Blockchain

LABEL Foundation Integrates with Binance Custody to Offer Cold Storage Support for $LBL Token

Tortola, British Virgin Islands–(Newsfile Corp. – June 8, 2022) – LABEL Foundation has announced that it has officially integrated with Binance Custody to take advantage of their highly secure cold storage solution. Thanks to the new integration, which provides support for the $LBL token via Binance Custody, security will no longer be an issue as the tokens will be stored using the institutional and insured cold storage service. Moreover, both BEP-20 and ERC-20 are available for deposits as well as withdrawals. If all goes well, the LABEL team hopes to further expand its partnership with the Binance ecosystem in the future as well.

LABEL Foundation Integrates With Binance Custody

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/8675/126540_198280ae54adda8d_001full.jpg

A budding relationship

Binance Custody was only released in 2021, but there is nevertheless plenty of faith in the high level of user protection being offered by the service. LABEL had been searching for a reliable custody service for quite a while, and when choosing a custody service, the main aspects that LABEL primarily focused on were security and insurance coverage.

Keeping that in mind, Binance Custody indeed appeared to be the optimal choice as it uses industry-leading secure MPC (Multi-Party Computing), threshold signing schemes, and offline key-sharing storage to decentralize fund management, all of which are vital components to ensuring the safety of users’ digital assets.

Also, in terms of insurance, Binance Custody obtained insurance from Arch Syndicate 2012 at Lloyd’s of London, which was mediated by Lockton’s Emerging Asset Protection (LEAP), the world’s largest independent insurance broker, to further enhance investor protection.

The benefits of transferring ownership of digital assets to Binance Custody are hence not only limited to security from hackers and malicious individuals, but also delegation of authority. By sharing access with the custodian and delegating this authority, users can thus potentially prevent the loss of assets in the event of lost cryptographic inheritance, private passwords, or any other kind of data loss or hack.

Choosing Binance Custody was an easy choice for LABEL Foundation because of its aforementioned safe cold storage solution. LABEL integrating with Binance Custody therefore provides another level of security by protecting users’ $LBL tokens with the institutional-grade digital asset management infrastructure and security features.

This provides some much-needed peace of mind to LABEL’s customers, as reliable security measures have quickly become mandatory for any project in this industry. According to CSO Hyung Soon Choi, there will also be discussions on potentially considering further strategic collaboration with Binance Custody and the broader Binance Ecosystem in the foreseeable future.

About LABEL Foundation

LABEL Foundation is a blockchain-oriented NFT copyright fee sharing platform that supports investment, distribution and advertising processes along with removing significant barriers to modern content production and investment.

Essentially, LABEL Foundation represents an incubation system designed to disrupt the DeFi industry and it uses the native $LBL token, which is Ethereum-based governance and utility token, to do so. Furthermore, the tokens are mainly used to establish the basic token economy of the platform by acting as payment, staking and governance entities.

Lastly, the DAO (Decentralized Autonomous Organization) voting infrastructure allows contributors to claim profits via the non-fungible token shareholding system, which adds a strong sense of community in addition to the aforementioned security features.

For more information and regular updates, be sure to check out the official website and Medium, Telegram and Twitter channels.

Contact information:

Hyungsoon Choi

Email: [email protected]

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/126540

Blockchain

Breaking News: Bitgert Coin Price Expected To Skyrocket In Coming Days

In recent news, Bitgert coin’s price is anticipated to soar in the coming days, marking a significant development in the cryptocurrency market. This projection has attracted attention from investors and enthusiasts alike, as they await potential gains from the anticipated price surge.

The expected rise in Bitgert coin’s price has stirred excitement among crypto investors, who are closely monitoring market trends and developments to capitalize on potential opportunities. This surge is attributed to various factors, including market sentiment, technological advancements, and investor confidence in the project’s prospects.

As the cryptocurrency landscape continues to evolve, Bitgert coin’s projected price increase underscores the dynamic nature of the market and the potential for significant gains. Investors are advised to conduct thorough research and exercise caution when trading cryptocurrencies, as price movements can be volatile and unpredictable.

Overall, the anticipated surge in Bitgert coin’s price reflects the growing interest and optimism surrounding the project, highlighting its potential to deliver substantial returns for investors in the near future.

Source: cryptodaily.co.uk

The post Breaking News: Bitgert Coin Price Expected To Skyrocket In Coming Days appeared first on HIPTHER Alerts.

Blockchain

Ethereum Developers Target Ease of Crypto Wallets With ‘EIP-3074’

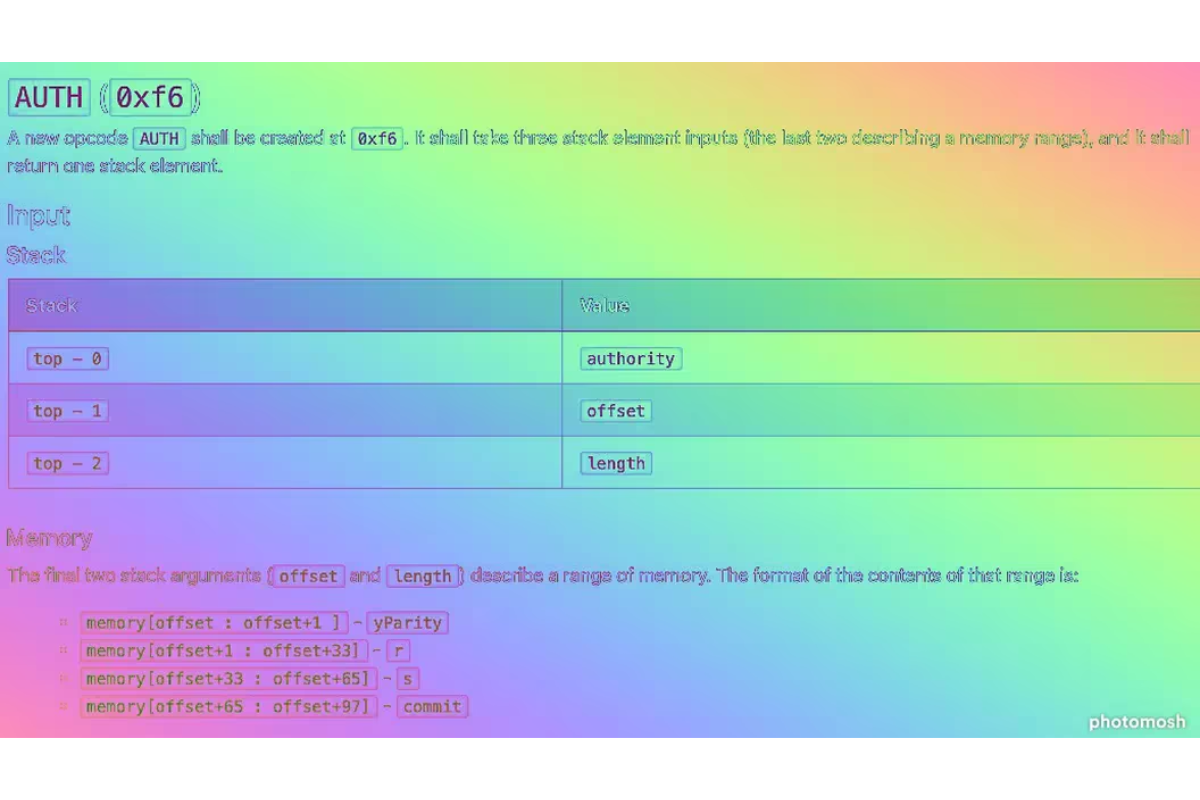

Ethereum developers are setting their sights on improving the user experience of crypto wallets with the implementation of Ethereum Improvement Proposal (EIP) 3074. This proposal aims to simplify the process of interacting with Ethereum smart contracts, making it easier for users to manage their digital assets securely.

EIP-3074 introduces a new type of account called “constrained accounts,” which are designed to restrict certain types of interactions with smart contracts. This feature enhances the security of crypto wallets by limiting the scope of potential attacks and reducing the risk of unauthorized access to funds.

One of the key benefits of EIP-3074 is its ability to streamline the user experience of interacting with Ethereum smart contracts. By simplifying the process of managing digital assets, this proposal aims to make crypto wallets more accessible to a wider audience, including non-technical users.

In addition to improving usability, EIP-3074 also enhances the security of Ethereum wallets by introducing new permissioning mechanisms. Constrained accounts allow users to define specific rules and conditions for interacting with smart contracts, providing an additional layer of protection against potential vulnerabilities and exploits.

Overall, EIP-3074 represents a significant step forward in the ongoing effort to enhance the usability and security of Ethereum wallets. By introducing constrained accounts and new permissioning mechanisms, this proposal aims to make it easier for users to manage their digital assets securely while also reducing the risk of unauthorized access and potential attacks.

Source: coindesk.com

The post Ethereum Developers Target Ease of Crypto Wallets With ‘EIP-3074’ appeared first on HIPTHER Alerts.

Blockchain

Istanbul Blockchain Week 2024 Returns Showcasing Turkey as the Rising Star in Web3 Adoption

Istanbul Blockchain Week 2024 is making a comeback, highlighting Turkey as a rising star in Web3 adoption. This event, set to take place in Istanbul, aims to showcase Turkey’s growing prominence in the adoption of Web3 technologies and its potential to become a leader in the blockchain industry.

With a focus on fostering collaboration and innovation in the blockchain space, Istanbul Blockchain Week 2024 will bring together industry experts, developers, investors, and enthusiasts from around the world. The event will feature a series of keynote speeches, panel discussions, workshops, and networking sessions, providing participants with valuable insights and opportunities to connect with key players in the industry.

One of the key objectives of Istanbul Blockchain Week 2024 is to highlight Turkey’s vibrant blockchain ecosystem and its potential to drive innovation and economic growth. As a strategically located hub between Europe, Asia, and the Middle East, Turkey offers a unique opportunity for blockchain companies to tap into diverse markets and access a skilled talent pool.

The event will also serve as a platform for showcasing the latest developments and trends in the blockchain industry, including decentralized finance (DeFi), non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), and more. Attendees can expect to gain valuable insights into the future of blockchain technology and its potential impact on various industries.

Istanbul Blockchain Week 2024 is expected to attract a diverse audience, including blockchain enthusiasts, investors, entrepreneurs, government officials, and academics. By bringing together stakeholders from across the globe, the event aims to foster collaboration, drive innovation, and accelerate the adoption of blockchain technology in Turkey and beyond.

Overall, Istanbul Blockchain Week 2024 promises to be an exciting and impactful event, showcasing Turkey’s growing influence in the blockchain industry and highlighting the country’s potential to become a global leader in Web3 adoption.

Source: cryptoslate.com

The post Istanbul Blockchain Week 2024 Returns Showcasing Turkey as the Rising Star in Web3 Adoption appeared first on HIPTHER Alerts.

-

Blockchain6 days ago

Blockchain6 days agoMeritrust Credit Union Joins Metal Blockchain’s Banking Innovation Program

-

Blockchain Press Releases6 days ago

Blockchain Press Releases6 days agoDeltec Bank Receives System and Organization Controls (SOC 2) Type 1 Certification

-

Blockchain6 days ago

Blockchain6 days agoZettaBlock announces the addition of blockchain data

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days agoDiscover Move Move Coin: Is This the Next Sports Blockchain for Your Workout?

-

Blockchain6 days ago

Blockchain6 days agoGlobal eCommerce Payments Markets to 2030 | A $612 Billion Opportunity | Blockchain Technology and Cryptocurrencies Reshaping eCommerce by Providing Secure, Cross-Border Payment Solutions

-

Blockchain6 days ago

Blockchain6 days agoHong Kong joins global crypto ETF race

-

Blockchain6 days ago

Blockchain6 days agoAnkr expands Bitcoin liquid staking tokens to AI blockchain Talus

-

Blockchain2 days ago

Blockchain2 days agoTop 10 Sessions You Can’t Miss at MARE BALTICUM Gaming & TECH Summit 2024 (Tallinn, Estonia, 4-5 June)