Blockchain

CoinAnalyst Corp. Announces Proposed Acquisition of RockStock Equities Inc.

Toronto, Ontario–(Newsfile Corp. – January 20, 2022) – CoinAnalyst Corp. (CSE: COYX) (FSE: 1EO) (“CoinAnalyst” or the “Company“) is pleased to announce that it has entered into a binding letter agreement (the “Letter Agreement“) dated January 11, 2022 with RockStock Equities Inc. (“RockStock“) and all of the shareholders of RockStock™ (the “Vendors“), in respect of the acquisition by the Company of all of the issued and outstanding shares in the capital of RockStock (the “Transaction“).

About RockStock

RockStock Equities Inc. is poised to capitalize on the dramatic impact of Blockchain technology, Cryptocurrencies, and NFTs on a once beleaguered music industry. With a primary focus on the development of an Artist/Fan Utility, RockStock will facilitate and empower artists through a state-of-the-art app platform, allowing them to directly monetize their music, create “pay-per-view” performances and participate in the exciting new world of NFT revenue generation. For the fans, it is an opportunity to connect and support the artists they love through a multi genre, online competition and participate in profit opportunities created through the purchase of Artist Security Tokens and NFTs. For more information about RockStock, please visit www.myrockstock.com.

The Letter Agreement

Under the terms of the Letter Agreement, the Company will purchase all of the shares of RockStock from the Vendors in consideration for $937,500, which will be satisfied through the issuance of 3,750,000 common shares of the Company (“Common Shares“) at a deemed price of $0.25 per share (the “Consideration Shares“). If, at the end of six (6) months period immediately following the closing of the Transaction (the “Closing Date“), RockStock has developed a minimum viable product (MVP) for its product, the Company will issue an additional 250,000 Common Shares at a deemed price of $0.25 per share (the “Earn-Out Shares“). The Consideration Shares and the Earn-Out Shares will be allocated to the Vendors based on their pro rata shareholdings in RockStock.

The Letter Agreement includes a number of conditions to the Closing Date, including but not limited to, (a) a consulting agreement to be entered into between David Abbott and the Company; (b) each Vendor entering into an agreement with the Company for a contractual restriction on resale of the Consideration Shares (the “Lock-Up Agreements“) pursuant to which each Vendor will, among other things, agree not to trade the Consideration Shares, provided that (i) 10% of the Consideration Shares will be free trading on the Closing Date, and (ii) further 15% tranches of Consideration Shares may be traded on each successive three months anniversary of the Closing Date; and (c) the appointment of David Abbott to sit on the board of the Company.

Further information

The CSE has in no way passed upon the merits of the Transaction and has neither approved nor disapproved the contents of this news release.

Cautionary Statements Regarding Forward Looking Information

This news release contains “forward-looking information” within the meaning of applicable securities laws relating to the proposal to complete the Transaction and associated transactions. Any such forward-looking statements may be identified by words such as “expects”, “anticipates”, “believes”, “projects”, “plans” and similar expressions. Readers are cautioned not to place undue reliance on forward-looking statements. Statements about, among other things, the appointment of David Abbott on the Board of the Company; the consulting agreement to be entered into between David Abbott and the Company; and the Lock-Up Agreements to be entered into by each of the Vendors and the parties’ ability to satisfy closing conditions and receive necessary approvals are all forward-looking information. These statements should not be read as guarantees of future performance or results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those implied by such statements. Although such statements are based on management’s reasonable assumptions, there can be no assurance that the Transaction will occur or that, if the Transaction does occur, it will be completed on the terms described above. CoinAnalyst and RockStock assume no responsibility to update or revise forward-looking information to reflect new events or circumstances unless required by applicable law.

For more information, please contact:

Andrew Sazama

Chief Operating Officer and Director

Email: [email protected]

Phone: + 49 69 2648485 – 20

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/110958

Blockchain

Breaking News: Bitgert Coin Price Expected To Skyrocket In Coming Days

In recent news, Bitgert coin’s price is anticipated to soar in the coming days, marking a significant development in the cryptocurrency market. This projection has attracted attention from investors and enthusiasts alike, as they await potential gains from the anticipated price surge.

The expected rise in Bitgert coin’s price has stirred excitement among crypto investors, who are closely monitoring market trends and developments to capitalize on potential opportunities. This surge is attributed to various factors, including market sentiment, technological advancements, and investor confidence in the project’s prospects.

As the cryptocurrency landscape continues to evolve, Bitgert coin’s projected price increase underscores the dynamic nature of the market and the potential for significant gains. Investors are advised to conduct thorough research and exercise caution when trading cryptocurrencies, as price movements can be volatile and unpredictable.

Overall, the anticipated surge in Bitgert coin’s price reflects the growing interest and optimism surrounding the project, highlighting its potential to deliver substantial returns for investors in the near future.

Source: cryptodaily.co.uk

The post Breaking News: Bitgert Coin Price Expected To Skyrocket In Coming Days appeared first on HIPTHER Alerts.

Blockchain

Ethereum Developers Target Ease of Crypto Wallets With ‘EIP-3074’

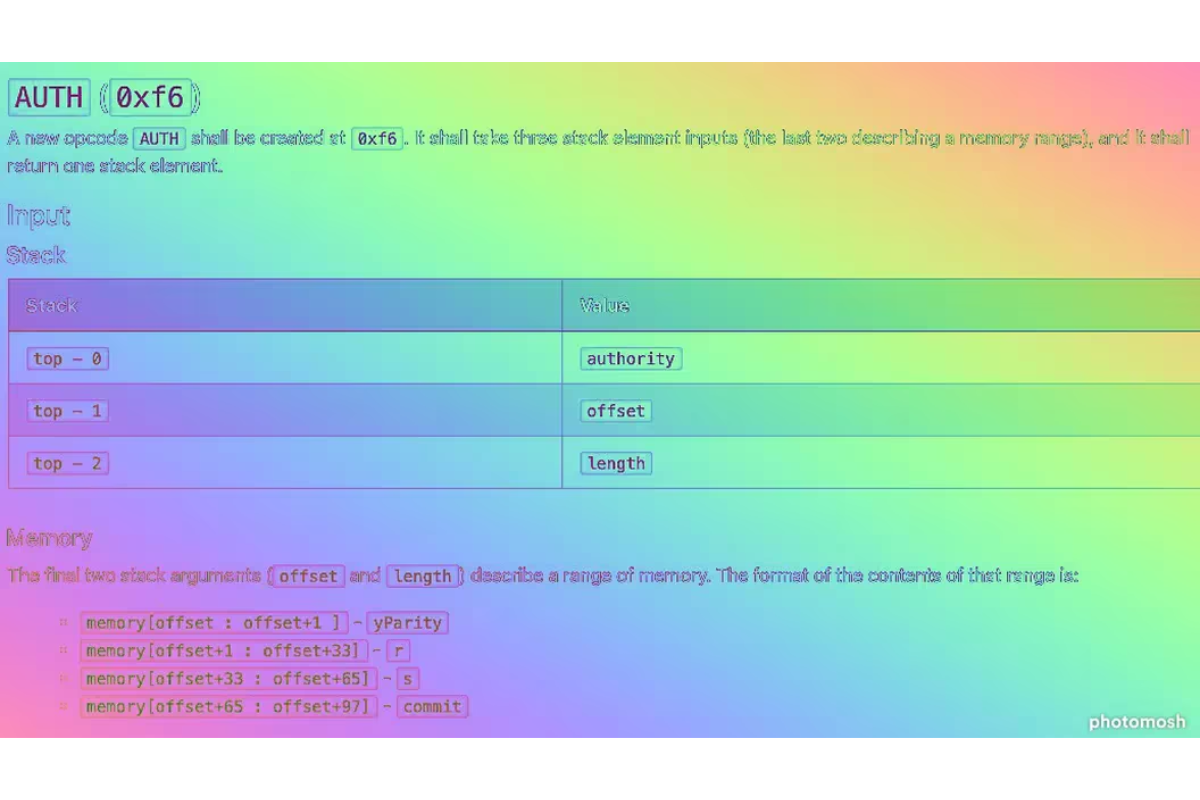

Ethereum developers are setting their sights on improving the user experience of crypto wallets with the implementation of Ethereum Improvement Proposal (EIP) 3074. This proposal aims to simplify the process of interacting with Ethereum smart contracts, making it easier for users to manage their digital assets securely.

EIP-3074 introduces a new type of account called “constrained accounts,” which are designed to restrict certain types of interactions with smart contracts. This feature enhances the security of crypto wallets by limiting the scope of potential attacks and reducing the risk of unauthorized access to funds.

One of the key benefits of EIP-3074 is its ability to streamline the user experience of interacting with Ethereum smart contracts. By simplifying the process of managing digital assets, this proposal aims to make crypto wallets more accessible to a wider audience, including non-technical users.

In addition to improving usability, EIP-3074 also enhances the security of Ethereum wallets by introducing new permissioning mechanisms. Constrained accounts allow users to define specific rules and conditions for interacting with smart contracts, providing an additional layer of protection against potential vulnerabilities and exploits.

Overall, EIP-3074 represents a significant step forward in the ongoing effort to enhance the usability and security of Ethereum wallets. By introducing constrained accounts and new permissioning mechanisms, this proposal aims to make it easier for users to manage their digital assets securely while also reducing the risk of unauthorized access and potential attacks.

Source: coindesk.com

The post Ethereum Developers Target Ease of Crypto Wallets With ‘EIP-3074’ appeared first on HIPTHER Alerts.

Blockchain

Istanbul Blockchain Week 2024 Returns Showcasing Turkey as the Rising Star in Web3 Adoption

Istanbul Blockchain Week 2024 is making a comeback, highlighting Turkey as a rising star in Web3 adoption. This event, set to take place in Istanbul, aims to showcase Turkey’s growing prominence in the adoption of Web3 technologies and its potential to become a leader in the blockchain industry.

With a focus on fostering collaboration and innovation in the blockchain space, Istanbul Blockchain Week 2024 will bring together industry experts, developers, investors, and enthusiasts from around the world. The event will feature a series of keynote speeches, panel discussions, workshops, and networking sessions, providing participants with valuable insights and opportunities to connect with key players in the industry.

One of the key objectives of Istanbul Blockchain Week 2024 is to highlight Turkey’s vibrant blockchain ecosystem and its potential to drive innovation and economic growth. As a strategically located hub between Europe, Asia, and the Middle East, Turkey offers a unique opportunity for blockchain companies to tap into diverse markets and access a skilled talent pool.

The event will also serve as a platform for showcasing the latest developments and trends in the blockchain industry, including decentralized finance (DeFi), non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), and more. Attendees can expect to gain valuable insights into the future of blockchain technology and its potential impact on various industries.

Istanbul Blockchain Week 2024 is expected to attract a diverse audience, including blockchain enthusiasts, investors, entrepreneurs, government officials, and academics. By bringing together stakeholders from across the globe, the event aims to foster collaboration, drive innovation, and accelerate the adoption of blockchain technology in Turkey and beyond.

Overall, Istanbul Blockchain Week 2024 promises to be an exciting and impactful event, showcasing Turkey’s growing influence in the blockchain industry and highlighting the country’s potential to become a global leader in Web3 adoption.

Source: cryptoslate.com

The post Istanbul Blockchain Week 2024 Returns Showcasing Turkey as the Rising Star in Web3 Adoption appeared first on HIPTHER Alerts.

-

Blockchain5 days ago

Blockchain5 days agoMeritrust Credit Union Joins Metal Blockchain’s Banking Innovation Program

-

Blockchain Press Releases5 days ago

Blockchain Press Releases5 days agoDeltec Bank Receives System and Organization Controls (SOC 2) Type 1 Certification

-

Blockchain5 days ago

Blockchain5 days agoZettaBlock announces the addition of blockchain data

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days agoDiscover Move Move Coin: Is This the Next Sports Blockchain for Your Workout?

-

Blockchain5 days ago

Blockchain5 days agoGlobal eCommerce Payments Markets to 2030 | A $612 Billion Opportunity | Blockchain Technology and Cryptocurrencies Reshaping eCommerce by Providing Secure, Cross-Border Payment Solutions

-

Blockchain5 days ago

Blockchain5 days agoHong Kong joins global crypto ETF race

-

Blockchain5 days ago

Blockchain5 days agoAnkr expands Bitcoin liquid staking tokens to AI blockchain Talus

-

Blockchain2 days ago

Blockchain2 days agoTop 10 Sessions You Can’t Miss at MARE BALTICUM Gaming & TECH Summit 2024 (Tallinn, Estonia, 4-5 June)