Blockchain

MicroPets Announces 2D NFT Launch

Cape Coral, Florida–(Newsfile Corp. – December 14, 2021) – MicroPets has announced it’s 2D NFT Launced on BSC. MicroPets has achieved over 60,000 holders within just two months and a market cap of over $200M.

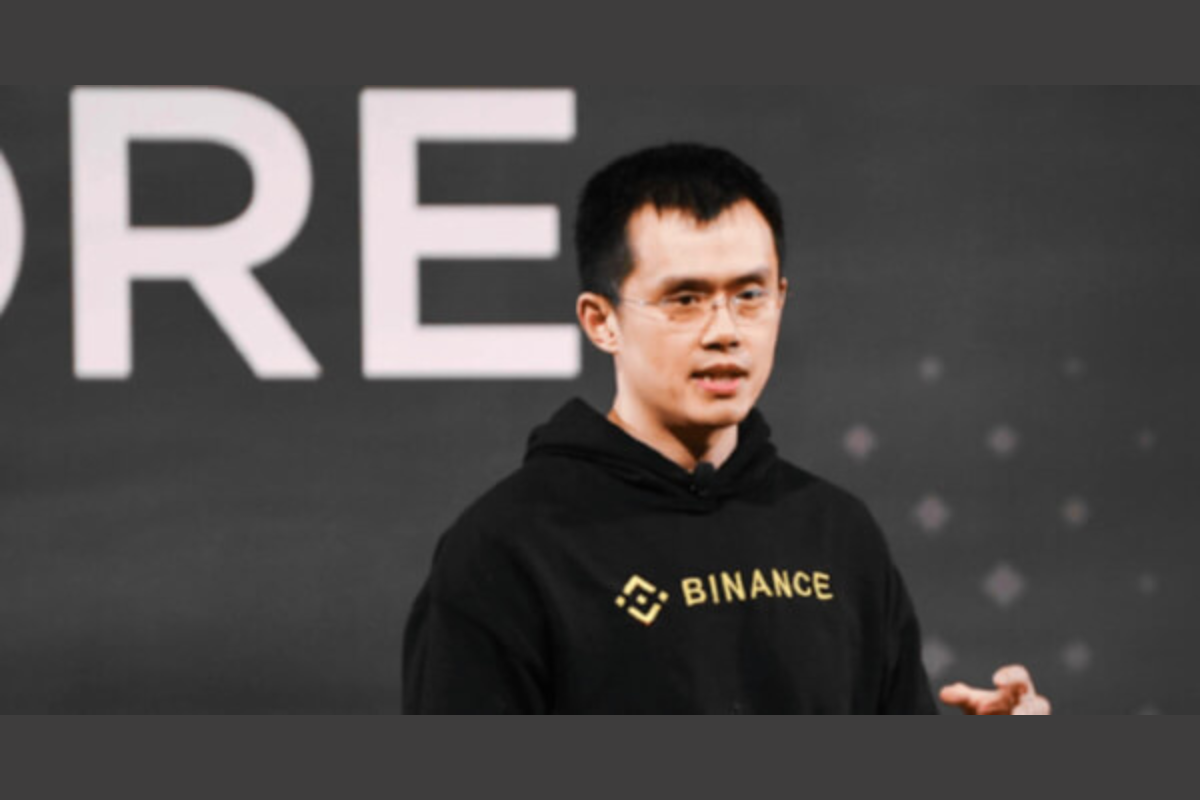

Figure 1: MicroPets Announces 2D NFT Launch

What is MicroPets?

MicroPets has taken the hottest memes in the crypto space, from Doge to Floki, and transformed them into loveable 3D NFT’s. Users purchase MicroPets tokens on PancakeSwap, visit their custom-built dApp and then purchase a crate. Inside of the crate is a random 3D NFT, each with their own unique rarity and staking multiplier. The rarer the NFT the better the rewards. The team also has an upcoming Play-To-Earn (P2E) game in development by Cubix, a renowned app development company, set for early Q1 of 2022 release. Thus far, the team has sold tens of thousands of 3D NFT’s.

About the MicroPets 2D NFT Collection

The limited edition MicroPets 2D NFT collection will encompass 10,000 NFT’s, each with their own unique attributes and backgrounds. The beautifully designed collection will be available on the MicroPets dApp for purchase, costing just .25 BNB. Users will also be able to view and display their inventory inside of the dApp. The team has custom built a smart contract to handle all of the randomization and NFT generation. Considering the strength of the brand and the community, the sale is anticipated to spread far and wide throughout social media and beyond.

$100K Charitable Donation

The MicroPets team has committed to donating $100K to charity upon reaching the 50% sold milestone of this collection.

Centralized Exchange Listing Funding

Knowing a next key milestone for MicroPets is top Centralized Exchange (CEX) listings, the team will use a portion of the funding generated from the 2D NFT sale to cover these costs. These listings are anticipated to lead to long-term investor value for both MicroPets holders and 2D NFT collectors, ensuring an even stronger and more well-known MicroPets brand. The team will specifically target CEX’s that it believes can bring the most value to MicroPets investors. MicroPets is already listed on several exchanges, but the team has set its sights on even higher targets.

Metaverse Expansion Funding

The Metaverse has quickly become an ever-expanding trend and market within the cryptocurrency space. Although the team already has a P2E game in development, it believes the Metaverse is the next direction it needs to head to continue to build momentum and drive longevity of the project. Currently, the team has a vision to build an entire MicroPets Metaverse ecosystem, powered by the MicroPets token, that brings their current NFT offerings to life in an interactive and engaging world. Knowing bringing this vision to life will not be cheap, the team seeks to raise funding through the sale of the MicroPets 2D NFT collection. The team will budget a significant amount of the funding raised towards this development.

MicroPets Milestones & Marketing Prowess

Since their launch on October 18th, 2021, the leadership team, combined with the support of over 30 admins, have grown their holder count to over 60,000. Furthermore, MicroPets continues to be one of the top trending tokens on CoinMarketCap, CoinGecko and Crypto.com due to its popularity and user demand. In less than two months the team was able to grow its Telegram community to over 20,000 members spread across its numerous international communities. The smart contract is audited by Certik with Skyshield, further solidifying the team’s commitment to top-notch execution.

The emphasis on branding not only drives the long-term value of NFT’s, but also consistently creates more engaged and passionate community members, the heart and soul of the MicroPets ecosystem.

MicroPets Contact Information

Email: [email protected]

Website: https://www.micropets.io

Telegram: https://t.me/micropets

Twitter: https://mobile.twitter.com/micropetsbsc

PR Contact –

Dave Ruiz

[email protected]

https://telegram.me/cryptokidfinance

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/107507

Blockchain

39% of Canada’s institutional investors have exposure to crypto: KPMG

According to a report from CoinTelegraph, nearly forty percent of institutional investors in Canada have exposure to cryptocurrency, as revealed by KPMG. This finding underscores the growing acceptance and adoption of digital assets among institutional investors in the country.

The report indicates that a significant portion of institutional investors in Canada are actively investing in or exploring opportunities in the cryptocurrency market. This trend reflects a shift in sentiment towards digital assets, with more investors recognizing the potential for long-term growth and diversification offered by cryptocurrencies.

KPMG’s findings highlight the increasing mainstream acceptance of cryptocurrencies among traditional investors, as well as the growing interest in blockchain technology and its potential applications across various industries. As institutional investors continue to enter the cryptocurrency market, they are expected to bring additional capital and liquidity, further fueling the growth and maturation of the digital asset ecosystem.

Overall, KPMG’s report signals a significant milestone in the adoption of cryptocurrencies in Canada, indicating that institutional investors are increasingly recognizing the value proposition of digital assets and integrating them into their investment portfolios. This trend is likely to accelerate the broader adoption and mainstream acceptance of cryptocurrencies in the country and beyond.

Source: cointelegraph.com

The post 39% of Canada’s institutional investors have exposure to crypto: KPMG appeared first on HIPTHER Alerts.

Blockchain

BounceBit (BB) Megadrop Now Open: Participate by Subscribing to BNB Locked Products or Completing Web3 Quests

The BounceBit (BB) Megadrop is now open for participation, as announced by Blockchain.News. This event presents an exciting opportunity for users to earn BB tokens by engaging in various activities, including subscribing to BNB locked products and completing Web3 quests.

Participants can join the BB Megadrop by subscribing to BNB locked products or completing Web3 quests, both of which offer different avenues for earning BB tokens. By participating in these activities, users have the chance to accumulate BB tokens and potentially benefit from the rewards associated with the Megadrop.

Subscribing to BNB locked products allows users to earn BB tokens by locking their BNB assets for a specified period. This not only provides users with an opportunity to earn rewards but also contributes to the liquidity and stability of the BounceBit ecosystem.

Additionally, completing Web3 quests offers users an alternative way to earn BB tokens by engaging in various tasks and challenges related to Web3 technology. These quests provide users with a fun and interactive way to learn about blockchain and cryptocurrency while earning rewards in the form of BB tokens.

Overall, the BB Megadrop presents an exciting opportunity for users to participate in the BounceBit ecosystem and earn rewards by engaging in activities that contribute to the growth and development of the platform. As the Megadrop progresses, participants can look forward to additional opportunities to earn BB tokens and potentially benefit from the rewards associated with this event.

Source: blockchain.news

The post BounceBit (BB) Megadrop Now Open: Participate by Subscribing to BNB Locked Products or Completing Web3 Quests appeared first on HIPTHER Alerts.

Blockchain

Cronos collaborates with KYVE to revolutionize Blockchain Data

Cronos, a prominent blockchain platform, has announced a collaboration with KYVE aimed at revolutionizing blockchain data, as reported by CryptoNewsZ. This partnership represents a significant step forward in enhancing the efficiency and scalability of blockchain data storage and retrieval.

The collaboration between Cronos and KYVE seeks to leverage KYVE’s decentralized data storage and retrieval solution to enhance the capabilities of the Cronos blockchain platform. By integrating KYVE’s technology, Cronos aims to address the challenges associated with storing and accessing large volumes of data on the blockchain, such as scalability and cost-effectiveness.

KYVE’s decentralized data storage solution utilizes a network of distributed nodes to store and retrieve data, ensuring high availability and reliability. This approach not only improves the efficiency of data storage and retrieval but also enhances the security and resilience of the blockchain network.

The partnership between Cronos and KYVE is expected to unlock new possibilities for decentralized applications (dApps) and smart contracts built on the Cronos platform. By providing a more efficient and scalable solution for blockchain data management, Cronos aims to attract developers and enterprises seeking to leverage blockchain technology for a wide range of applications.

Overall, the collaboration between Cronos and KYVE represents a significant development in the blockchain industry, highlighting the importance of innovation and collaboration in driving the evolution of decentralized technologies. As the partnership progresses, it is poised to deliver transformative benefits for blockchain data management and accelerate the adoption of decentralized applications and services.

Source: cryptonewsz.com

The post Cronos collaborates with KYVE to revolutionize Blockchain Data appeared first on HIPTHER Alerts.

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days agoDWF Labs joins the Klaytn Governance Council

-

Blockchain7 days ago

Blockchain7 days agoPhoenix Group Engages BHM Capital as Liquidity Provider to Boost ADX Liquidity and Enhance Market Dynamics

-

Blockchain7 days ago

Blockchain7 days agoCrypto fans count down to bitcoin’s ‘halving’

-

Blockchain7 days ago

Blockchain7 days agoTether USDT stablecoin goes live on TON blockchain

-

Blockchain Press Releases3 days ago

Blockchain Press Releases3 days agoDeFi Lens builds advanced Generative AI for Technical Analysis

-

Blockchain2 days ago

Blockchain2 days agoVenezuela’s Oil Giant Turns to Crypto as US Sanctions Bite Again

-

Blockchain7 days ago

Blockchain7 days agoCrypto and Blockchain Weave Deeper Into the Biometrics Space – Identity News Digest

-

Blockchain2 days ago

Blockchain2 days agoHalving weakness sees $206 million exit crypto funds, Bitcoin miners pivot to AI