Blockchain

NetCents Declares Readiness for Expected US Federal Reserve “Digital Dollar”

New Currency Anticipated to be Part of Future COVID-19 Stimulus Package

Vancouver, British Columbia–(Newsfile Corp. – April 6, 2020) – NetCents Technology Inc. (CSE: NC) (FSE: 26N) (OTCQB: NTTCF) (“NetCents” or the “Company“), a disruptive cryptocurrency payments technologies company, is pleased to announce that it has completed internally designated preparation for the expected US Government backed cryptocurrency, “Central Bank Digital Currency” (CBDC).

NetCents jumped into action as soon as it learned of the plans US Congress made to legislate for this US Federal Reserve Digital Currency as part of two different versions of the first COVID-19 Stimulus Bill (“Stimulus Bill” or the “Bill”). Ultimately this aspect of the legislation wasn’t included in the final version of the first Stimulus Bill, but the Board and Advisors of NetCents have agreed that this “Digital Dollar” will be included in subsequent legislation.

The Bill is expected to establish a “Digital Dollar”, defined as ‘a balance expressed as a dollar value consisting of digital ledger entries that are recorded as liabilities in the accounts of any Federal Reserve Bank or … an electronic unit of value, redeemable by an eligible financial institution.’ This will create a cryptocurrency backed and guaranteed by the US Federal Government. The Bill goes on to define a digital wallet, and a requirement that US chartered banks offer these wallets.

The establishment of these products is intended to simplify the cost and process of distributing the millions of stimulus payments contemplated by the Bill, but the effects of this move will be far reaching. While the complexity of this undertaking meant that Congress was unable to include it in the first Bill – NetCents Management believes the ultimate adoption is a foregone conclusion.

Daniel Gorfine, founder of fintech advisory firm Gattaca Horizons and former Chief Innovation Officer at Commodity Futures Trading Commission (“CFTC”), as well as a founding Director of the Digital Dollar Project, stated to Forbes, ‘It is worth exploring, testing, and piloting a true USD CBDC and broader digital infrastructure in order to improve our future capabilities and resiliency. While the crisis underscores the importance of upgrading our financial infrastructure, broadly implementing a CBDC will require time and thoughtful coordination between the government and private sector stakeholders.’ – Forbes, March 24, 2020 (link below)

NetCents has developed software to support these initiatives and stands ready to support the effort. Part of the Bill requires US chartered banks to offer these digital wallets to their clients – NetCents has built this platform as part of its current white-label offering for financial institutions.

The Forbes article goes on to quote Carmelle Cadet, Founder and CEO of EMTECH, a modern central bank technology and services company. She has recently started a new initiative called, ‘Project New Dawn’ to ensure the unbanked and underbanked receive economic stimulus payments. Citing a FDIC report in 2017 that identified 63 million unbanked and underbanked in the U.S., she notes, ‘If checks are the form of payment, the stimulus is not going to reach many of them. That would be approximately $100B underutilized of stimulus for lower income householders.’

“We fully support the US Government in its’ creation of the contemplated Digital Reserve Currency. The US dollar is already the reserve currency of the World – so moving it to a digital format makes total sense. The US might have 63 million unbanked, but the planet Earth has billions of unbanked – it only makes sense that the dollar take a digital form to enable remittance and micropayments for the unbanked globally – as well as ensure its status as the World’s dominant currency. The benefits to the Treasury would accrue into many billions of dollars in innumerable ways. Societal benefits would be created as well; a Digital Dollar would be difficult to use for crimes and funding terrorism for example. This milestone is the ultimate endorsement that Cryptocurrency and Blockchain are here to stay,” stated Clayton Moore, Chief Executive Officer, NetCents. “We look forward to offering our platform to US Banks and then to Global Banks so that they can meet the requirements for a digital USD wallet,” he summarized.

NetCents Technologies enables transactions that are both touchless and within social distancing guidelines – which is an added benefit in the current environment.

The NetCents Suite of software enables individuals and merchants to transact using Cryptocurrency both in a physical store environment as well as in an e-commerce setting – it is deploying Crypto-enabled financial products across numerous business verticals to become a complete Crypto ecosystem.

Welcome to the future!

About NetCents

NetCents Technology Inc, the transactional hub for all cryptocurrency payments, equips forward-thinking businesses with the technology to seamlessly integrate cryptocurrency processing into their payment model without taking on the risk or volatility of the crypto market. NetCents Technology is registered as a Money Services Business (MSB) with FINTRAC.

For more information, please visit the corporate website at www.net-cents.com or contact Sonja Bakgaard, Investor Relations: [email protected].

To keep up to date with the Company and talk directly with the Team and other Shareholders, make sure to join the Telegram. https://t.me/Netcents

On Behalf of the Board of Directors

NetCents Technology Inc.

“Clayton Moore”

Clayton Moore, CEO, Founder and Director

NetCents Technology Inc.

1000 – 1021 West Hastings Street

Vancouver, BC, V6E 0C3

Cautionary Note Regarding Forward-Looking Information

This release includes certain statements that may be deemed “forward-looking statements”. All statements in this release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include regulatory actions, market prices, and continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates, and opinions of the Company’s management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Blockchain

Venture Capital Investment Market Report 2024, Featuring Sequoia Capital, Greylock, Andreessen Horowitz, Accel, Index Ventures, Union Square Ventures, Founders Fund and First Round Capital

Blockchain

Breaking News: Bitgert Coin Price Expected To Skyrocket In Coming Days

In recent news, Bitgert coin’s price is anticipated to soar in the coming days, marking a significant development in the cryptocurrency market. This projection has attracted attention from investors and enthusiasts alike, as they await potential gains from the anticipated price surge.

The expected rise in Bitgert coin’s price has stirred excitement among crypto investors, who are closely monitoring market trends and developments to capitalize on potential opportunities. This surge is attributed to various factors, including market sentiment, technological advancements, and investor confidence in the project’s prospects.

As the cryptocurrency landscape continues to evolve, Bitgert coin’s projected price increase underscores the dynamic nature of the market and the potential for significant gains. Investors are advised to conduct thorough research and exercise caution when trading cryptocurrencies, as price movements can be volatile and unpredictable.

Overall, the anticipated surge in Bitgert coin’s price reflects the growing interest and optimism surrounding the project, highlighting its potential to deliver substantial returns for investors in the near future.

Source: cryptodaily.co.uk

The post Breaking News: Bitgert Coin Price Expected To Skyrocket In Coming Days appeared first on HIPTHER Alerts.

Blockchain

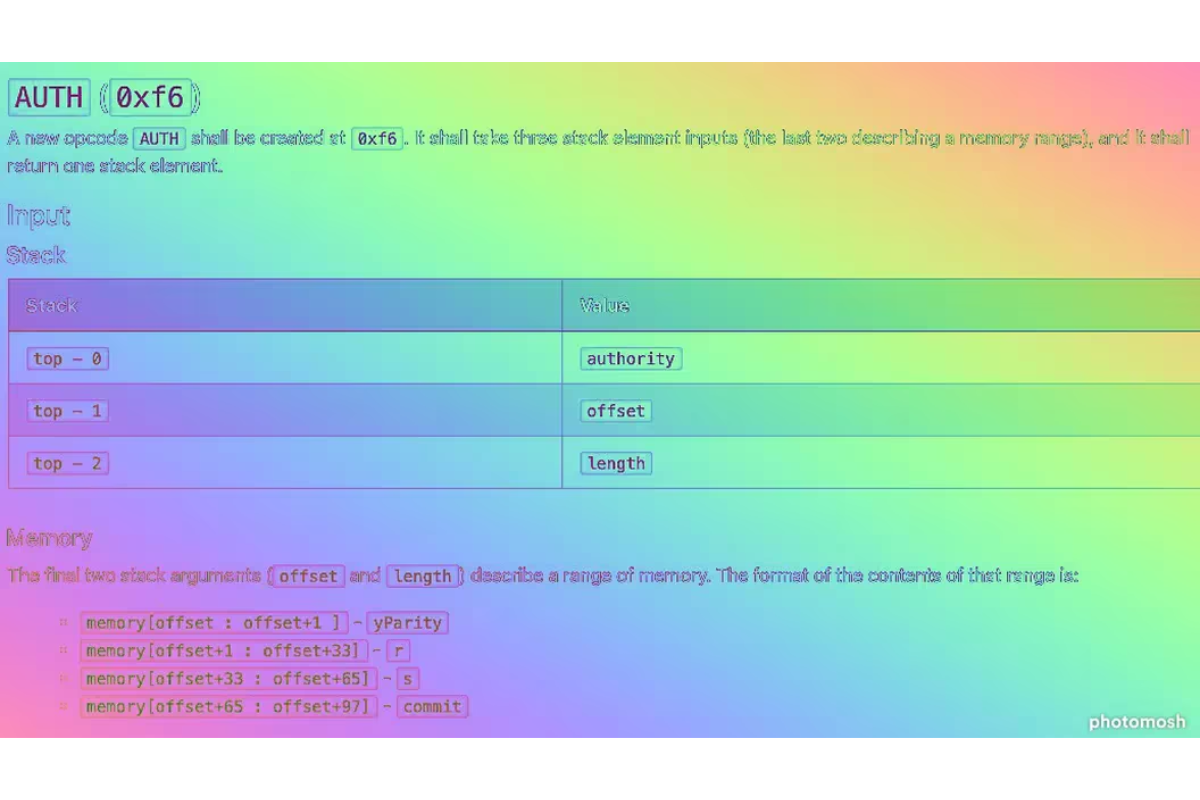

Ethereum Developers Target Ease of Crypto Wallets With ‘EIP-3074’

Ethereum developers are setting their sights on improving the user experience of crypto wallets with the implementation of Ethereum Improvement Proposal (EIP) 3074. This proposal aims to simplify the process of interacting with Ethereum smart contracts, making it easier for users to manage their digital assets securely.

EIP-3074 introduces a new type of account called “constrained accounts,” which are designed to restrict certain types of interactions with smart contracts. This feature enhances the security of crypto wallets by limiting the scope of potential attacks and reducing the risk of unauthorized access to funds.

One of the key benefits of EIP-3074 is its ability to streamline the user experience of interacting with Ethereum smart contracts. By simplifying the process of managing digital assets, this proposal aims to make crypto wallets more accessible to a wider audience, including non-technical users.

In addition to improving usability, EIP-3074 also enhances the security of Ethereum wallets by introducing new permissioning mechanisms. Constrained accounts allow users to define specific rules and conditions for interacting with smart contracts, providing an additional layer of protection against potential vulnerabilities and exploits.

Overall, EIP-3074 represents a significant step forward in the ongoing effort to enhance the usability and security of Ethereum wallets. By introducing constrained accounts and new permissioning mechanisms, this proposal aims to make it easier for users to manage their digital assets securely while also reducing the risk of unauthorized access and potential attacks.

Source: coindesk.com

The post Ethereum Developers Target Ease of Crypto Wallets With ‘EIP-3074’ appeared first on HIPTHER Alerts.

-

Blockchain6 days ago

Blockchain6 days agoMeritrust Credit Union Joins Metal Blockchain’s Banking Innovation Program

-

Blockchain Press Releases6 days ago

Blockchain Press Releases6 days agoDeltec Bank Receives System and Organization Controls (SOC 2) Type 1 Certification

-

Blockchain6 days ago

Blockchain6 days agoZettaBlock announces the addition of blockchain data

-

Blockchain6 days ago

Blockchain6 days agoGlobal eCommerce Payments Markets to 2030 | A $612 Billion Opportunity | Blockchain Technology and Cryptocurrencies Reshaping eCommerce by Providing Secure, Cross-Border Payment Solutions

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days agoDiscover Move Move Coin: Is This the Next Sports Blockchain for Your Workout?

-

Blockchain6 days ago

Blockchain6 days agoHong Kong joins global crypto ETF race

-

Blockchain6 days ago

Blockchain6 days agoAnkr expands Bitcoin liquid staking tokens to AI blockchain Talus

-

Blockchain Press Releases2 days ago

Blockchain Press Releases2 days agoTiger Brokers (HK) officially launches virtual asset trading services, leading the way in Hong Kong’s online brokerage industry