Blockchain Press Releases

France concludes global AI Action Summit, aims to become 3rd AI power after US and China; Artprice by Artmarket unveils 2025-2029 Strategic Plan and emerges as leader in AI art market intelligence with Intuitive Artmarket® AI

PARIS, Feb. 12, 2025 /PRNewswire/ — As France recently hosted the Global AI Action Summit, Artprice by Artmarket – world leader in art market data for 28 years – has unveiled its 2025-2029 strategic roadmap and the first concrete successes of its Intuitive Artmarket® AI, consolidating its position as the global leader in AI-driven art market intelligence. Artprice by Artmarket.com est cotée sur le marché réglementé Euronext Paris.

On February 10 and 11, 2025, France received nearly 100 countries as part of the Global Summit for Action on Artificial Intelligence – “AI Action Summit” – using its fabulous Grand Palais to host heads of state and government, leaders of international organizations, small and large businesses, academics, researchers, non-governmental organizations, artists and various other representatives of civil society.

The summit was part of a broader AI Action Week starting February 6, featuring key events such as Scientific conferences on February 6–7 at École Polytechnique and a cultural weekend on February 8–9 organized by the French Ministry of Culture under Minister Rachida Dati, which included Artprice and its founder-CEO, thierry Ehrmann.

According to Rachida Dati, Minister of Culture: “The Cultural Weekend program, designed by the Ministry of Culture, aims to highlight, to as wide an audience as possible, the opportunities that artificial intelligence offers to creators. However, while we hope to make a veritable contribution to a new era of creativity, we need to keep a sharp focus on the challenges and risks that the cultural sectors face today.”

Echoing this, Artprice, in its capacity as the World Leader in Art Market Information, previewed exclusive figures from its upcoming 30th Annual Art Market Report, produced in partnership with China’s Artron Research Academy of Arts.

This landmark report – eagerly anticipated by the global art world in March of each year – is distributed in 122 countries and 11 languages through Artprice’s 26-year partnership with Cision PR Newswire. This year’s edition highlights France as Europe’s leading art market by auction turnover, the world’s second market in terms of art auction transaction volumes, and the world’s fourth largest by total auction turnover (after the United States, China and the UK).

The AI summit provided France with a platform to showcase its AI expertise and the vibrancy of its business and research ecosystems, and to launch a new phase of its national AI strategy.

To this end, Clara Chappaz, Secretary of State for Artificial Intelligence and Digital Technology and the official host for this summit in the government of François Bayrou, identified three objectives: societal & cultural, economic and diplomatic.

In an interview in Les Échos on the eve of the summit, Clara Chappaz addressed a number of key issues: “At the White House in Washington on 21 January 2025, the United States – through the voice of President Donald Trump accompanied by Larry Ellison, co-founder of Oracle, Masayoshi Son, CEO of SoftBank, and Sam Altman, CEO of OpenAI – announced Stargate, a $500 billion AI plan, while China now has DeepSeek, a very efficient and low-cost model.

Where does Europe stand in this field? AI is an opportunity for Europe. The Draghi report, released last September, was incisive. It showed that Europe has reacted. I am not waiting for a European surge, it has happened. The European Commission’s recent Competitiveness Compass clearly prioritizes innovation. We’re in the race, we but must stay there.

Is there a surge in large groups, which are key in the adoption and diffusion of AI? During the summit, which will take place at the Grand Palais, the world‘s largest companies and the world’s largest AI start-ups will come together. This has never happened before. This shows that everyone is around the same table and that silos are being broken down.”

Anne Bouverot, an AI expert, engineer, and special envoy of French President Emmanuel Macron, played a central role in preparing the AI Action Summit. She oversaw work on five main themes: AI for public interest, the future of work, innovation ecosystems, AI safety, and global AI governance. She also coordinates international efforts to establish open, democratic AI governance and founded the Abeona Foundation to promote responsible AI. She co-chairs the Paris-based AI & Society Institute.

Indeed, on February 9, during his special speech on France 2, President Emmanuel Macron declared that he wanted to make France a powerhouse of artificial intelligence, announcing 109 billion euros of investments in Artificial Intelligence in France by groups like MGX, BlackRock, Brookfield, Amazon, Microsoft, Fluidstack, Data4, Equinix, Digital Realty, Prologis, Evroc, Sesterce, Opcore, Mistral, BPI France, Infravia and Scaleway.

At the end of the Summit for Action on AI in Paris, co-chaired with India in the presence of its Prime Minister Narendra Modi, it was clear that President Macron wants to see France become “number 3 in the world”, behind the United States and China. The summit brought together nearly 100 countries, leaders of international organizations, researchers and representatives of civil society to define the foundations of global AI governance.

Among them were: United Nations Secretary-General António Guterres; U.S. Vice President J.D. Vance, who made a career in Silicon Valley; Chinese Vice Premier Ding Xuexiang; European Commission President Ursula von der Leyen; the German Chancellor, Olaf Scholz as well as the President of the United Arab Emirates, Mohamed Bin Zayed Al-Nahyan.

This summit was also attended by representatives of international organizations such as Ngozi Okonjo-Iweala, Director General of the WTO; Mathias Corman, Secretary General of the OECD; Fatih Birol, Director of the International Energy Agency; Moussa Faki, Chairperson of the African Union Commission; as well as numerous tech company executives such as Sam Altman, CEO of OpenAI; Google CEO Sundar Pichai; Arthur Mensch, CEO of Mistral AI; Xavier Niel, Founder of the Iliad group; Demis Hassabis, Director of Google DeepMind; Brad Smith, President of Microsoft.

There were also many scientists and experts like Yann Le Cun, AI pioneer and Scientific Director at Meta; Joëlle Barral, Researcher at Google DeepMind; Michael Jordan, Professor at the University of Berkeley, and, Nobel Prize winners like Geoffrey Hinton, considered one of the “fathers” of modern AI; journalist and Nobel Peace Laureate, Maria Ressa, and economist, Joseph Stiglitz.

A steering committee bringing together representatives from around thirty countries and international institutions as well as representatives from academia, businesses and civil society met five times to prepare the discussions for this Summit.

France plans to train 40,000 to 100,000 researchers by 2030 and build 35 data centers (including a €30–50 billion UAE-funded facility). It also plans to establish a Franco-European regulatory framework for AI.

Brookfield announced a €20 billion investment in French data centers, including a 1-gigawatt facility in Cambrai. This investment mainly targets the development of data centers, essential for training AI, as well as associated infrastructure, such as energy production. Among the major projects, a mega-data center will be built in Cambrai, in the north of France, with a maximum power of 1 gigawatt.

According to an official French government source, France is Europe’s top destination for foreign AI investments.

At the end of the summit, the creation of an observatory of the energy impact of artificial intelligence, led by the International Energy Agency (IEA), was formalized as well as a coalition for sustainable AI, which intends to bring together the main companies in the sector.

Artprice by Artmarket reached a new milestone on January 9, 2025, with the success of its Intuitive Artmarket® AI and is now the world leader in AI for Art Market information

At the end of 2024, Artprice by Artmarket gave its high-end subscribers access to data learned by its Intuitive Artmarket® AI and its algorithms.

On January 9, 2025, Artprice by Artmarket consolidated its position as the global leader in AI-driven art market intelligence with the successful roll-out of its Intuitive Artmarket® AI. Today, with one month of hindsight, we already see that these subscriptions have become the preferred annual subscriptions in our high-end offer.

This spectacular development demonstrates that the 9.3 million customers and members of Artprice by Artmarket have accepted the advent of AI culture into the heart of our databases and are moving towards premium subscriptions that include Intuitive Artmarket® AI, with a corresponding impact on the growth of our recurring revenue (ARR). Over the coming years, Artprice will increase its research and results to a level never before reached in the art market for its clients and members, offering a whole range of new services and products.

Artprice was particularly interested in a DOMO Inc. study, (figures from which were published by Les Échos/Solutions ). DOMO uses an important index that scores the ability of a company to integrate AI into its processes. This index measures the processing of data/second per employee.

The average is a generation of 1.7 MB of data/second.

Following an IT audit by Mazars, Artprice by Artmarket was able to see for itself that each of its employees generates 35MB/second, i.e. 21 times more than the European average, which is perfectly consistent with Artprice’s Core Business as a major global publisher of professional databases and proprietary algorithms and world leader in information on the Art Market.

Artprice monitors the attitudes and policies of the Big Five Audit & Consulting firms towards AI. Clearly AI is ‘the major subject’. For example, Accenture and NVIDIA announcing an alliance under the name Accenture NVIDIA Business Group, to bring companies into the AI era.

Arnaud Naudan, President of BDO France reacted on Ecorama: “One of the two major challenges for our clients is artificial intelligence“. Deloitte, the leading Big 5 Auditor, created AI Institute “to bring together the brightest minds in the field of AI“. For KPMG: “Three quarters of French CEOs consider that their management team is aware of the benefits of Generative Artificial Intelligence to strengthen the competitiveness of their companies (CEO Outlook Study).

This cultural revolution is introducing a whole new vocabulary to the commercial world. But the processes and tools that make up AI are already scientifically at the very core of Artprice by Artmarket. Via this new vocabulary, Artprice’s clients and partners are discovering the unexplored riches of Artprice and the extraordinary depth of data that corresponds exactly to their needs.

In addition, Artprice by Artmarket has twice consecutively obtained the state label “Innovative Company” (a rare occurrence for companies listed on a regulated market), awarded by the Banque Publique d’Investissement (BPI) and it is pursuing its ambitions in this direction.

Artprice by Artmarket.com, drawing on the experience of its parent company Groupe Serveur – a pioneer of the Internet in Europe, legal databases, and the first computer-generated images since 1987 – has developed over these decades thousands of increasingly powerful and relevant proprietary algorithms with more than 180 data banks which allow it to set up its own Intuitive Artmarket® AI, in strict compliance with various countries’ legislations, particularly those regarding PDP and IP.

This was only possible through the targeted acquisition in 1999 by Groupe Server, then by Artprice, of innovative companies such as Xylogic, a Swiss company composed exclusively of top scientists (from CERN, WHO, etc.) who were considerably ahead of their time and who already pre-figured the solid beginnings and fundamentals of artificial intelligence (see Artmarket.com’s AMF reference document).

In the cozy world of large global publishers of professional databases that Artprice belongs to, it is vital for the long-term development of industries to integrate proprietary AI into core businesses. This is why Artprice by Armarket has taken a very significant lead since 1999 and made 2025/2029 the key period for the commercial launch of its a proprietary algorithmic AI, Intuitive Artmarket®.

According to thierry Ehrmann, Founder of Artprice and CEO of Artmarket.com (official certified Who’s Who In France biography: https://imgpublic.artprice.com/img/wp/sites/11/2024/02/2024_Biographie_thierry_Ehrmann_WhosWhoInFrance.pdf )

“By exploiting its hundreds of millions of anonymized proprietary logs, texts and tens of millions of artworks in its databases, Artprice by Artmarket algorithms are capable of identifying all the language used to describe the initial approach of an artist, his universe, his inspirations, the mediums used, his themes, his forms and volumes, etc.”

This precious data allows users to get closer to the 861,000 referenced artists with their biographies and certified data, beyond the classic academic visual criteria, thanks to the neural networks of the Intuitive Artmarket® AI.

Our Intuitive Artmarket ® AI can already calculate reliable price information and explore the traceability of an artwork, examining its auction results over time, using the repeated sales method that is specific to Artprice; but it is also capable of anticipating future value fluctuations of unique works.

It can also detect transversal artistic trends of extreme complexity which largely escape the academic, institutional, university and commercial worlds.

In this respect, an in-depth ‘spontaneous awareness’ study was prepared to measure the precise footprint Artprice has in the world of Art and Art History.

The study was conducted during the CIHA Lyon 2024, France – 36th world congress devoted to research in Art History with more than 70 countries and 1000 speakers, where Artprice was a committed patron of these Art History Olympiads which have been held every 4 years in a major city of the world since 1873.

In the study, Artprice ranks as the ‘top-of-mind’ database on the Art Market.

After several months of preparation, Artprice by Artmarket was able to be present during the entire congress, participating in conferences, ensuring a presence at the CIHA book fair and hosting a special evening event at its world headquarters located in the heart of its Organe Museum of Contemporary Art, the entity which manages the “Abode of Chaos” (dixit the New York Times).

In addition to ‘spontaneous awareness’, Artprice also tried to determine the level of ‘qualified awareness’.

This very qualitative study benefited from two exceptional factors: on the one hand, by physically questioning conference attendees from 70 countries, it avoided online or telephone questionnaires, the relevance of which is sometimes unreliable and cannot be truly verified. On the other hand, Artprice was able to interact directly with the registered and certified congress and conference attendees, taking note of their professions, specialties, positions, titles, diplomas, and institutions or universities.

We asked the following question: “Which databases on the Art Market do you know?”

Out of 378 delegates questioned, 325 cited Artprice first, i.e. 86%, clearly placing Artprice as the ‘top-of-mind’ art market database.

‘Top-of-mind’ awareness is the percentage of people whose first response identifies a particular brand, product, or service. It is both a spontaneous response and the first of their responses.

To return to the Intuitive Artmarket ® AI algorithms, they can help art galleries and auction houses set optimal prices for artworks based on various factors such as demand, rarity, and of course the notoriety of the artist concerned. In short, Intuitive Artmarket ® artificial intelligence offers significant potential to revolutionize the art market by improving access to information, personalizing the buyer experience, fighting counterfeiting and opening new creative perspectives.

The Intuitive Artmarket® AI works exclusively on an almost infinite scope of proprietary content, and is therefore protected under IP law, which gives users freedom from potential copyright obstacles and prohibitions. Intuitive Artmarket® AI therefore has no need to look elsewhere for data and/or responses to very specific requests from art market users.

This not only guarantees its sustainability, but also guarantees a considerable increase in Artprice by Artmarket.com revenue over time, via a growing volume of added-value subscriptions.

thierry Ehrmann, CEO of Artprice by Artmarket :

“Over the last two decades Artprice has been recording, observing and inducing hundreds of millions of anonymized human behaviors relating to the art market which, by nature, is infinitely complex because artworks are all different, all singular, and abstract notions of beauty depend on human emotion.”.

This reinforced algorithmic learning has allowed Artprice to create an unique AI model specific to the art market that will constitute the 2025/2029 growth driver for Artprice by Artmarket.

No less than 95% of companies in the S&P 500 plan to build their growth on Artificial Intelligence.

According to the top Anglo-Saxon financial analysts – who are one step ahead of Europe on this subject – the only economically viable model that does not expose the company (whatever its size) to constant legal attacks is an AI based on an extremely well-defined economic segment.

The economic segment of AI is based on five pillars that all relate to the history of IT: Big Data, Deep learning, Data Mining, Proprietary Algorithms, and, of course, a Core Business based on the sale of ultra-qualified information, with standardization of data for all processes.

The information produced by Artprice by Artmarket plays a vital role and the company has full intellectual property rights over all of these five pillars, with copyright and related rights confirmed over all algorithms, databases, Big Data, machine learning (deep learning) and neural networks.

In sum, the AIs that will triumph with a very significant economic gain, without industrial or legal risk, are those created by economic entities that own, in full intellectual property, all the different stages of the proprietary AI in a defined market segment where high added value information, with a high cost, is vital. And this is exactly the case of the Intuitive Artmarket ® AI developed by Artprice by Artmarket.com, World Leader in Art Market information.

In the 2025-2029 master plan, Artprice by Artmarket has planned the creation of approximately 20 specific AIs which each represent the sum of the knowledge of each Artprice department. These are Econometrics & Statistics for Art Market Indices, Artist Biographies, Documentary Collections of Manuscripts & Catalogs, Databases, Editorial, Intranet Auctioneers, ArtMarketInsight press agency, Annual Art Market Reports, IT, SGE (Search Generative Experience), Data Analyst & Scientist, R&D, Marketing, Customer Service, Multi-users & Major accounts, Standardized Marketplace, Artist & Creative Entities Communications department , Institutional & Financial Communication, Legal, Financial and Management… in other words, an AI potentially specific to each department.

One of Artprice’s key approaches to AI was to avoid fuzzy set theory, also known as ‘fuzzy logic’, which is a method based on ‘degrees of truth’ rather than the usual Boolean logic system based on 0 or 1. This amounts to searching, in Boolean logic, for unknown but nonetheless indisputable underlying elements.

Artprice has developed, among other things, a unique approach to its Intuitive Artmarket® AI which it calls Blind Spot AI®. This revolutionary AI concept, created by Artprice, searches the blind spots between structured data.

In Art History, our Blind Spot AI® would be the equivalent to Marcel Duchamp’s infrathin concept, which is an aesthetic and scientific notion designating an imperceptible difference or interval, sometimes only imaginable but very real, between two identified phenomena.

This Duchampian theory came from work with the famous mathematician Henri Poincaré, author of Science and Hypothesis, a work on the importance of using models in science. It is plausible that this work inspired Einstein for his thinking which led to the founding article of the theory of special relativity, published in 1905.

Indeed, among the major global publishers of databases, we are fully conscious that there is no room for mistakes as the relationship of trust established with users cannot tolerate approximate or erroneous data.

Artprice is demonstrating that it is possible to produce unexplored data with its proprietary AI and its Blind Spot AI ® process, without undermining the trust that has, for 27 years, been based on indisputable, reliable, exhaustive and long-lasting data, essential to Artprice’s clients, namely Experts, Auctioneers / Auction Houses, Art Dealers, Gallerists, Institutions, Museums, Insurance Companies, Private Bankers, Banks, Asset Managers and Collectors.

Considering the sometimes very high financial values of artworks, we are perfectly aware that our loyal and recurring Artprice clientele will not tolerate the slightest error.

In its beta test at the end of 2024, Artprice by Artmarket provided proof that having stabilized the question of alignment (the ‘alignment’ problem) in a decade – which is essential for the successful completion of the genesis and then the construction of its Intuitive Artmarket® AI – the high added value data produced by its Intuitive Artmarket® AI respects the ethics, values, expectations and human sensitivities that are specific to the Artprice by Artmarket group, its clients and to the intangible and centuries-old rules of the art market.

During 2025, Artprice, with its AIDB Search Artist® will allow its 9.3 million customers and members to search for an artwork via a paid service, based on a photograph of the work, (similar to Google Lens), to find the same or similar works on Artprice, with the artist’s data.

Our proprietary Artprice AI application, AIDB Search Artist®, is the result of seven years of development, taking into account the 210 million images or engravings of works of art (with a hard core of 18 million tokenized images) from 1700 to the present day from the largest collection in the world of physical manuscripts and art market sales catalogs, a veritable ‘Library of Alexandria‘, that belongs to Artprice by Artmarket and has been annotated and analyzed by our historians and experts.

Artprice’s AIDB Search Artist® AI application could only be designed by having full control over all the processes and copyrights, with manual learning, in the early years, by Artprice specialists to train a deep-learning application, allowing research on an artwork, which no other specialized company has succeeded in achieving to date.

In fact, the thirty companies that were confronted with this exercise limited it to their non-exhaustive content where the references rarely exceeded 20,000 artists, whereas Artprice lists 861,000. Furthermore, in many cases, the reproduction rights of the artists were not honored.

In the context of Intellectual Property, artists’ rights are frequently absent from AI and are often victims of copyright violations. That is why Artprice pays for the reproduction rights of the artists it references through 54 copyright societies in different countries.

A fourth AI tool will be based on the recognition and expertise of the signatures and monograms of artists from the 4th century to the present day: AIDB signatures & monograms® by Artprice.

It has been trained using the three largest global databases of signatures and monograms, acquired by Artprice over the past 28 years: Caplan & Creps (USA), Sound View Press (USA), Editions Van Wilder (Europe), Enrique Mayer (Switzerland) [see Artmarket.com reference document].

Artprice by Artmarket has fully approved the technological concept and resulting legal solution of NVIDIA’s Project DIGITS.

Indeed, this compact and energy-efficient box format represents a genuine revolution. It will allow Artprice to equip all of its employees with Project DIGITS boxes within the framework of production, knowledge and expertise. Everything will be connected exclusively to the Artprice by Artmarket’s Intranet via a DMZ network.

With Project DIGITS, users can develop and run inference on models using their own desktop system, then seamlessly deploy the models to exclusive Artprice-owned cloud or data center infrastructure.

According to Jensen Huang, founder and CEO of NVIDIA,“AI will be mainstream in every application for every industry. With Project DIGITS, the Grace Blackwell Superchip comes to millions of developers. Placing an AI supercomputer on the desks of every data scientist, AI researcher and student empowers them to engage and shape the age of AI.”

Likewise, all the data generated by Artprice’s numerous proprietary AIs will only be generated from these 180 proprietary data banks, which significantly limits the phenomenon of ‘hallucination’ specific to AI. Lastly, the control of methodological biases is much better managed, because all of the calculation and reflection chains will rely entirely on the Artprice databases and its global Intranet which has been connecting to its 7,200 partner Auction Houses for 28 years.

According to Artprice’s analysis, NVIDIA’s Project DIGITS is based on a singular innovation: the GB10 Grace Blackwell chip. The box using this chip provides a computing power reaching 1 petaflop, or the equivalent of 1000 operations per second in FP4 precision. Finally, its real strength remains in its ability to run AI models with up to 200 billion parameters – a performance that rises to 405 billion when two units are connected together.

The device comes with Linux-based NVIDIA DGX OS.

Artprice by Artmarket, since its inception, has developed all of its infrastructures and databases under Linux and therefore has perfect mastery of the Linux Kernel to integrate a Project DIGITS for each Artprice employee, whatever their function.

According to Artprice, this strategy can only be a winner. By individually offering this type of equipment with colossal power at a competitive price, NVIDIA meets Artprice’s specifications and thus confirms its position as the leader in accelerated computing.

Artprice by Artmarket monitors and analyzes all the main LLMs (Large Language Models), particularly those in Open Source.

Since its irruption in January 2025, Artprice has naturally analyzed Deepseek R1 in Open Source – an open weighted model of 671 billion parameters which performs comparably to OpenAI, but at a 90 to 95% lower cost by distilling 6 Llama and Qwen models.

Now continuing its work in this direction, DeepSeek has released DeepSeek-R1, which uses a combination of RL and supervised fine-tuning to handle complex reasoning tasks and match the performance of Open AI o1.

In testing, DeepSeek-R1 scored 79.8% on the AIME 2024 math tests and 97.3% on the MATH-500. It also scored 2,029 on Codeforces, better than 96.3% of human programmers. On the other hand, Open AI’s o1-1217 obtained 79.2%, 96.4% and 96.6% respectively on these tests. It also demonstrated strong general knowledge, with an accuracy of 90.8% on the MMLU, just behind o1’s 91.8%.

For Artprice by Artmarket, the heated and controversial debates surrounding Deepseek simply confirm the importance of Artprice’s work and analysis on the real measured needs for its Intuitive Artmarket® AI.

The decisive parameter that validated Deepseek’s impact was the ‘Black Monday’ on Wall Street on January 27, 2025, which saw over a $1 trillion withdrawn from American tech stocks. The Western world was largely surprised to discover the language models of this start-up, whose performances are comparable with those of American AI leaders (OpenAI, Anthropic, Meta), but at an infinitely lower cost to use.

On this ‘black day’ for the tech industry, one company fared better than the others: Apple. Its shares increased by 3.18%, even though the company is also concerned with generative artificial intelligence via its Apple Intelligence suite. One of the reasons for this resistance is that DeepSeek’s work validates several avenues chosen by Apple.

For the Artprice group, limiting the energy costs of AI is a reality that could inspire the world of large publishers of vertical data banks to which it belongs.

Apple Intelligence’s vision reinforces Artprice’s convictions

Our reasoning is similar to Apple Intelligence where Tim Cooks, Apple’s CEO, has perfectly understood that his clients are above all creators and artists who want to work on their own while avoiding regular plundering by third parties. At Artprice we have equipped employees in our Artistic Direction department with the M4 chips equipped with Apple’s Neural Engine while awaiting Apple’s AI Chip, developed with Broadcom, known for the time being as “Baltra”.

For Artprice, Elon Musk’s warning, echoing predictions of Ilya Sutskever, former scientific chief of OpenAI, who from 2022 warned of the imminence of a “peak data” moment, is a very concrete reality. This concept, borrowed from “peak oil” theory, suggests that the amount of quality data available for training AI, primarily from the web and online human activity, has peaked and is beginning to decline.

Artprice considers that Peak Data, Slop and the gradual destruction of free websites constitute a threat to the Internet ecosystem. Likewise, “autophagy”, where AI feeds on AI, can lead to a collapse of models, which produce responses that initially become less and less original and relevant, and then end up having no meaning, according to an article published at the end of July 2024, in the scientific journal Nature.

Concretely, with the use of this type of data called “synthetic data” (because it is generated by machines), the sample from which the AI models draw to provide their answers loses in richness.

The analysis by Eric Schmitt, former CEO of Google, validates Artprice‘s economic model for AI.

In a conference at Stanford University, Eric Schmitt showed that he agrees with Artprice’s reasoning, where the virtuous economic model of AI can only be achieved through paid models, due to the simple fact that AI requires, for its training, high value-added data which is protected by copyright and other related rights. This has been Artprice’s Core Business for 28 years.

In addition, the former Google CEO indicates that the cash burn of AI development is so high that a company will need a paid economic model, since the data from the free Internet will be ‘exhausted’ by peak data.

About the EU AI Act and Intellectual Property regarding global AI

According to Perplexity AI, intellectual property case law related to AI is still evolving, but several key principles are emerging domestically and internationally.

The AI Act protects the rights of authors against the use of their works by generative AI systems through several key measures:

– Obligation of transparency: Generative AI providers must indicate whether the data used to train their models is protected by copyright. They must also provide a detailed summary of the protected works exploited, in accordance with Article 28 ter of the AI Act.

– Right of opposition (opt-out): Authors can refuse the use of their works for training AI by exercising their right of opposition. This mechanism is provided for by the 2019 European Copyright Directive and reinforced by the AI Act, although it remains difficult to apply in practice due to the lack of control over the actual uses of works online.

– Traceability and accountability: The AI Act imposes traceability requirements to ensure that AI developers inform users and rights-holders about the origin of the data used, allowing for better rights management and increased transparency.

– Legal framework: The regulation aims to balance innovation and protection of authors by establishing mechanisms such as collective management, which facilitates the consultation of authorizations and ensures fair remuneration to creators for the commercial use of their works.

These provisions aim to protect the rights of authors while encouraging ethical and transparent use of generative AI technologies.

According to Artprice, within the framework of Europe’s AI Act and the creation of an EU AI Office, each jurisdiction will face numerous new obligations within sometimes very short deadlines. In total, Artprice has identified 88 responsibilities at the national level that are regularly discussed in its Boards of Directors and its Internal Control meetings.

Lastly, during the recent AI Action Summit, President Emmanuel Macron stated “We will continue to defend copyright and similar rights. We will continue to preserve human creativity. AI will bring lots of revolutions, lots of things, but creativity remains human. AI is, first of all, a true technological and scientific revolution for progress and in the service of progress. This revolution must be conducted in the service of humanity, to improve lives.”

How is the explosion of artificial intelligence disrupting today‘s world and particularly the art market? How to measure it in the face of the energy transition that is also a major issue?

For thierry Ehrmann, Founder of Artprice and CEO of Artmarket.com:

“We live in a world where computing power doubles every six months. Gordon Moore’s law, (Founder of Intel), which historically suggested that the number of transistors on a chip doubled every eighteen months at equal price, has been surpassed by new ‘scaling laws’. From now on, the acceleration of generative AI could be measured by a formula that I suggest as ‘token (digital asset) per Euro and per watt’, that is to say a new unit of measurement corresponding to the way in which AI processes a request for information, taking into account each euro spent and each watt actually consumed.

We are certain that it would be extremely dangerous for LLM publishers to ignore the carbon impact. It is simply excessive. Deepseek R1, but also in recent days a whole series of researchers from the Anglo-Saxon world, have all confirmed that it is possible to design LLMs with much more energy-frugal servers. It is strange that in the midst of the energy transition, this subject has been largely side-stepped.

We must remember with humility that the human brain’s language functioning is beginning to be well imitated by AI, while those of mathematics and geometry remain largely misunderstood.

Furthermore, seen as an integrated circuit, the human brain, from the scientific point of view, is to this day inimitable.

Even if we begin to understand its algorithms and reproduce them in very high capacity servers with several hundred billion parameters, we still cannot reproduce them with the same energy efficiency. Where the human brain weighs 1.4 kg and operates with only 30 watts, the AI giants in the USA are racing towards nuclear power plants and gigantic dams… Indeed, Microsoft is relaunching the Three Mile Island nuclear power plant in the state of Pennsylvania in the USA. Meanwhile, the human brain, with its capacity for imagination and creativity, remains unbeatable by the unit of measurement of AI which is the “token per Euro and per watt”.

According to thierry Ehrmann, Founder of Artprice & Groupe Serveur and CEO of Artmarket.com, the Group’s line of action for its AI is very simple:

“There cannot be artificial intelligence without human intelligence.” This notion underlines the importance that our group attaches to the interaction between human intelligence and artificial intelligence in the development of its own AI, called Intuitive Artmarket®. “This philosophy was firmly anchored in our group when we started the beginnings of AI in 1987 with shape recognition algorithms that were at the heart of the Lumière® stations (artificial computer-generated images) designed by Groupe Serveur and based on advanced techniques such as 3D rendering, light-matter simulation, vector modeling and raster mode.”

Analysis of Perplexity AI by Artprice and Groupe Serveur

All the dozens of subjects and studies of AI conducted over many years by Artprice, as well as the history of the development of its Intuitive Artmarket® AI, Blind Spot AI® as a revolutionary concept in AI, of which Artprice is the author, are available on: https://www.perplexity.ai/

Groupe Serveur, main shareholder of Artprice, which was at the origin of the first Linux search engine in France Netscan in the 1990s, considers, through its expertise of more than 38 years, that Perplexity AI has emerged as the best solution at this point in the artificial intelligence scene as a sophisticated search engine and chatbot. It is by combining these two roles that it facilitates a deep understanding of natural language.

Aravind Srinivas, Principal Founder and CEO of Perplexity, co-founded with Denis Yarats, Johnny Ho and Andy Konwinski have managed to make Perplexity AI a potential competitor for Google. In 2025, Deep Web researchers use it as their main working tool.

The initiative behind Perplexity AI motivated the development of a conversational engine that can answer various questions in real time. This gives it, according to Artprice and Groupe Serveur, an undeniable competitive advantage in the field of AI, by scrupulously respecting copyright and related rights when displaying its sources.

By investing in technical advances, Perplexity AI has built an architecture that uses modern neural approaches. This allows for better interpretation and management of complex language-related tasks. The community of search engine professionals such as SEO consultants, web SEOs and creative netlinkers who work with SE algorithms is predominantly in favor of Perplexity AI according to opinions collected by Artprice and Groupe Serveur in January 2025.

Copyright 1987-2025 thierry Ehrmann www.artprice.com – www.artmarket.com

Artprice’s econometrics department can answer all your questions relating to personalized statistics and analyses: econometrics@artprice.com

Find out more about our services with the artist in a free demonstration: https://artprice.com/demo

Our services: https://artprice.com/subscription

About Artmarket.com:

Artmarket.com is listed on Eurolist by Euronext Paris. The latest TPI analysis includes more than 18,000 individual shareholders excluding foreign shareholders, companies, banks, FCPs, UCITS: Euroclear: 7478 – Bloomberg: PRC – Reuters: ARTF.

Watch a video about Artmarket.com and its Artprice department: https://artprice.com/video

Artmarket and its Artprice department were founded in 1997 by thierry Ehrmann, the company’s CEO. They are controlled by Groupe Serveur (created in 1987). cf. the certified biography from Who’s Who In France©:

Artmarket is a global player in the Art Market with, among other structures, its Artprice department, world leader in the accumulation, management and exploitation of historical and current art market information (the original documentary archives, codex manuscripts, annotated books and auction catalogs acquired over the years) in databanks containing over 30 million indices and auction results, covering more than 863,000 artists.

Artprice Images® allows unlimited access to the largest art market image bank in the world with no less than 181 million digital images of photographs or engraved reproductions of artworks from 1700 to the present day, commented by our art historians.

Artmarket, with its Artprice department, constantly enriches its databases from 7,200 auction houses and continuously publishes art market trends for the main agencies and press titles in the world in 119 countries and 9 languages.

Artmarket.com makes available to its 9.3 million members (members log in) the advertisements posted by its Members, who now constitute the first global Standardized Marketplace® for buying and selling artworks at fixed or auction prices (auctions regulated by paragraphs 2 and 3 of Article L321.3 of France’s Commercial Code).

There is now a future for the Art Market with Artprice’s Intuitive Artmarket® AI.

Artmarket, with its Artprice department, has twice been awarded the State label “Innovative Company” by the French Public Investment Bank (BPI), which has supported the company in its project to consolidate its position as a global player in the art market.

Artprice by Artmarket publishes its 2024 Contemporary Art Market Report:

https://www.artprice.com/artprice-reports/the-contemporary-art-market-report-2024

See our 2023 Global Art Market Annual Report, published in March 2024 by Artprice by Artmarket: https://www.artprice.com/artprice-reports/the-art-market-in-2023

Summary of Artmarket press releases with its Artprice department: https://serveur.serveur.com/artmarket/press-release/en/

Follow all the Art Market news in real-time with Artmarket and its Artprice department on Facebook and Twitter:

www.facebook.com/artpricedotcom/ (more than 6.5 million subscribers)

Discover the alchemy and the universe of Artmarket and its Artprice department: https://www.artprice.com/video

whose head office is the famous Museum of Contemporary Art Abode of Chaos dixit The New York Times / La Demeure of Chaos:

https://issuu.com/demeureduchaos/docs/demeureduchaos-abodeofchaos-opus-ix-1999-2013

La Demeure du Chaos/Abode of Chaos – Total Work of Art and Singular Architecture.

Confidential bilingual work, now made public: https://ftp1.serveur.com/abodeofchaos_singular_architecture.pdf

- L’Obs – The Museum of the Future: https://youtu.be/29LXBPJrs-o

- https://www.facebook.com/la.demeure.du.chaos.theabodeofchaos999 (more than 4.1 million subscribers)

- https://vimeo.com/124643720

Contact Artmarket.com and its Artprice department – Thierry Ehrmann, ir@artmarket.com

Photo – https://mma.prnewswire.com/media/2617848/AI_Action_Summit.jpg

Photo – https://mma.prnewswire.com/media/2617847/AI_Intuitive_Artmarket.jpg

Logo – https://mma.prnewswire.com/media/2260897/Artmarket_logo.jpg

Blockchain

Blocks & Headlines: Today in Blockchain – May 19, 2025 | DoubleZero, Toobit, Story Protocol, Marco Polo, Argo Blockchain

May 19, 2025 — As the blockchain industry surges into its next phase of maturity, today’s briefing spotlights five pivotal developments shaping the crypto ecosystem: the physical limits of the public internet, a major exchange’s European push, Hollywood’s bet on Web3, blockchain’s role in global trade finance, and the drive for sustainable mining. Together, these stories reflect an industry wrestling with infrastructure bottlenecks, forging new community models, and renewing its environmental and regulatory commitments. From fiber-optics rails to Hollywood IP tokenization, let’s unpack what matters today—and why it matters to you.

1. Breaking the Bandwidth Barrier: DoubleZero’s Quest for High-Speed Blockchain Rails

The Story: At Consensus 2025 in Toronto, DoubleZero co-founder and CEO Austin Federa warned that today’s public internet “was never built for high-performance systems,” creating a critical bottleneck for high-throughput blockchain networks. Unlike traditional client–server models, modern blockchains require validators to rapidly switch between heavy data consumption and mass broadcast, demanding both low latency and massive bandwidth. By building dedicated fiber-optic communication rails, DoubleZero aims to slash transaction latency, tighten DeFi spreads, and unlock new use cases once stymied by internet constraints. Founded in late 2024, the project raised $28 million and plans its public mainnet launch in H2 2025, following an April token sale open to validators from Solana, Celestia, Sui, Aptos, and Avalanche.

Analysis & Implications: Federa’s remarks signal a shift: the limiting factor for blockchain performance has moved off software and compute and onto physical infrastructure. As decentralized networks scale, the quality of global connectivity becomes paramount. For DeFi traders, faster rails could mean tighter arbitrage windows and lower slippage; for enterprise adopters, sub-second confirmations could finally rival traditional payment rails. Yet building and maintaining dedicated networks carries capital and regulatory burdens. Will blockchain projects partner with telecom giants or build private consortia? How will this influence the ongoing L2 vs. L1 scalability debate? As the blockchain space broadens into enterprise domains, physical network investments may become as strategic as protocol design.

Source: Cointelegraph

2. Toobit’s European Expansion: Platinum Sponsorship at Dutch Blockchain Week

The Story: On May 19, Toobit announced its role as Platinum Sponsor of Dutch Blockchain Week 2025 (May 19–25) and revealed plans to host a booth at the Dutch Blockchain Summit in Amsterdam on May 21–22. Coming off its Platinum role at Web3 Amsterdam earlier this year, the award-winning derivatives exchange seeks to deepen ties with Europe’s crypto community—showcasing trading solutions, exploring partnerships, and engaging physically with its user base.

Analysis & Implications: Sponsorship of marquee events like Dutch Blockchain Week underscores exchanges’ pivot toward community engagement and regional regulatory alignment. As the EU advances its Markets in Crypto-Assets (MiCA) framework, European crypto players face both opportunity and uncertainty. Toobit’s visible presence signals confidence in the continent’s evolving legal landscape—and the strategic importance of in-person dialogue. Beyond brand building, these events catalyze partnerships with custodians, DeFi projects, and institutional investors. For traders, this focus on local engagement could translate into tailored products—European stablecoins, localized fiat on-ramps, or region-specific compliance tools. Toobit is betting that boots on the ground matter as much as bits on the chain.

Source: GlobeNewswire

3. Hollywood Meets Web3: David Goyer’s “Emergence” Universe on Story Protocol

The Story: At Consensus’s Toronto conference, filmmaker David Goyer (Blade trilogy, The Dark Knight, Apple TV’s Foundation) unveiled Emergence, a sprawling sci-fi franchise built on his blockchain platform Incention and powered by Story Protocol. Leveraging a 2,500-page story bible and an AI “Atlas” agent, Goyer plans community-driven storytelling—fans co-create characters, up-vote submissions, and share licensing upside via on-chain smart contracts. Story Protocol, which has raised over $80 million from a16z, Hashed, and Endeavor, offers IP registration, royalty-sharing, and permissioned remixing, aiming to decentralize franchise building.

Analysis & Implications: Goyer’s venture epitomizes the emerging creator economy in Web3, where tokenized IP and community governance challenge Hollywood’s top-down model. By placing narrative rights and royalties on-chain, creators and fans potentially share in franchise upside—aligning incentives but also demanding robust smart-contract frameworks. Yet risks abound: quality control, legal enforceability of on-chain IP, and community moderation. Will traditional studios adapt or resist? And can emergent on-chain governance scale for billion-dollar franchises? As AI and blockchain converge, the entertainment industry faces disruptive opportunities—and headwinds—around ownership, monetization, and creative collaboration.

Source: CoinDesk

4. Beyond Letters of Credit: Blockchain’s Transformative Role in Digital Trade Finance

The Story: In a comprehensive overview, Global Trade Magazine highlights blockchain’s potential to overhaul international commerce by digitizing trade finance workflows. Traditional paper-based processes—letters of credit, bills of lading—are slow, error-prone, and fraud-susceptible. Blockchain introduces immutable, shared ledgers and smart contracts that automate payment releases (e.g., upon IoT-verified delivery), collapse settlement times from weeks to hours, and enhance KYC/AML compliance via permissioned networks. Platforms such as R3’s Marco Polo, the we.trade consortium, and IBM/Maersk’s TradeLens demonstrate real-world deployments. Looking ahead, AI, machine learning, and IoT integration will further streamline risk scoring and anomaly detection—but challenges around protocol interoperability, regulatory standardization, and legal enforceability remain.

Analysis & Implications: As global trade rebounds post-pandemic, inefficiencies in trade finance cost banks and businesses billions annually. Blockchain’s promise lies in single-source-of-truth data sharing—cutting reconciliation costs and unlocking capital. For DeFi projects eyeing institutional corridors, tokenized trade-finance instruments could represent multi-trillion-dollar on-chain markets. Yet widespread adoption hinges on multi-stakeholder collaboration—banks, customs agencies, insurers, and carriers—and on harmonized regulations. The next frontier: bridging public and private blockchains, ensuring data privacy while enabling transparency. For blockchain advocates, trade finance offers both a showcase and a stern test of real-world scalability.

Source: Global Trade Magazine

5. Argo Blockchain’s Green Mining Playbook for 2025

The Story: UK-based miner Argo Blockchain (LSE: ARB, NASDAQ: ARBK) continues to expand sustainable crypto-mining operations in 2025. Leveraging hydroelectric power in Quebec and deregulated energy in Texas, Argo mined 1,298 BTC in 2024 at 2.8 EH/s capacity. In March, it announced a $25 million credit facility to upgrade its Texas data center with next-gen ASICs—targeting a 20% hash-rate boost by Q3 2025. With 95% of Quebec power from renewables, Argo aims for 3.5 EH/s by 2026. Competitors Marathon Digital (29.8 EH/s) and Riot Platforms (22.5 EH/s) focus on vertical integration and energy arbitrage, but remain more reliant on fossil fuels. Facing Bitcoin’s price swings, halving pressure, and potential regulatory curbs, Argo’s public listing and green credentials position it to attract ESG-conscious investors.

Analysis & Implications: Crypto mining’s environmental impact remains a flashpoint. Argo’s renewable-first strategy offers a template for sustainable operations, but scaling green hashing sustainably—and profitably—poses capital and regulatory challenges. As governments scrutinize energy usage, mining hubs may shift toward regions with abundant renewables. The storage of zero-carbon electricity via mining rigs could even emerge as a grid-stabilization service. Yet profitability remains tightly coupled to Bitcoin’s price and block rewards. For institutional backers and ESG funds, companies like Argo may represent the safest crypto-mining bet. However, industry consolidation and hardware innovation cycles will determine who thrives in this high-stakes infrastructure race.

Source: Blockchain Magazine

Conclusion: Key Takeaways

-

Infrastructure Matters: With dedicated fiber-optics rails, projects like DoubleZero spotlight that blockchain scaling is as much about hardware as code.

-

Regional Engagement: Toobit’s European sponsorship underscores the ongoing importance of in-person community building amid evolving regulatory regimes.

-

Creator-Economy Revolution: David Goyer’s Emergence franchise illustrates Web3’s potential—and complexities—in democratizing IP creation and monetization.

-

Institutional Use Cases: Trade finance remains a prime arena for blockchain’s real-world impact, but adoption depends on interoperability and regulation.

-

Sustainability Imperative: Mining firms like Argo must balance growth, profitability, and environmental stewardship to appeal to both crypto purists and ESG investors.

As the blockchain and cryptocurrency landscape advances, these stories offer a snapshot of an ecosystem grappling with scale, regulation, community, and sustainability. Stay tuned for tomorrow’s briefing—where we’ll continue to track the innovations and challenges defining Web3’s evolution.

The post Blocks & Headlines: Today in Blockchain – May 19, 2025 | DoubleZero, Toobit, Story Protocol, Marco Polo, Argo Blockchain appeared first on News, Events, Advertising Options.

Blockchain Press Releases

From Web3 to Wall Street: Bybit Becomes the First Crypto Exchange to Offer Direct Global Stock Trading with USDT

DUBAI, UAE, May 19, 2025 /PRNewswire/ — In a landmark move bridging traditional and decentralized finance, Bybit, the world’s second-largest crypto exchange by trading volume, has launched direct trading of top global stocks with USDT. This innovation—part of Bybit’s expanding Gold & Forex (MT5) product suite— unlocks direct trading of 78 of the most sought-after global equities—including Apple ($AAPL), Tesla ($TSLA), Meta ($META), Nvidia ($NVDA), and Amazon ($AMZN)—all powered by USDT. Users can now tap into traditional markets like stocks, gold, oil, indices, and forex, without fiat onboarding or leaving the crypto ecosystem.

With this launch, Bybit became the first and only major crypto exchange to unify crypto, stocks, and traditional assets under one roof, enabling seamless trading across asset classes from a single account and wallet. Whether you’re chasing earnings, hedging exposure, or responding to global macro shifts, this upgrade delivers crypto-native speed, simplicity, and flexibility to global markets.

From Bitcoin to Wall Street and beyond, Bybit traders can now move fluidly between digital and traditional markets—leveraging the power of stablecoins to access a full spectrum of global opportunities in real time.

Why This is a Game Changer

- Access Top Global Stocks: Including Apple ($AAPL), Tesla ($TSLA), Meta ($META), Nvidia ($NVDA), Amazon ($AMZN), and more—all now live on Bybit Gold & FX (MT5).

- One Platform, All Trading: Trade crypto, stocks, gold, oil, indices, and forex—all using USDT.

- Seamless, Crypto-Native Execution: No fiat required. No barriers. Just pure trading freedom.

Whether you’re hedging crypto volatility with gold, speculating on oil or forex, or investing in tech stocks, Bybit’s enhanced Gold & FX offering opens the door to a truly unified financial experience.

Wall Street Meets Web3: Limited-Time Launch Offer

To celebrate this milestone, Bybit is launching the “Wall Street meets Web3” campaign. From June 2 to June 15, 10:00 (UTC), all users will receive a 50% discount on trading fees for stock trades made through Bybit Gold & FX. It’s your chance to explore the future of finance—where the flexibility of crypto meets the legacy of Wall Street—at half the cost.

#Bybit / #TheCryptoArk

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 70 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open, and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Photo – https://mma.prnewswire.com/media/2690597/From_Web3_Wall_Street_Bybit_Becomes_First_Crypto_Exchange_Offer.jpg

Logo – https://mma.prnewswire.com/media/2267288/Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/from-web3-to-wall-street-bybit-becomes-the-first-crypto-exchange-to-offer-direct-global-stock-trading-with-usdt-302458937.html

View original content:https://www.prnewswire.co.uk/news-releases/from-web3-to-wall-street-bybit-becomes-the-first-crypto-exchange-to-offer-direct-global-stock-trading-with-usdt-302458937.html

Blockchain Press Releases

ETH on the Rise: Bybit x Block Scholes Report Reveals Optimistic Market Signals

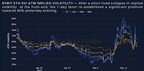

DUBAI, UAE, May 19, 2025 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, released a new weekly crypto derivatives analytics report in collaboration with Block Scholes, detailing the interplay between BTC and ETH’s rapid ascend in the past week, with ETH in the lead gaining 40% in spot prices. Bybit’s trading data recorded positive funding data across the board with positive futures curves and call-side volatility smiles at all tenors.

Key Highlights:

- ETH’s Winning Streak: The spell of good news moved markets in the last few days, adding some $900M in ETH open interest in the rally which peaked between May 11 and 12. Crypto’s second favorite poster child overtook BTC for the second week in a row, and derivatives indicators suggest further upside as investors put more calls than puts on the table, readying ETH for another surge.

- BTC Volatility: BTC’s return to $100K since early February coincided with the broader bullish ambience, with its short-term volatility dropped to a low 38%. A 5% skew towards OTM calls suggests continued risk-on sentiment, despite put options dominating with over $200M in volume compared to $140M for calls.

Access the Full Report

For detailed insights, readers may download the full report.

#Bybit / #TheCryptoArk /#BybitResearch

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 70 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Photo – https://mma.prnewswire.com/media/2690679/Source_Bybit_Block_Scholes.jpg

Logo – https://mma.prnewswire.com/media/2267288/Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/eth-on-the-rise-bybit-x-block-scholes-report-reveals-optimistic-market-signals-302458983.html

View original content:https://www.prnewswire.co.uk/news-releases/eth-on-the-rise-bybit-x-block-scholes-report-reveals-optimistic-market-signals-302458983.html

-

Blockchain Press Releases5 days ago

Blockchain Press Releases5 days agoFintica AI and Mima Wallet Announce Strategic Partnership and Launch Joint Venture, Fintica Crypto Ltd

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days agoBullish partners with the Gibraltar Government and GFSC to pioneer world’s first crypto clearing regulation

-

Blockchain4 days ago

Blockchain4 days agoBlocks & Headlines: Today in Blockchain – May 15, 2025 (BTC’s Push, Pi Network Fund, Stablecoin Levers, JPM Pilot, OKX × Man City)

-

Blockchain4 days ago

Blockchain4 days agoBDM Digital Initiates Promising Dialogue with Stanford Law School in Pursuit of Strategic Partnerships in Silicon Valley

-

Blockchain4 days ago

Wen Acquisition Corp Announces the Pricing of $261,000,000 Initial Public Offering

-

Blockchain4 days ago

Mercurity Fintech’s Subsidiary Grows Cross-Border Business Advisory Services with New Asia-Pacific Healthcare Client Engagement

-

Blockchain4 days ago

Blockchain4 days agoSaudi Arabia Loan Aggregator Market Report 2025: Retail Digital Payments Hit 70% as Tech Adoption Transforms Saudi Financial Services – Competition, Forecast & Opportunities to 2030

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days agoIndependent Audit from Hacken Confirms MEXC’s Strong Security Standards