Blockchain

HIVE Blockchain Provides April 2022 Production Update

This news release constitutes a “designated news release” for the purposes of the Company’s prospectus supplement dated February 2, 2021 to its amended and restated short form base shelf prospectus dated January 4, 2022.

Vancouver, British Columbia–(Newsfile Corp. – May 4, 2022) – HIVE Blockchain Technologies Ltd. (TSX.V:HIVE) (Nasdaq:HIVE) (FSE:HBF) (the “Company” or “HIVE”) is pleased to announce the production figures from the Company’s global Bitcoin and Ethereum mining operations for the month of April 2022, with a BTC HODL balance of 2,832 Bitcoin and 15,914 Ethereum as of May 2, 2022. In addition, the Company is providing an update on our continued operational scaling with renewable green energy.

April 2022 Production Figures

HIVE is pleased to announce its April 2022 production figures and mining capacity:

- 268.8 BTC Produced

- 2.0 Exahash of Bitcoin mining capacity at beginning of April

- Increased to 2.15 Exahash of Bitcoin mining capacity at end of April

- 2,537 ETH Produced*

- 6.1 Terahash of Ethereum mining capacity at beginning of April

- Increased to 6.26 Terahash of Ethereum mining capacity at end of April

*The Company’s production of ETH from GPU mining (including selective optimizations of GPU hashrate) has yielded a total ETH production of 2,537 ETH.

Frank Holmes, Executive Chairman of HIVE stated “We are very pleased to report HIVE has continued its strong momentum in hashing power expansion, notably our Bitcoin mining hash power grew by 8% this month, through ongoing optimizations and electrical upgrades. In April we produced an average of 9.0 BTC per day, and we are pleased to note that as of today, we are producing approximately 9.2 BTC a day even after the recent difficulty increase of 5.5%.”

Aydin Kilic, President & COO of HIVE noted “We continue to strive for operational excellence, ensuring that as we scale our hashrate as a company we also optimize our uptime, to ensure ideal Bitcoin and Ethereum output figures. Mr. Kilic continued, “We also would like to provide an update on the BTC and ETH equivalency, where one can equate value of the coins produced daily. As such the ETH that HIVE produced during the month of April, calculated on a daily basis, is approximately equal a monthly total of 189.5 BTC, which we refer to as Bitcoin equivalent or BTC equivalent. This is in addition to the 268.8 BTC produced from our Bitcoin mining operations during April, for a total of 458.3 Bitcoin equivalent”

The Company’s total Bitcoin equivalent production in April 2022 was:

- 458.3 BTC Equivalent Produced

- 15.3 BTC Equivalent produced per day on average

- 3.4 Exahash of BTC Equivalent Hashrate (BTC hashrate plus equivalent ETH Hashrate as of April 30)

Successful Green Energy Scaling Through Supply Disruptions

HIVE is pleased to provide a market update on the Company’s growth plans for the year ahead. The Company will be at 6.2 Exahash BTC equivalent hashrate in one year, based on contracted monthly deliveries of ASIC and GPU hardware (with deposits in place), up from 3.4 Exahash of BTC equivalent hashrate today.

The Company has been consistently receiving ASIC and GPU deliveries monthly and is hopeful this to continue on schedule. However the supply chain challenges that have faced the world for the past 2 years has not ended, with lockdowns continuing to take place in China which is a source of a great deal of the world’s manufacturing. HIVE has carefully endeavoured to balance sustainable growth of its data center infrastructure to optimize the incoming ASIC and GPU hardware orders, so that we have maximum operating hashrate, and the best efficiency in Bitcoin per Exahash amongst industry peers.

The crypto mining industry in general appears to find itself at a crossroads with a supply of very expensive ASIC chips and no few places to plug them in. Moreover, new market entrants racing to secure a position in the Bitcoin mining ecosystem contend with a current payback of buying ASIC chips at current retail prices from Chinese manufacturers with close to a 2-year ROI. Only a year ago, the experience was one where it was only a 6 to 9 month payback on capital. This is a result of the disproportionately high $ per Terahash ($/TH) retail prices from Chinese manufacturers, relative to current hashrate economics. Securing hardware at an attractive $/TH price, is key to generating a strong return on invested capital (ROIC). Whereas HIVE’s deal with Intel is much more attractive in ROIC, which the Company has studied in comparison to market offers from other Bitcoin ASIC miner suppliers.

HIVE is resolute in cautiously and strategically building our BTC production to generate the highest ROIC for our shareholders. Over the past year our production of BTC has grown substantially and we are now at 1% of the global network while our profitable ETH production has increased over the past 4 months. The current daily revenue generated from coin production is approximately US$600.000 per day.

As it pertains to rapidly scaling, HIVE has endeavoured to first find sources of renewable green energy before buying large allocations of GPUs or ASIC miners in an effort to maximize our efficiencies and generate robust returns on invested capital. In our market intelligence, the Company has noticed significant supply disruptions for electrical equipment needed to make data centers, such as transformers and switch gear. Striving to scale large production has run into many roadblocks due to these supply line issues. Our research from China with over 30 cities locked down has created an epic traffic jam of empty ships waiting to pick up manufactured products in ports along the China coast. This is impacting their whole manufacturing sector, as well as other industries which rely on these suppliers. We are closely monitoring the trade off between risks of not receiving needed electrical and hardware for building data centers and Bitcoin mining machines. Our treasury of Bitcoin and Ethereum mined with green energy is currently valued at approximately US$150 million.

Network Mining Difficulty

The Bitcoin network difficulty increased as much as 5.5% and similarly the Ethereum network difficulty increased as much as 5% during the month of April. These factors impact our gross profit margins.

About HIVE Blockchain Technologies Ltd.

HIVE Blockchain Technologies Ltd. went public in 2017 as the first cryptocurrency mining company with a green energy and ESG strategy.

HIVE is a growth-oriented technology stock in the emergent blockchain industry. As a company whose shares trade on a major stock exchange, we are building a bridge between the digital currency and blockchain sector and traditional capital markets. HIVE owns state-of-the-art, green energy-powered data centre facilities in Canada, Sweden, and Iceland, where we source only green energy to mine on the cloud and HODL both Ethereum and Bitcoin. Since the beginning of 2021, HIVE has held in secure storage the majority of its ETH and BTC coin mining rewards. Our shares provide investors with exposure to the operating margins of digital currency mining, as well as a portfolio of cryptocurrencies such as ETH and BTC. Because HIVE also owns hard assets such as data centers and advanced multi-use servers, we believe our shares offer investors an attractive way to gain exposure to the cryptocurrency space.

We encourage you to visit HIVE’s YouTube channel here to learn more about HIVE.

For more information and to register to HIVE’s mailing list, please visit www.HIVEblockchain.com. Follow @HIVEblockchain on Twitter and subscribe to HIVE’s YouTube channel.

On Behalf of HIVE Blockchain Technologies Ltd.

“Frank Holmes”

Executive Chairman

For further information please contact:

Frank Holmes

Tel: (604) 664-1078

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-Looking Information

Except for the statements of historical fact, this news release contains “forward-looking information” within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates and projections as at the date of this news release. “Forward-looking information” in this news release includes, but is not limited to, business goals and objectives of the Company; and other forward-looking information concerning the intentions, plans and future actions of the parties to the transactions described herein and the terms thereon.

Factors that could cause actual results to differ materially from those described in such forward-looking information include, but are not limited to, the volatility of the digital currency market; the Company’s ability to successfully mine digital currency; the Company may not be able to profitably liquidate its current digital currency inventory as required, or at all; a material decline in digital currency prices may have a significant negative impact on the Company’s operations; the volatility of digital currency prices; continued effects of the COVID-19 pandemic may have a material adverse effect on the Company’s performance as supply chains are disrupted and prevent the Company from carrying out its expansion plans or operating its assets; and other related risks as more fully set out in the registration statement of Company and other documents disclosed under the Company’s filings at www.sec.gov/EDGAR and www.sedar.com.

The forward-looking information in this news release reflects the current expectations, assumptions and/or beliefs of the Company based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions about the Company’s objectives, goals or future plans, the timing thereof and related matters. The Company has also assumed that no significant events occur outside of the Company’s normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/122740

Blockchain

Venture Capital Investment Market Report 2024, Featuring Sequoia Capital, Greylock, Andreessen Horowitz, Accel, Index Ventures, Union Square Ventures, Founders Fund and First Round Capital

Blockchain

Breaking News: Bitgert Coin Price Expected To Skyrocket In Coming Days

In recent news, Bitgert coin’s price is anticipated to soar in the coming days, marking a significant development in the cryptocurrency market. This projection has attracted attention from investors and enthusiasts alike, as they await potential gains from the anticipated price surge.

The expected rise in Bitgert coin’s price has stirred excitement among crypto investors, who are closely monitoring market trends and developments to capitalize on potential opportunities. This surge is attributed to various factors, including market sentiment, technological advancements, and investor confidence in the project’s prospects.

As the cryptocurrency landscape continues to evolve, Bitgert coin’s projected price increase underscores the dynamic nature of the market and the potential for significant gains. Investors are advised to conduct thorough research and exercise caution when trading cryptocurrencies, as price movements can be volatile and unpredictable.

Overall, the anticipated surge in Bitgert coin’s price reflects the growing interest and optimism surrounding the project, highlighting its potential to deliver substantial returns for investors in the near future.

Source: cryptodaily.co.uk

The post Breaking News: Bitgert Coin Price Expected To Skyrocket In Coming Days appeared first on HIPTHER Alerts.

Blockchain

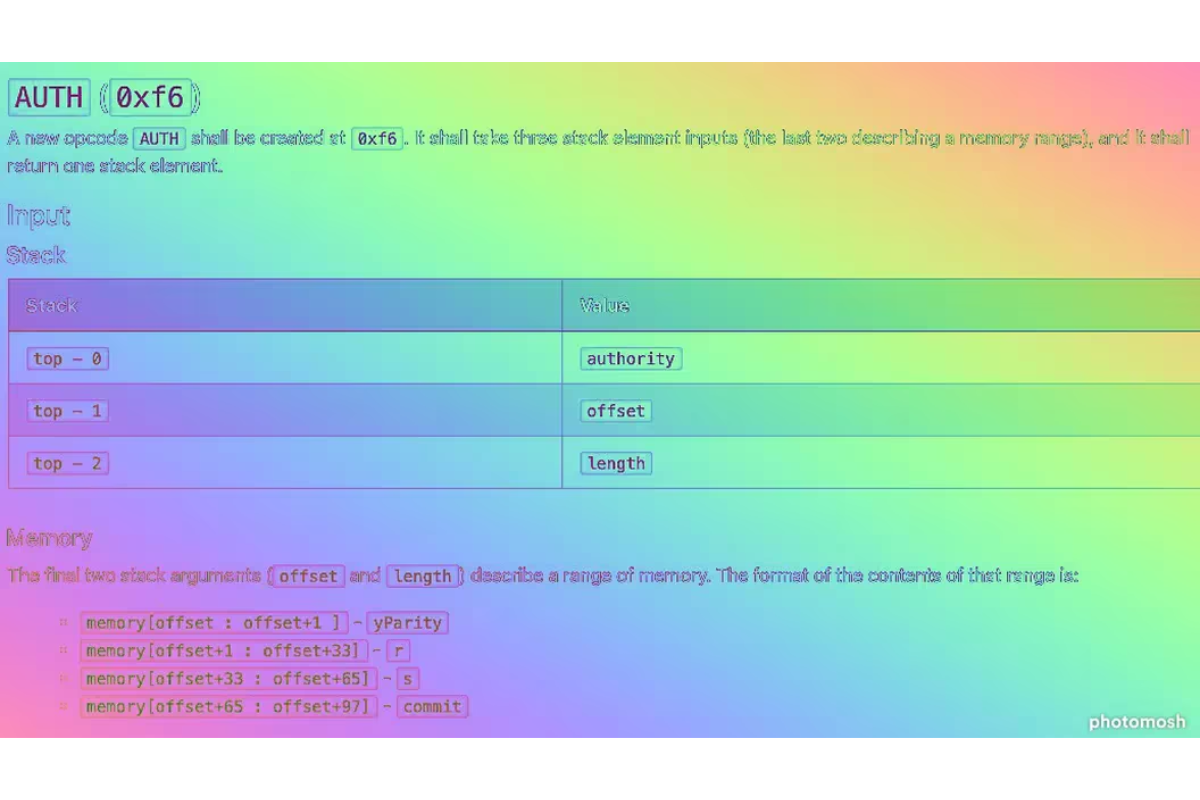

Ethereum Developers Target Ease of Crypto Wallets With ‘EIP-3074’

Ethereum developers are setting their sights on improving the user experience of crypto wallets with the implementation of Ethereum Improvement Proposal (EIP) 3074. This proposal aims to simplify the process of interacting with Ethereum smart contracts, making it easier for users to manage their digital assets securely.

EIP-3074 introduces a new type of account called “constrained accounts,” which are designed to restrict certain types of interactions with smart contracts. This feature enhances the security of crypto wallets by limiting the scope of potential attacks and reducing the risk of unauthorized access to funds.

One of the key benefits of EIP-3074 is its ability to streamline the user experience of interacting with Ethereum smart contracts. By simplifying the process of managing digital assets, this proposal aims to make crypto wallets more accessible to a wider audience, including non-technical users.

In addition to improving usability, EIP-3074 also enhances the security of Ethereum wallets by introducing new permissioning mechanisms. Constrained accounts allow users to define specific rules and conditions for interacting with smart contracts, providing an additional layer of protection against potential vulnerabilities and exploits.

Overall, EIP-3074 represents a significant step forward in the ongoing effort to enhance the usability and security of Ethereum wallets. By introducing constrained accounts and new permissioning mechanisms, this proposal aims to make it easier for users to manage their digital assets securely while also reducing the risk of unauthorized access and potential attacks.

Source: coindesk.com

The post Ethereum Developers Target Ease of Crypto Wallets With ‘EIP-3074’ appeared first on HIPTHER Alerts.

-

Blockchain6 days ago

Blockchain6 days agoMeritrust Credit Union Joins Metal Blockchain’s Banking Innovation Program

-

Blockchain Press Releases6 days ago

Blockchain Press Releases6 days agoDeltec Bank Receives System and Organization Controls (SOC 2) Type 1 Certification

-

Blockchain6 days ago

Blockchain6 days agoZettaBlock announces the addition of blockchain data

-

Blockchain6 days ago

Blockchain6 days agoGlobal eCommerce Payments Markets to 2030 | A $612 Billion Opportunity | Blockchain Technology and Cryptocurrencies Reshaping eCommerce by Providing Secure, Cross-Border Payment Solutions

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days agoDiscover Move Move Coin: Is This the Next Sports Blockchain for Your Workout?

-

Blockchain6 days ago

Blockchain6 days agoHong Kong joins global crypto ETF race

-

Blockchain6 days ago

Blockchain6 days agoAnkr expands Bitcoin liquid staking tokens to AI blockchain Talus

-

Blockchain2 days ago

Blockchain2 days agoTop 10 Sessions You Can’t Miss at MARE BALTICUM Gaming & TECH Summit 2024 (Tallinn, Estonia, 4-5 June)