Blockchain

GlobalBlock Announces Management Changes, Delay of Financial Statements and Application for Voluntary Management Cease Trade Order

London, United Kingdom and Vancouver, British Columbia–(Newsfile Corp. – April 29, 2022) – GlobalBlock Digital Asset Trading Limited (TSXV: BLOK) (OTC Pink: BLVDF) (FSE: BD4) (the “Company” or “GlobalBlock“) is pleased to announce the appointment of Amaan Jalwa as new Chief Financial Officer, to be effective following the departure of Jessica Van Den Akker, who will leave the business to focus on other opportunities, once the audited financials have been filed alongside an orderly handover period.

Amaan is a qualified Chartered Accountant having trained at KPMG in London. Amaan was most recently interim-CFO of digital asset liquidity technology platform Enigma Securities, a firm backed by British billionaire investor Alan Howard, prior to which he was the Finance Director of Outlier Ventures, the tech VC firm focused on blockchain, AI and Web 3 startups. Before then, Amaan served as the interim-Finance Director of Omnio, the digital banking fintech business.

Early international experience included joining the Japanese electronics firm JVC Kenwood as a Finance Manager before being promoted to Head of Finance in 2012. He then went onto real estate business Asia Pacific Investment Partners as VP for Finance and Accounting, before joining the Japanese MBO Fund Asia Growth Capital as their COO and CFO.

Rufus Round, CEO of GlobalBlock, said:

“We are delighted to welcome Amaan Jalwa, who’s experience is highly complementary to GlobalBlock, in particular in fintech and blockchain. He will be joining us at a very exciting time for the business and industry as a whole.

“We would also like to thank Jessica for her stewardship during her time both before and after last year’s business combination, in particular during that transition and through the Company’s maiden audit and wish her the best in her future endeavours.”

Amaan Jalwa, CFO at GlobalBlock, said:

“GlobalBlock is a great business run by experienced and seasoned financial services professionals. I am looking forward to supporting the board in its short, medium and long term objectives. Blockchain and financial services are experiencing a dynamic shift and my plan is to help grow GlobalBlock to be a pioneer in the provision of digital asset trading and products in the UK and beyond, with support of the management team and the board.”

The Company further announces that it does not anticipate being in a position to file its audited annual financial statements, management’s discussion and analysis, and related certifications for the fiscal year ended December 31, 2021 (collectively, the “Annual Filings“) on or before May 2, 2022 as required, due to (i) this being the first annual financial statements for the Company following the acquisition of GlobalBlock Limited and its digital asset brokerage business in the United Kingdom (the “Acquisition“); (ii) the Company updating the accounting systems and procedures of its new subsidiary GlobalBlock Limited following the Acquisition; and (iii) this being the first annual financial statements of the Company being audited by its new auditor, Kingston Ross Pasnak LLP; and therefore additional time is required by the auditor to complete their review and procedures.

Accordingly, the Company has applied to the British Columbia Securities Commission, the Company’s principal securities regulator in Canada, for the issuance of a management cease trade order (“MCTO“) under the provisions of National Policy 12-203 Management Cease Trade Orders (“NP 12-203“) to be granted in connection with the late filing of the Annual Filings, so as to permit the continued trading in the Company’s common shares by persons other than the Company’s Chief Executive Officer, Chief Financial Officer and such other directors, officers and persons as determined by the applicable regulatory authorities. There is no guarantee that a MCTO will be granted. The Company expects to file the Annual Filings on or before May 13, 2022.

The Company confirms that it intends to satisfy the provisions of section 10 of NP 12-203 and issue bi-weekly default status reports for so long as the Company remains in default of the financial statement filing requirement, containing any material changes to the information in this release, all actions taken by the Company to remedy the default; particulars of any failure by the Company to fulfil these provisions, any subsequent defaults of the Company requiring a default announcement and any other material information concerning the affairs of the Company not previously disclosed.

There is no material information concerning the affairs of the Company that has not been generally disclosed and GlobalBlock remains in a sound financial position with a strong cash balance and is debt free.

ABOUT THE COMPANY

GlobalBlock Digital Asset Trading Limited is a publicly traded holding company (TSXV: BLOK) whose wholly owned subsidiary, GlobalBlock Limited (https://www.globalblock.co.uk), is at this time a United Kingdom based digital asset broker that provides a personalised telephone brokerage service, trading platform and mobile app. Established in 2018 by an experienced team of financial services professionals, GlobalBlock Limited acts as a trusted agent serving the digital asset needs of individuals, corporates, institutional financial firms and intermediaries, providing best execution trading and safe custody of digital assets. At this time, GlobalBlock Limited only accepts United Kingdom and Ireland resident clients or customers for its digital asset broker or trading services.

For further information please contact the Company at:

Rufus Round, CEO

c/o 65 Curzon Street, London, W1J 8PE, United Kingdom

Tel. +00 44 20 3286 2904

[email protected]

https://globalblock.co.uk/ and http://www.globalblockdigital.com/

https://twitter.com/Globalblocknews

https://www.linkedin.com/company/globalblock/

Media Contact

Angus Campbell

Citigate Dewe Rogerson

[email protected]

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information set out in this news release constitutes forward-looking statements or information. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “intend”, “could”, “might”, “should”, “believe” and similar expressions. In particular, this news release contains forward-looking statements in respect of among other things: the timing, audit, completion and filing of the Annual Filings; the application and grant of a MCTO; the continued and successful development of the businesses and technologies of each of the Company and its subsidiaries, the ability of the Company and its subsidiaries to obtain the applicable regulatory approvals to continue to conduct its business and other information concerning the intentions, plans, future action and future successes of the Company, and its businesses, technologies and products described herein. Forward-looking statements are based upon the opinions and expectations of management of the Company as at the effective date of such statements and, in certain cases, information provided or disseminated by third parties. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, and that information obtained from third party sources is reliable, they can give no assurance that those expectations will prove to have been correct. Readers are cautioned not to place undue reliance on forward-looking statements included in this document, as there can be no assurance that the plans, intentions or expectations upon which the forward-looking statements are based will occur. By their nature, forward-looking statements involve numerous assumptions, known and unknown risks and uncertainties that contribute to the possibility that the predictions, forecasts, projections and other forward-looking statements will not occur, which may cause actual results in future periods to differ materially from any estimates or projections of future performance or results expressed or implied by such forward-looking statements. These risks and uncertainties include, among other things, risk factors set forth in the Company’s most recent management’s discussion and analysis, a copy of which is filed on SEDAR at www.sedar.com, and readers are cautioned that the risk factors disclosed therein should not be construed as exhaustive. These statements are made as at the date hereof and unless otherwise required by law, the Company does not intend, or assume any obligation, to update these forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/122069

Blockchain

39% of Canada’s institutional investors have exposure to crypto: KPMG

According to a report from CoinTelegraph, nearly forty percent of institutional investors in Canada have exposure to cryptocurrency, as revealed by KPMG. This finding underscores the growing acceptance and adoption of digital assets among institutional investors in the country.

The report indicates that a significant portion of institutional investors in Canada are actively investing in or exploring opportunities in the cryptocurrency market. This trend reflects a shift in sentiment towards digital assets, with more investors recognizing the potential for long-term growth and diversification offered by cryptocurrencies.

KPMG’s findings highlight the increasing mainstream acceptance of cryptocurrencies among traditional investors, as well as the growing interest in blockchain technology and its potential applications across various industries. As institutional investors continue to enter the cryptocurrency market, they are expected to bring additional capital and liquidity, further fueling the growth and maturation of the digital asset ecosystem.

Overall, KPMG’s report signals a significant milestone in the adoption of cryptocurrencies in Canada, indicating that institutional investors are increasingly recognizing the value proposition of digital assets and integrating them into their investment portfolios. This trend is likely to accelerate the broader adoption and mainstream acceptance of cryptocurrencies in the country and beyond.

Source: cointelegraph.com

The post 39% of Canada’s institutional investors have exposure to crypto: KPMG appeared first on HIPTHER Alerts.

Blockchain

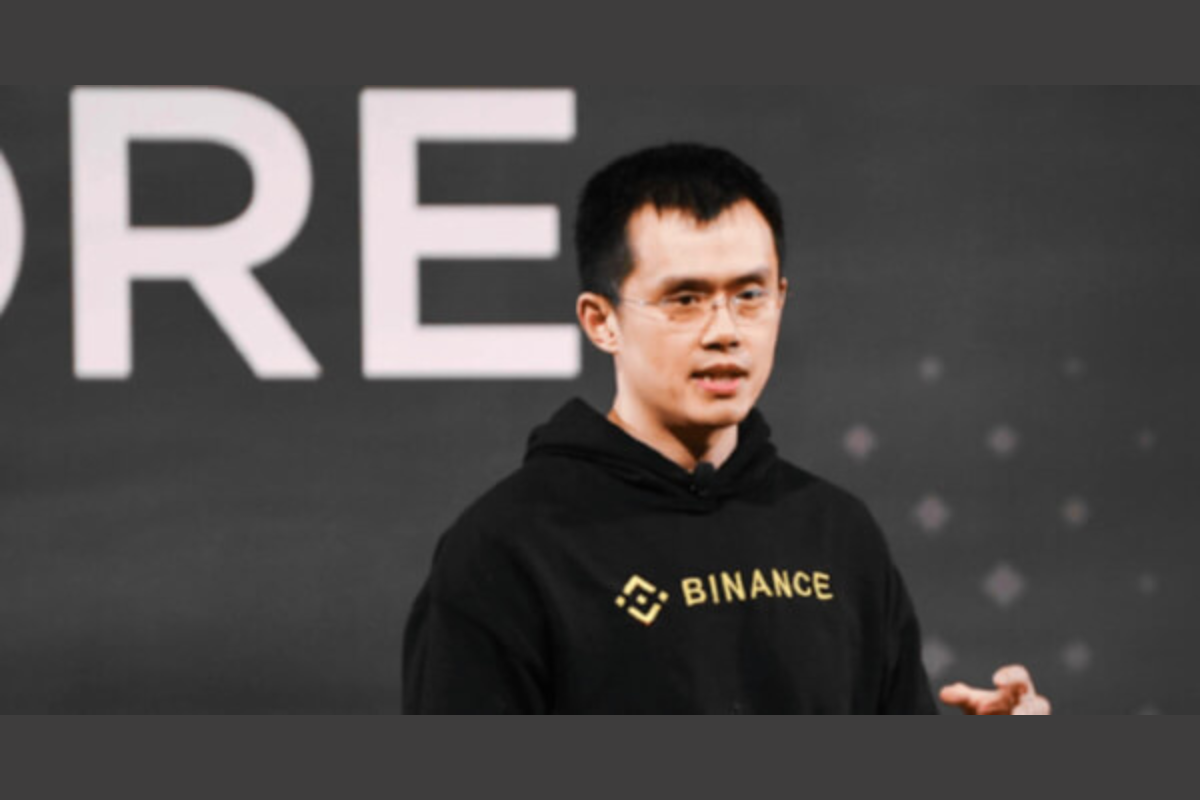

BounceBit (BB) Megadrop Now Open: Participate by Subscribing to BNB Locked Products or Completing Web3 Quests

The BounceBit (BB) Megadrop is now open for participation, as announced by Blockchain.News. This event presents an exciting opportunity for users to earn BB tokens by engaging in various activities, including subscribing to BNB locked products and completing Web3 quests.

Participants can join the BB Megadrop by subscribing to BNB locked products or completing Web3 quests, both of which offer different avenues for earning BB tokens. By participating in these activities, users have the chance to accumulate BB tokens and potentially benefit from the rewards associated with the Megadrop.

Subscribing to BNB locked products allows users to earn BB tokens by locking their BNB assets for a specified period. This not only provides users with an opportunity to earn rewards but also contributes to the liquidity and stability of the BounceBit ecosystem.

Additionally, completing Web3 quests offers users an alternative way to earn BB tokens by engaging in various tasks and challenges related to Web3 technology. These quests provide users with a fun and interactive way to learn about blockchain and cryptocurrency while earning rewards in the form of BB tokens.

Overall, the BB Megadrop presents an exciting opportunity for users to participate in the BounceBit ecosystem and earn rewards by engaging in activities that contribute to the growth and development of the platform. As the Megadrop progresses, participants can look forward to additional opportunities to earn BB tokens and potentially benefit from the rewards associated with this event.

Source: blockchain.news

The post BounceBit (BB) Megadrop Now Open: Participate by Subscribing to BNB Locked Products or Completing Web3 Quests appeared first on HIPTHER Alerts.

Blockchain

Cronos collaborates with KYVE to revolutionize Blockchain Data

Cronos, a prominent blockchain platform, has announced a collaboration with KYVE aimed at revolutionizing blockchain data, as reported by CryptoNewsZ. This partnership represents a significant step forward in enhancing the efficiency and scalability of blockchain data storage and retrieval.

The collaboration between Cronos and KYVE seeks to leverage KYVE’s decentralized data storage and retrieval solution to enhance the capabilities of the Cronos blockchain platform. By integrating KYVE’s technology, Cronos aims to address the challenges associated with storing and accessing large volumes of data on the blockchain, such as scalability and cost-effectiveness.

KYVE’s decentralized data storage solution utilizes a network of distributed nodes to store and retrieve data, ensuring high availability and reliability. This approach not only improves the efficiency of data storage and retrieval but also enhances the security and resilience of the blockchain network.

The partnership between Cronos and KYVE is expected to unlock new possibilities for decentralized applications (dApps) and smart contracts built on the Cronos platform. By providing a more efficient and scalable solution for blockchain data management, Cronos aims to attract developers and enterprises seeking to leverage blockchain technology for a wide range of applications.

Overall, the collaboration between Cronos and KYVE represents a significant development in the blockchain industry, highlighting the importance of innovation and collaboration in driving the evolution of decentralized technologies. As the partnership progresses, it is poised to deliver transformative benefits for blockchain data management and accelerate the adoption of decentralized applications and services.

Source: cryptonewsz.com

The post Cronos collaborates with KYVE to revolutionize Blockchain Data appeared first on HIPTHER Alerts.

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days agoDWF Labs joins the Klaytn Governance Council

-

Blockchain7 days ago

Blockchain7 days agoPhoenix Group Engages BHM Capital as Liquidity Provider to Boost ADX Liquidity and Enhance Market Dynamics

-

Blockchain7 days ago

Blockchain7 days agoCrypto fans count down to bitcoin’s ‘halving’

-

Blockchain7 days ago

Blockchain7 days agoTether USDT stablecoin goes live on TON blockchain

-

Blockchain Press Releases3 days ago

Blockchain Press Releases3 days agoDeFi Lens builds advanced Generative AI for Technical Analysis

-

Blockchain3 days ago

Blockchain3 days agoVenezuela’s Oil Giant Turns to Crypto as US Sanctions Bite Again

-

Blockchain2 days ago

Blockchain2 days agoHalving weakness sees $206 million exit crypto funds, Bitcoin miners pivot to AI

-

Blockchain7 days ago

Blockchain7 days agoSupply Chain Finance Market Forecast to Reach $9.4 Billion by 2029: Increasing Emphasis on Sustainable Sourcing