Blockchain

3iQ Supports Legal Measures Taken by Fir Tree Capital Management to Unlock the $4.5 Billion-Plus of Trapped Value to GBTC Shareholders

Toronto, Ontario–(Newsfile Corp. – December 22, 2022) – 3iQ strongly believes that many of GBTC’s shareholders are long-term investors in bitcoin. This statement is presented in the spirit of collaboration among the regulated investment community to achieve the goal of remedying GBTC’s discount and restoring both investor value and investor confidence during a time when they are sorely needed.

3iQ has been working with regulators since 2014 to bring commercially innovative and compliant digital asset products and solutions to global markets. We did this with a fiduciary obligation and at great expense to prioritize an investment structure with integrity that has served our clients over time.

The December 6th court filing from Fir Tree Capital Management (Fir Tree), as well as 3iQ’s own research, indicates that Grayscale has limited the rights of shareholders over time, starting with the revocation of redemption rights in 2014.

Fir Tree’s complaint is a “books and records” action seeking documentation to advance transparency and hopefully resolve this unfair discount by reinstating the redemption feature or instituting a conversion feature. Prior to Fir Tree’s filing, 3iQ engaged Grayscale with suggestions on how to collapse the discount, but to no avail, and bringing about this appeal.

It appears that Grayscale has taken notice of Fir Tree’s complaint. In a letter to investors, Grayscale’s CEO offered to explore a partial tender for GBTC shares. But with few details other than no redemption feature and a stated reliance on SEC approval, Grayscale’s ability to deliver value remains undefined at best.

The Fir Tree filing brought attention to critical components which 3iQ fully supports:

- Grayscale engagement with affiliates brings potential conflicts of interest – Per page 25 of the filing document, “Grayscale has engaged DCG affiliates for nearly all of its essential services, including (i) Genesis, which is a wholly owned subsidiary of DCG.”

- Shareholder redemption option not fully explored – Per the filing, “Grayscale’s disclosures failed to acknowledge, however, that it has never been required to obtain ‘regulatory approval’ to operate a redemption program, provided that it is not creating and redeeming shares at the same time.” Therefore, the decision NOT to offer a redemption mechanism is Grayscale’s alone.

- Grayscale is not delivering on its investment objective for the trust – As stated in the Trust document, “GBTC’s investment objective is for the value of its Shares (based on BTC per Share) to reflect the value of Bitcoin held by the Trust, less fees and expenses.” This failure has caused investors significant harm over the last 12-months with potential for the discount to widen further.

- GBTC shareholders are paying fees based on a valuation that investors cannot realize – Fees paid to Grayscale are based on Net Asset Value (NAV), which is almost 2x greater than the market value that investors would realize in a secondary market sale.

Regarding Fir Tree’s plea to have Grayscale restore the redemption feature, 3iQ’s current regulated structure can help remedy GBTC’s discount and restore value to investors.

3iQ Proposes a Market Solution for GBTC Shareholders

We encourage Grayscale to offer a conversion feature for GBTC that allows the physical movement of bitcoin to one of our current solutions. This would minimize the market impact of an immediate and wholescale redemption without burdening the courts or the taxpayer. A path forward to remedy the situation would include some or all the following attributes:

- Initiate a tender offer for the conversion of GBTC for a new or existing regulated bitcoin vehicle with redemption rights

- New or existing regulated bitcoin vehicles that facilitate cash or in-kind redemptions at Net Asset Value per Unit (NAVPU), less fees and expenses

As a registered digital asset manager, 3iQ appreciates and understands the need to restore confidence among institutions and investors that believed GBTC was a long-term, cost-effective, and secure, physically backed investment vehicle. Grayscale has been unresponsive to our outreach, however, 3iQ now calls on our clients, supporters, and peers in the regulated investment community to join this broader appeal. Together, we can help remedy GBTC’s discount and restore investor value and investor confidence.

About 3iQ

Founded in 2012, 3iQ is one of world’s leading digital asset investment fund managers. 3iQ was the first Canadian investment fund manager to offer a public bitcoin investment fund, The Bitcoin Fund (TSX: QBTC) (TSX: QBTC.U), and a public ether investment fund, The Ether Fund (TSX: QETH.UN) (TSX: QETH.U). More recently, 3iQ launched the 3iQ CoinShares Bitcoin ETF (TSX: BTCQ) (TSX: BTCQ.U) and the 3iQ CoinShares Ether ETF (TSX: ETHQ) (TSX: ETHQ.U). 3iQ offers investors convenient and familiar investment products to gain exposure to digital assets.

Press Contact:

Mark Connors

[email protected]

THESE MATERIALS AND THE INFORMATION CONTAINED HEREIN, IS RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE UNITED STATES OR ANY JURISDICTION IN WHICH THE SAME WOULD BE UNLAWFUL.

These materials do not constitute an offer to sell or issue or the solicitation of an offer to buy or subscribe for securities in the United States or any other jurisdiction. Neither the 3iQ Corp.’s (the “Manager”) nor the Fund’s securities have been nor will be registered under the United States Securities Act of 1933, as amended (the “Securities Act”), nor under the applicable securities laws of any state or other jurisdiction of the United States, and may not be offered, sold, resold, transferred or delivered, directly or indirectly within, into or in the United States, absent registration or an applicable exemption from, or except in a transaction not subject to, the registration requirements of the Securities Act and in compliance with the securities laws of any relevant state or other jurisdiction of the United States. No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise.

You will usually pay brokerage fees to your dealer if you purchase or sell units of the ETF on a stock exchange or other alternative Canadian trading system (an “exchange”). If units of the ETF are purchased or sold on an exchange, investors may pay more than the current net asset value when buying units of the ETF and may receive less than the current net asset value when selling them.

There are ongoing fees and expenses associated with owning units of an investment fund. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the ETF in its public filings available at www.sedar.com. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Certain statements contained in this document constitute forward-looking information within the meaning of Canadian securities laws. Forward-looking information may relate to matters disclosed in this document and anticipated events or results and may include statements regarding the future financial performance of the funds managed by 3iQ. In some cases, forward-looking information can be identified by terms such as “may”, “will”, “should”, “expect”, “plan”, “anticipate”, “believe”, “intend”, “estimate”, “predict”, “potential”, “continue” or other similar expressions concerning matters that are not historical facts. Actual results may vary from such forward-looking information. Investors should not place undue reliance on forward-looking statements. These forward-looking statements are made as of the date hereof and we assume no obligation to update or revise them to reflect new events or circumstances.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/149299

Blockchain

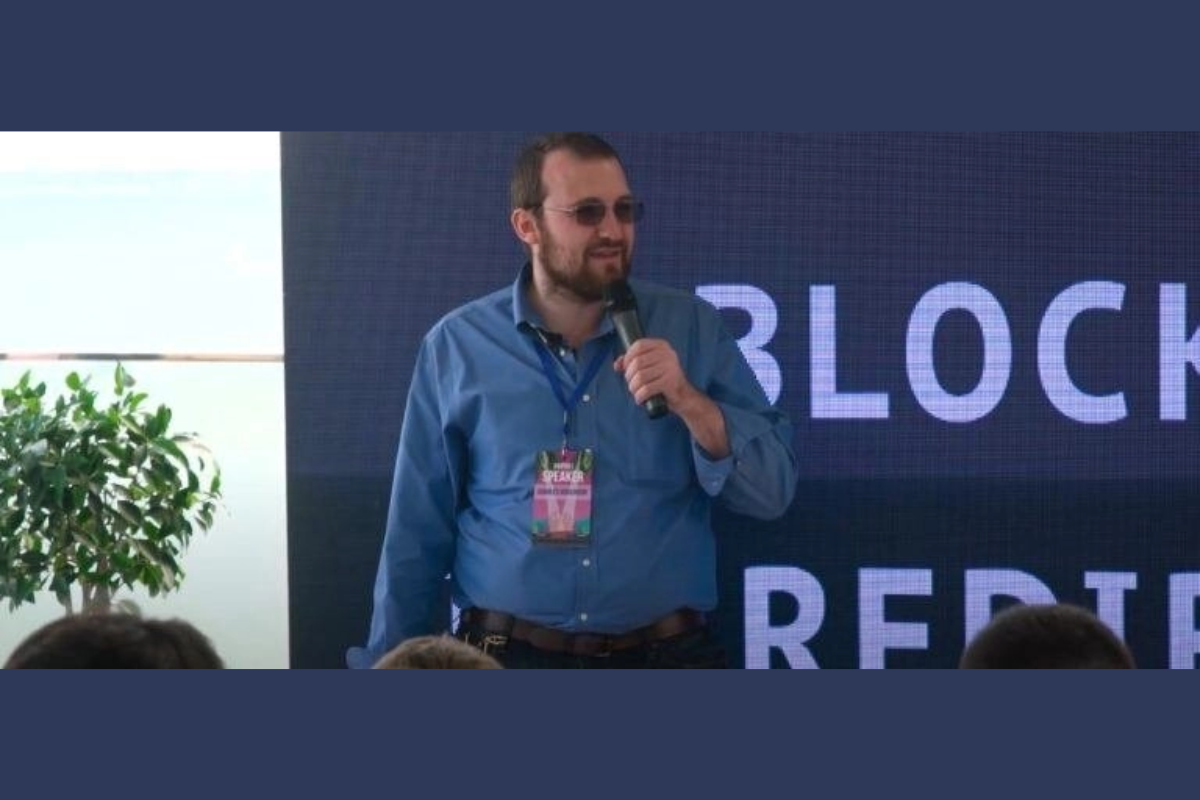

Cardano Founder Says “Crypto Doesn’t Want To Set The World On Fire”

According to a report from Crypto Daily, the founder of Cardano, Charles Hoskinson, expressed a sentiment that the cryptocurrency industry does not aim to “set the world on fire.” This statement reflects a broader perspective on the role of cryptocurrency and blockchain technology in the global economy and society.

Hoskinson’s remark suggests that the cryptocurrency industry is not solely focused on disruptive or revolutionary change but rather on providing innovative solutions to existing challenges and improving upon traditional systems. This viewpoint underscores the belief that cryptocurrencies and blockchain technology can coexist and collaborate with established financial and technological infrastructures, rather than seeking to replace them entirely.

By emphasizing a collaborative approach, Hoskinson highlights the potential for cryptocurrencies like Cardano to complement existing financial systems and contribute to positive developments in various sectors. This includes areas such as finance, governance, healthcare, and supply chain management, where blockchain technology can offer enhanced security, transparency, and efficiency.

Overall, Hoskinson’s statement reflects a pragmatic and inclusive perspective on the role of cryptocurrency in society, emphasizing the importance of cooperation and collaboration in driving meaningful progress and innovation. As the cryptocurrency industry continues to evolve, this mindset is likely to shape its trajectory and impact on the broader economy and society.

Source: cryptodaily.co.uk

The post Cardano Founder Says “Crypto Doesn’t Want To Set The World On Fire” appeared first on HIPTHER Alerts.

Blockchain

Pantera Capital Targets $1 Billion for New ‘All-in-One’ Blockchain Fund Set for 2025 Launch

Pantera Capital aims to raise $1 billion for its new all-in-one blockchain fund, slated for launch in 2025, as reported by Bitcoin.com. This ambitious fundraising goal underscores Pantera’s confidence in the potential of blockchain technology and its commitment to supporting innovative projects in the space.

The new blockchain fund from Pantera Capital is designed to be a comprehensive investment vehicle, providing exposure to a wide range of blockchain-related assets and opportunities. By offering a diversified portfolio of investments, the fund aims to capitalize on the growth and development of the blockchain ecosystem while managing risk effectively.

Pantera Capital’s decision to launch a new blockchain fund reflects its bullish outlook on the long-term prospects of the blockchain industry. With increasing mainstream adoption and institutional interest in cryptocurrencies and blockchain technology, Pantera sees significant opportunities for growth and value creation in the coming years.

The $1 billion fundraising target for the new blockchain fund is indicative of Pantera’s confidence in its ability to attract capital from investors seeking exposure to the burgeoning blockchain market. As one of the leading blockchain-focused investment firms, Pantera Capital is well-positioned to capitalize on the growing demand for blockchain-related investment opportunities.

Overall, the launch of Pantera Capital’s new all-in-one blockchain fund represents a significant development in the blockchain investment landscape, offering investors a comprehensive vehicle for gaining exposure to the rapidly evolving blockchain industry. As the fund prepares for its launch in 2025, it is poised to play a key role in shaping the future of blockchain investment and innovation.

Source: news.bitcoin.com

The post Pantera Capital Targets $1 Billion for New ‘All-in-One’ Blockchain Fund Set for 2025 Launch appeared first on HIPTHER Alerts.

Blockchain

Exverse debuts its token on Bybit ahead of the FPS game’s launch

Exverse, a free-to-play game bringing a fresh take on AAA first-person-shooters to Web3, announces the launch of its native $EXVG token on ByBit, a top-three crypto exchange by volume with over 20 million users. The ByBit launch will be followed by spot listings on the MEXC and Gate exchanges. Ahead of its full alpha launch in mid-May, Exverse hosted a soft-launch tournament for 5,000 early registrees on April 15 with cash rewards for top performers.

During the last bull run, Web3 games rose to prominence under the play-to-earn mechanism that made games like “Axie Infinity” so popular. As this model became widely replicated, many of these blockchain-based games prioritized the crypto elements at the expense of the actual game aspects. This trend could be seen in practice by many titles opting to undergo a token launch before even having a working demo, disincentivizing developers to build a quality game, and leaving users with no ecosystem or functioning game to play and spend or the native currency in.

With Exverse approaching its full launch, players can earn $EXVG by performing well while using the native token to enter matches, purchase premium items, and more. The $EXVG token builds on Exverse’s extensive beta and serves as the ecosystem’s currency while the game’s community witnessed a 20 percent growth in verified signups within a month. Supporting Exverse in their token launch are prominent launchpads and incubators that include Seedify, ChainGPT, and GameFi.

To build momentum for its upcoming alpha launch in mid-May, Exverse showcased its game by holding an exclusive deathmatch-style tournament for 5,000 early wait listers on April 15. The five-day tournament, which took place on the game’s ‘Battle Planet,’ gives players a chance to demonstrate their skills and win rewards via stablecoins and tokens. With $50,000 in total up for grabs, the top 100 performers earned at least $200. Top five finishers earnings were dispersed accordingly:

1st place: $4,000

2nd place: $2,000

3rd place: $1,500

4th and 5th place: $1,000

Built using Epic’s Unreal Engine 5, Exverse utilizes blockchain technology to strike a balance between enjoyable, realistic, and immersive real-time gameplay. The game prioritizes skill over pay-2-win mechanics, enabling players to earn rewards by staking tokens before a season’s kickoff. Top performers receive a share of profits from in-game NFTs such as cosmetics and skins.

To support the ecosystem’s development, expansion, and growth while rewarding the team and its early supporters, 400 million $EXVG will be minted.

“We are extremely excited about our token launch and proud to work with a great partner like ByBit to make it happen,” says Fei Ooi Hoong, CEO of Exverse. “We worked tirelessly to develop a diverse, engaging, and intuitive first-person shooter capable of revolutionizing how the public views blockchain-based gaming. Our talented team tapped into its background in traditional gaming to develop a rich and immersive gaming experience and then strategically implemented the NFT elements and in-game economics to enhance the user experience.”

The post Exverse debuts its token on Bybit ahead of the FPS game’s launch appeared first on HIPTHER Alerts.

-

Blockchain Press Releases3 days ago

Blockchain Press Releases3 days agoDeFi Lens builds advanced Generative AI for Technical Analysis

-

Blockchain3 days ago

Blockchain3 days agoVenezuela’s Oil Giant Turns to Crypto as US Sanctions Bite Again

-

Blockchain3 days ago

Blockchain3 days agoHalving weakness sees $206 million exit crypto funds, Bitcoin miners pivot to AI

-

Blockchain2 days ago

Blockchain2 days agoGlobal Payment Gateway Industry Report 2024: Seamless Integration with In-Game Virtual Currency Systems Enables Payment Gateways to Contribute to the Monetization Strategies of Game Developers

-

Blockchain4 days ago

PairedWorld Earns Blockchain Award Nomination, Secures $1.5 Million in Private Token Sales, and Welcomes BlackRock Venture Partner to Advisory Board

-

Blockchain3 days ago

PairedWorld Earns Nomination for Best Blockchain Project for Social Impact, Secures $1.5 Million in Private Token Sales, and Welcomes Paul Taylor Who Is a Venture Partner at BlackRock to its Advisory Board

-

Blockchain1 day ago

Blockchain1 day agoBounceBit (BB) Megadrop Now Open: Participate by Subscribing to BNB Locked Products or Completing Web3 Quests

-

Blockchain4 days ago

Blockchain4 days agoDeFi Technologies to Present at the Blockchain & Digital Asset Virtual Investor Conference April 25th