about our token launch and proud to work with a great partner like ByBit to make it happen,” says Fei Ooi Hoong, CEO of Exverse. “We worked tirelessly to develop a diverse, engaging, and intuitive first-person shooter capable of revolutionizing how the public views blockchain-based gaming. Our talented team tapped into its background in traditional gaming to develop a rich and immersive gaming experience and then strategically implemented the NFT elements and in-game economics to enhance the user experience.”

The post Exverse debuts its token on Bybit ahead of the FPS game’s launch appeared first on HIPTHER Alerts.

Blockchain

39% of Canada’s institutional investors have exposure to crypto: KPMG

According to a report from CoinTelegraph, nearly forty percent of institutional investors in Canada have exposure to cryptocurrency, as revealed by KPMG. This finding underscores the growing acceptance and adoption of digital assets among institutional investors in the country.

The report indicates that a significant portion of institutional investors in Canada are actively investing in or exploring opportunities in the cryptocurrency market. This trend reflects a shift in sentiment towards digital assets, with more investors recognizing the potential for long-term growth and diversification offered by cryptocurrencies.

KPMG’s findings highlight the increasing mainstream acceptance of cryptocurrencies among traditional investors, as well as the growing interest in blockchain technology and its potential applications across various industries. As institutional investors continue to enter the cryptocurrency market, they are expected to bring additional capital and liquidity, further fueling the growth and maturation of the digital asset ecosystem.

Overall, KPMG’s report signals a significant milestone in the adoption of cryptocurrencies in Canada, indicating that institutional investors are increasingly recognizing the value proposition of digital assets and integrating them into their investment portfolios. This trend is likely to accelerate the broader adoption and mainstream acceptance of cryptocurrencies in the country and beyond.

Source: cointelegraph.com

The post 39% of Canada’s institutional investors have exposure to crypto: KPMG appeared first on HIPTHER Alerts.

Blockchain

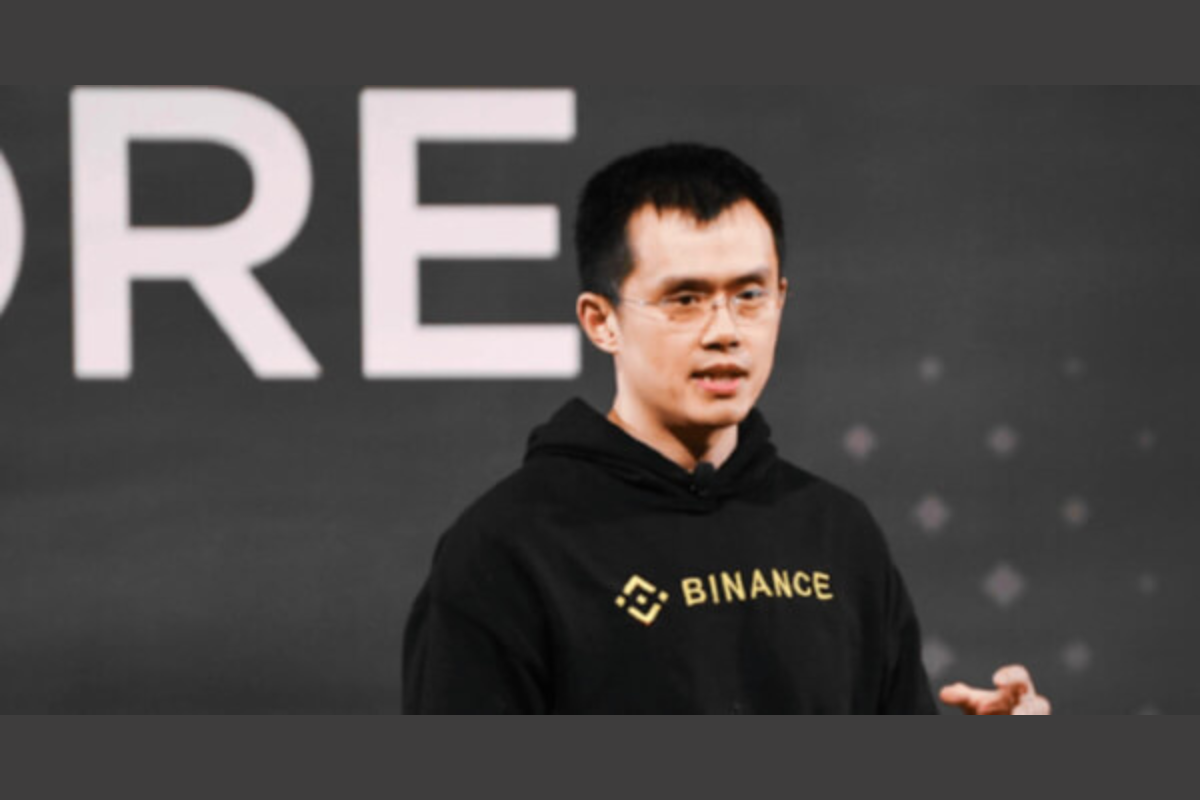

BounceBit (BB) Megadrop Now Open: Participate by Subscribing to BNB Locked Products or Completing Web3 Quests

The BounceBit (BB) Megadrop is now open for participation, as announced by Blockchain.News. This event presents an exciting opportunity for users to earn BB tokens by engaging in various activities, including subscribing to BNB locked products and completing Web3 quests.

Participants can join the BB Megadrop by subscribing to BNB locked products or completing Web3 quests, both of which offer different avenues for earning BB tokens. By participating in these activities, users have the chance to accumulate BB tokens and potentially benefit from the rewards associated with the Megadrop.

Subscribing to BNB locked products allows users to earn BB tokens by locking their BNB assets for a specified period. This not only provides users with an opportunity to earn rewards but also contributes to the liquidity and stability of the BounceBit ecosystem.

Additionally, completing Web3 quests offers users an alternative way to earn BB tokens by engaging in various tasks and challenges related to Web3 technology. These quests provide users with a fun and interactive way to learn about blockchain and cryptocurrency while earning rewards in the form of BB tokens.

Overall, the BB Megadrop presents an exciting opportunity for users to participate in the BounceBit ecosystem and earn rewards by engaging in activities that contribute to the growth and development of the platform. As the Megadrop progresses, participants can look forward to additional opportunities to earn BB tokens and potentially benefit from the rewards associated with this event.

Source: blockchain.news

The post BounceBit (BB) Megadrop Now Open: Participate by Subscribing to BNB Locked Products or Completing Web3 Quests appeared first on HIPTHER Alerts.

-

Blockchain Press Releases3 days ago

Blockchain Press Releases3 days agoDeFi Lens builds advanced Generative AI for Technical Analysis

-

Blockchain7 days ago

Blockchain7 days agoTether USDT stablecoin goes live on TON blockchain

-

Blockchain7 days ago

Blockchain7 days agoCrypto fans count down to bitcoin’s ‘halving’

-

Blockchain3 days ago

Blockchain3 days agoVenezuela’s Oil Giant Turns to Crypto as US Sanctions Bite Again

-

Blockchain3 days ago

Blockchain3 days agoHalving weakness sees $206 million exit crypto funds, Bitcoin miners pivot to AI

-

Blockchain7 days ago

Blockchain7 days agoSupply Chain Finance Market Forecast to Reach $9.4 Billion by 2029: Increasing Emphasis on Sustainable Sourcing

-

Blockchain7 days ago

Blockchain7 days agoCrypto and Blockchain Weave Deeper Into the Biometrics Space – Identity News Digest

-

Blockchain2 days ago

Blockchain2 days agoGlobal Payment Gateway Industry Report 2024: Seamless Integration with In-Game Virtual Currency Systems Enables Payment Gateways to Contribute to the Monetization Strategies of Game Developers