Blockchain Press Releases

Artmarket.com: Artprice looks at 2023’s NFT auction market, and the 50 most successful digital artists, a promising future with the record for cryptocurrencies in ETFs on Wall Street

PARIS, March 12, 2024 /PRNewswire/ — The year 2023 started with the first acquisitions of NFTs by museums and ended with another bull run on the stock markets and the main cryptocurrencies.

The major event in cryptocurrencies is notably BlackRock’s (the largest asset manager in the world) and Fidelity’s introduction of ETFs directly invested in Bitcoin (Bitcoin spot ETFs) authorized by the SEC on 11 January 2024. This is a real consecration for Bitcoin which on 11 March 2024 was quoted at around 72,000 dollars, while Ethereum was at $4,000 (ETH ETFs are expected very soon).

BlackRock and Fidelity have achieved the best ETF launches in 30 years thanks to Bitcoin. In their first month of trading, the “IBIT” and “FBTC” funds raised $6.5 billion, which is more than any of the 5,500 other index funds launched before them (according to Les Échos of 10 January 2024: “Bitcoin ETF: the SEC opens the doors of Wall Street wide to Bitcoin”.

This is a new record for Bitcoin. Of the 5,535 ETFs launched over the last thirty years, none have gotten off to such a strong start as BlackRock’s ‘IBIT’ and Fidelity’s ‘FBTC’, said Bloomberg expert Eric Balchunas.

This Monday, March 11, 2024, a Bloomberg report (by Tom Metcalf & Emily Nicolle) announces “The London Stock Exchange said it will start accepting applications for the admission of exchange traded notes backed by Bitcoin and Ether” in the second quarter, confirming London as the capital of cryptocurrencies on the European continent.

This allows retail and professional investors to gain exposure to the largest cryptocurrency by market capitalization, without having to directly hold the asset.

Via cryptocurrencies, new collectors and art enthusiasts have been attracted to the art market, often younger than their predecessors. Not averse to speculation and the excitement of taking risks, these art enthusiasts and collectors solidly welded to their crypto-universe of Web 3.0.

The near future of Artprice by Artmarket is the meeting place between Web 3.0. (Metaverse and NFT) and Artprice’s artificial intelligence, its Intuitive Artmarket ® AI.

The 2023 period in NFT auctions, significantly less speculative than the two previous years, allowed Digital Art to finally settle peacefully in the international cultural and economic environment. As the NFT market consolidates, Artprice draws up a summary of the transactions on NFTs hammered in auction rooms in 2023, dominated by Sotheby’s, but which finished with Christie’s “Next Wave” sale on the sidelines of the Art Basel Miami Beach fair.

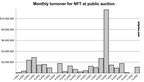

Monthly evolution of proceeds from public NFT auctions

Infographic – https://mma.prnewswire.com/media/2360542/NFT_auctions_1_Infographic.jpg

“Artprice by Artmarket.com recognizes in Digital Art – whether via NFTs or Artificial Intelligence – a revolution that it would be infinitely better to support and accompany than to reject or denigrate“, affirms thierry Ehrmann, CEO of Artmarket.com and Founder of Artprice.

“Artprice subscriptions will soon be able to be paid in ETH and BTC, and our databases have already been adapted to accommodate these two cryptocurrencies. We are very proud to support digital artists with the opening of our Standardized Marketplace to NFTs. Furthermore, we acquired and presented the works Flow (2023) by digital artist Josh Pierce on the cover of our latest Annual Report of the Contemporary Art Market in 2023 and the NFT work Chaos under the pure light by artist 1dontknows for our Annual 2023 Art Market report published in 2024.”

Annual Report of the Contemporary Art Market in 2023:

https://imgpublic.artprice.com/pdf/le-marche-de-lart-contemporain-2023.pdf

https://imgpublic.artprice.com/pdf/the-contemporary-art-market-report-2023.pdf

Annual 2023 Art Market report published in 2024:

https://imgpublic.artprice.com/pdf/le-marche-de-lart-en-2023.pdf

https://imgpublic.artprice.com/pdf/the-art-market-in-2023.pdf

This NFT paradigm shift is well explained in the ARTE documentary, recently released in 5 languages: “NFT, Chaos in the art world”

https://www.youtube.com/watch?v=_08d_1oY-Lo

Throughout this documentary, thierry Ehrmann, visual artist, NFT artist and Founding CEO of Artprice.com, delivers his analysis accompanied by other artists, experts and international players in the world of Art NFTs.

Any attempt to understand the significance of NFTs in Art History requires an appreciation of the digital and cultural revolution that they represent and some kind of prediction regarding their role and impact over the short and medium term.

According to thierry Ehrmann “In its various annual reports on the Art Market and the regulated information it publishes as a listed company, Artprice by Artmarket.com has always said with regard to NFTs that it is impossible to apprehend this new market without a true understanding of Blockchain, crypto-currencies and their cultural origins among the Cypherpunks (period of PGP-type data encryption at the beginning of the 1990s).”

Bearing in mind all the underlying parameters and data required, Artprice by Artmarket is the only organization on the global art market to be able to truly respond to the certification of primary issues of Art NFTs in an environment of cryptocurrencies and major international currencies.

In 2024, Artprice will be uniquely positioned in its capacity as a certifier of primary issues of Art NFTs based on the fact that Artprice by Artmarket has been the Global Leader in Art Market Information for more than 27 years and is the creator and owner of its globally recognized databases. It also has the world’s largest documentary collection of art market notes, manuscripts, codices and annotated sales catalogs from 1700 to the present day, which act as a guarantee of the authenticity and historical veracity of its databases.

1. Auctions of NFTs in 2023: key figures

– 350 lots sold

– 53 unsold lots (13% of lots)

– 32 sales sessions dedicated to or including NFTs

– 259 distinct artists

– $22.7 million in turnover (including fees)

– +65% growth compared with 2022

– 0.2% of global fine art turnover

– $1.9 million worth of NFTs sold per month on average

– 6 active auction houses

– 82% of the turnover generated by Sotheby’s ($18.4 million)

– $10.9 million total from “Grails: Property from an Iconic Digital Art Collection Part II” sale at Sotheby’s on 15 June 2023

– Minimum price: $126 for Ghost Sphynx (2023) by Asa Jarju

– Average price: $64,800

– Maximum price: $6.2 million for Ringers #879 (The Goose) (2021) by Dmitri Cherniak

https://www.artprice.com/artist/1091079/asa-jarju/nft/31233678/ghost-sphynx

https://www.artprice.com/artist/1023654/dmitri-cherniak/nft/30581409/ringers-879-the-goose

Distribution of public auctions of NFT by price range and by auction house

Infographic – https://mma.prnewswire.com/media/2360541/NFT_auctions_2_Infographic.jpg

2. Seven-digit auction results and other exceptional sales

In 2023, the seven best results of the year in the NFT category were hammered for Generative Art. This self-generating and random artistic approach is at the heart of the history of NFTs, notably with the controversial Profile Pictures (PFP) series such as the Bored Apes and the CryptoKitties. However, these series have now left their place at the forefront of the Generative scene to the abstract works created by artists like Dmitri Cherniak and Tyler Hobbs. Indeed, the series Autoglyph by Larva Labs now fetches higher prices than their CryptoPunks which made the artist duo famous.

Among the most anticipated pieces last year at auction, five digital creations created by Keith Haring at the end of the 1980s were put on sale at Christie’s in September 2023 by the Keith Haring Foundation. In the form of five unique NFTs (#1/1), these experiments were carried out on the first computers equipped with digital creation software a few years after those conducted by Andy Warhol. All the works found buyers at prices between $250,000 and $350,000.

https://onlineonly.christies.com/s/keith-haring-pixel-pioneer/lots/3479?sc_lang=en

Top 20 results for NFT works sold at auction in 2023

1. Dmitri Cherniak (b. 1988) – Ringers #879 (The Goose) (2021): $6,215,100

2. Tyler Hobbs (b. 1987) – fidenza #725 (2021): $1,016,000

3. Snowfro (XX-XXI) – Chromie Squiggle #1780 (2021): $635,000

4. Tyler Hobbs (b. 1987) – Fidenza #479 (2021): $622,300

5. Tyler Hobbs (b. 1987) – fidenza #216 (2021): $609,600

6. Larva Labs (b. 2005) – Autoglyph #187 (2019): $571,500

7. Tyler Hobbs (b. 1987) – fidenza #724 (2021): $442,170

8. Keith Haring (1958-1990) – Untitled (April 14, 1987) (1987): $352,800

9. Keith Haring (1958-1990) – Untitled #1 (April 16, 1987) (1987): $352,800

10. Keith Haring (1958-1990) – untitled #2 (April 16, 1987) (1987): $352,800

11. Kjetil Golid (b. 1991) – Archetype #397 (2021): $330,200

12. Larva Labs (b. 2005) – autoglyph #218 (2019): $330,200

13. Tyler Hobbs (b. 1987) – Fidenza #290 (2021): $279,400

14. Tyler Hobbs (b. 1987) – Fidenza #871 (2021): $279,400

15. Keith Haring (1958-1990) – untitled (feb 2, 1987) (1987): $277,200

16. XCOPY (b. 1981) – Loading New Conflict… Redux 6 (2018): $254,000

17. Larva Labs (b. 2005) – CryptoPunk#4153 (2017): $254,000

18. Keith Haring (1958-1990) – untitled (Feb 3, 1987) (1987): $252,000

19. Tyler Hobbs (b. 1987) – Fidenza #370 (2021): $241,300

20. Tyler Hobbs (b. 1987) – Fidenza #861 (2021): $241,300

3. Both in auction rooms and on the Metaverse

Sotheby’s now stands out as the most active auction house on the NFT market, regularly hosting sessions dedicated to this new medium. On 15 June 2023, Part II of its sale Grails: Property from an Iconic Digital Art Collection totaled $10.9 million in New York. But apart from these sales dedicated to NFTs, Sotheby’s now also includes NFTs in general sessions: at its day sale of Contemporary Art on 19 May 2023 in New York, Tyler Hobbs’ Fidenza #725 (2021) fetched over a million dollars (including fees), against an estimated range of $120,000 – $180,000.

https://www.artprice.com/artist/1062390/tyler-hobbs/nft/30222588/fidenza-725

Under Patrick Drahi’s leadership, Sotheby’s has also deployed a brand new platform called Metaverse, entirely dedicated to Web3: https://metaverse.sothebys.com. In 2023, it hosted the sale of 5,000 photographs by Sebastião Salgado in the form of NFTs, then a session entitled Snow Crash curated by artist Tony Sheeder, and lastly, a sale of 500 unique works generated by the pioneer Vera Molnar (who sadly passed away shortly after on 7 December 2023).

The projects carried out by Sotheby’s on its Metaverse platform, however, deviate somewhat from public sales in terms of transparency and communication of results and are undoubtedly more similar to private sales. Several important NFT works are still visible today on the sothebys-grails.eth wallet and are – according to Michael Bouhanna (VP, Contemporary Art Specialist & Head of Digital Art and NFTs at Sotheby’s) – available for private sale:

CryptoPunk #6669:

https://opensea.io/assets/ethereum/0xb47e3cd837ddf8e4c57f05d70ab865de6e193bbb/6669

Fidenza #526:

https://opensea.io/assets/ethereum/0xa7d8d9ef8d8ce8992df33d8b8cf4aebabd5bd270/78000526

Bored Ape #8552:

https://opensea.io/assets/ethereum/0xbc4ca0eda7647a8ab7c2061c2e118a18a936f13d/8552

4. ‘On-chain’ versus ‘off-chain’ transactions

The majority of NFT artworks publicly auctioned by Sotheby’s have so far gone through its main website, not through its Metaverse, and the transactions have therefore taken place outside the Blockchain. In other words, they were concluded “off-chain”; the hammer prices do not appear in the history of the NFT, where only a double transfer of ownership of the work is visible: from the seller’s portfolio (of the artist or collector) to that of Sotheby’s, and then from Sotheby’s to the buyer’s wallet, once payment is complete.

These “off-chain” transactions allow the auction house to maintain greater control over the transactions, in particular to collect payment before transferring the work to its new owner. This allows Sotheby’s to collect a commission by adding the usual fees. For its part, Christie’s, which carries out “on-chain” transactions via its Christie’s 3.0 platform https://nft.christies.com, does without a commission. Its FAQ specifies that “ Christie’s 3.0 does not add Buyer’s Premium to the hammer price” and that “You will need to pay a gas fee when you place a bid and, if applicable, when you pay sales tax and collect your NFT, Gas fees are not included in the final purchase price”. But these gas fees only concern the operating costs of the Blockchain and are not collected by the auction house.

5. The entry of NFTs into museum collections

The year 2023 saw the first acquisitions of NFTs by several museums, starting with the most prestigious, the LACMA, the MoMA, the Pompidou Center, and the Granet Museum in Aix-en-Provence. Unlike the ambiguous situation of 2021 which saw several institutions put digital duplicates of their masterpieces on sale, it is now a matter of acquisitions of NFTs by museums, directly from artists or via their collectors.

- CryptoPunks #110 acquired by the Center Pompidou and

- CryptoPunks #3831 acquired by LACMA

The reluctance of auction houses regarding “on-chain” transactions is shared by museums, which are subject to strict regulations regarding the acquisition of works. The procedures they must follow sometimes conflict with the principles of transparency and decentralization of Web3. Public institutions therefore prefer for the moment to acquire “off-chain” works and avoid placing all their NFT artworks in a single wallet.

The Los Angeles County Museum of Art (LACMA), which received a donation of 22 NFTs in February 2023 from anonymous collector Cozomo de’ Medici, has only 8 pieces on its e-wallet. Several NFTs, like Fragments of an Infinite Field #972 by Monica Rizzolli, have not yet been delivered and are still on the Cozomo de’ Medici wallet. As for the famous CryptoPunk #3831, the work has been placed in an independent portfolio.

Official announcement of the 22 NFTs acquired by LACMA:

https://unframed.lacma.org/2023/02/24/new-acquisition-cozomo-de-medici-collection

LACMA Collection on Opensea:

https://opensea.io/0x9482B7FEF251Ebb81CeF01108c5512C27520003D

Fragments of an Infinite Field #972 de Monica Rizzolli :

https://opensea.io/assets/ethereum/0xa7d8d9ef8d8ce8992df33d8b8cf4aebabd5bd270/159000972

CryptoPunk #3831 by Larva Labs :

https://opensea.io/0x0f7f63BA74681EfC4eab9777a463E2aF45916EDf

Marcella Lista, Head Curator at the Centre Pompidou explains the procedure followed by the French museum to make its first NFT acquisitions:

“The Center Pompidou has opened a digital wallet exclusively dedicated to the reception and conservation of tokens, knowing that the files of the works have been uploaded in parallel to be stored on the conservation servers of the Pompidou Center as is the case with any digital work in the collection. The works were acquired via a classic acquisition and distribution authorization contract, following the museum’s usual practice, and were paid in euros.

“The various states of visibility of these works on NFT platforms and on the Pompidou Center database can be explained by the long contractualization procedure, their registration on our inventory, and their entry into the database. Works that have not yet appeared are being processed in this administrative, accounting and technical chain.”

The Centre Pompidou NFT collection on Opensea:

https://opensea.io/Centre_Pompidou_MNAM

CryptoPunk #110 from the Centre Pompidou:

https://cryptopunks.app/cryptopunks/details/110

6. A reassuring start to 2024

Auction houses Christie’s and Sotheby’s have started 2024 with one and two sales respectively dedicated to NFTs. Patrick Drahi’s company has already taken the lead this year, generating 92% of the segment’s turnover.

Sotheby’s sessions GRAILS: Starry Night and Natively Digital: An Ordinals Curated Sale totaled over $1 million each, with 19 and 18 lots sold respectively, and no unsold lots. One of the best results was hammered for Genesis Cat, for Taproot Wizards (2024) by digital artist FAR. It was generally believed that the NFT market was now focused on more ‘serious’ creations, but this off-beat work – reminiscent of CryptoKitties – fetched the best NFT result at the start of 2024: $254,000 versus an estimated range of $15,000 to $20,000 (January 22 at Sotheby’s in New York).

Auction results exceeding $100,000 for Satoshi Nakamoto, Xcopy, Beeple and Des Lucréce continue to show that the success of these digital artists is not just anecdotal. In 2024 we will probably see a consolidation of the prices of works by these key signatures on the NFT market. And the rising values of Bitcoin and Ethereum will no doubt contribute to this progression.

7. Top 50 Artists by NFT public auction turnover in 2023

1. Dmitri Cherniak (b. 1988): $7,880,898 (14 lots sold)

2. Tyler Hobbs (b. 1987): $4,919,950 (15 lots sold)

3. Larva Labs (b. 2005): $1,811,675 (9 lots sold)

4. Keith Haring (1958-1990): $1,587,600 (5 lots sold)

5. Snowfro (XX-XXI): $743,529 (3 lots sold)

6. Kjetil Golid (b. 1991): $453,390 (7 lots sold)

7. Refik Anadol (b.1985-): $386,796 (4 lots sold)

8. Shroomtoshi (XX-XXI): $342,900 (2 lots sold)

9. 0xDEAFBEEF (XX-XXI): $325,120 (3 lots sold)

10. Des Lucréce (xx-xxi): $289,599 (10 lots sold)

11. Xcopy (b. 1981): $254,000 (1 lot sold)

12. Six N. Five (b. 1985): $210,321 (1 lot sold)

13. Seerlight (b. 1993): $165,100 (2 lots sold)

14. Andrea Bonaceto (b. 1989): $157,947 (1 lot sold)

15. Jack Butcher (xx-xxi): $144,534 (4 lots sold)

16. Ripcache (XX-XXI): $121,611 (2 lots sold)

17. Deekay Kwon (b. 1989): $115,597 (1 lot sold)

18. Grant Riven Yun (xx-xxi): $107,100 (1 lot sold)

19. Beeple & Madonna (XX-XXI): $100,800 (1 lot sold)

20. luxpris (xx-xxi): $90,170 (4 lots sold)

21. Pindar Van Arman (b. 1974): $82,786 (3 lots sold)

22. Ryan Koopmans (b. 1986): $78,315 (2 lots sold)

23. Matt Deslauriers (XX-XXI): $62,611 (6 lots sold)

24. Hideki Tsukamoto (b. 1973): $62,230 (4 lots sold)

25. Helena Sarin (XX-XXI)$61,355 (3 lots sold)

26. Anyma (b. 1988): $54,658 (1 lot sold)

27. Terrell Jones (b. 1997): $54,052 (3 lots sold)

28. Jack Kaido (xx-xxi): $49,638 (2 lots sold)

29. Mad Dog Jones (b. 1985): $48,165 (1 lot sold)

30. Sam Spratt (XX-XXI): $48,165 (1 lot sold)

31. Alpha Centauri Kid (b. 1986): $45,139 (2 lots sold)

32. Elman Mansimov (XX-XXI): $41,314 (1 lot sold)

33. GMUNK (b. 1975): $38,559 (1 lot sold)

34. Sofia Crespo (b. 1991): $36,915 (2 lots sold)

35. Laura El (b. 1991): $35,645 (2 lots sold)

36. William Mapan (b. 1988): $34,984 (1 lot sold)

37. Pop Wonder (b. 1982): $34,925 (2 lots sold)

38. 0xdgb (XX-XXI)$33,020 (1 lot sold)

39. neurocolor (XX-XXI): $30,480 (2 lots sold)

40. omentejovem (XX-XXI): $30,462 (1 lot sold)

41. Casey Reas (b. 1972): $28,669 (3 lots sold)

42. Samantha Cavet (b. 1997): $28,389 (2 lots sold)

43. Bryan Brinkman (b. 1985): $28,236 (3 lots sold)

44. Luke Shannon (b. 2000): $27,988 (1 lot sold)

45. Isaac Wright (xx-xxi): $27,940 (1 lot sold)

46. Yatreda ያጥሬዳ (XXI): $27,543 (1 lot sold)

47. Ryan Talbot (b. 1997): $27,329 (1 lot sold)

48. Guido Di Salle (b. 1979): $26,308 (1 lot sold)

49. Tyler Hobbs & Dandelios Wist (xx-xxi): $25,400 (1 lot sold)

50. Carlos Marcial (b. 1984): $24,596 (1 lot sold)

Images:

Copyright 1987-2024 thierry Ehrmann www.artprice.com – www.artmarket.com

- Don’t hesitate to contact our Econometrics Department for your requirements regarding statistics and personalized studies: [email protected]

- Try our services (free demo): https://www.artprice.com/demo

- Subscribe to our services: https://www.artprice.com/subscription

Artmarket.com is listed on Eurolist by Euronext Paris, and Euroclear: 7478 – Bloomberg: PRC – Reuters: ARTF.

Discover Artmarket and its Artprice department on video: www.artprice.com/video

Artmarket and its Artprice department was founded in 1997 by its CEO, thierry Ehrmann. Artmarket and its Artprice department is controlled by Groupe Serveur, created in 1987.

See certified biography in Who’s who ©:

Artmarket is a global player in the Art Market with, among other structures, its Artprice department, world leader in the accumulation, management and exploitation of historical and current art market information (the original documentary archives, codex manuscripts, annotated books and auction catalogs acquired over the years ) in databanks containing over 30 million indices and auction results, covering more than 835,800 artists.

Artprice by Artmarket, the world leader in information on the art market, has set itself the ambition through its Global Standardized Marketplace to be the world’s leading Fine Art NFT platform.

Artprice Images® allows unlimited access to the largest Art Market image bank in the world: no less than 180 million digital images of photographs or engraved reproductions of artworks from 1700 to the present day, commented by our art historians.

Artmarket with its Artprice department accumulates data on a permanent basis from 7200 Auction Houses and produces key Art Market information for the main press and media agencies (7,200 publications). Its 7.2 million (‘members log in’+social media) users have access to ads posted by other members, a network that today represents the leading Global Standardized Marketplace® to buy and sell artworks at a fixed or bid price (auctions regulated by paragraphs 2 and 3 of Article L 321.3 of France’s Commercial Code).

The Art Market’s future is now brighter than ever with Artprice’s Artmarket® Intuitive AI

Artmarket, with its Artprice department, has twice been awarded the State label “Innovative Company” by the Public Investment Bank (BPI), which has supported the company in its project to consolidate its position as a global player in the art market.

Artprice by Artmarket’s Global Art Market Report, “The Art Market in 2023”, published in March 2024:

https://www.artprice.com/artprice-reports/the-art-market-in-2023

Artprice by Artmarket publishes its 2023 Contemporary Art Market Report:

https://www.artprice.com/artprice-reports/the-contemporary-art-market-report-2023

Index of press releases posted by Artmarket with its Artprice department:

https://serveur.serveur.com/artmarket/press-release/en/

Follow all the Art Market news in real time with Artmarket and its Artprice department on Facebook and Twitter:

www.facebook.com/artpricedotcom/ (over 6.5 million followers)

Discover the alchemy and universe of Artmarket and its artprice department https://www.artprice.com/video headquartered at the famous Organe Contemporary Art Museum “The Abode of Chaos” (dixit The New York Times): https://issuu.com/demeureduchaos/docs/demeureduchaos-abodeofchaos-opus-ix-1999-2013

La Demeure du Chaos / Abode of Chaos

GESAMTKUNSTWERK & SINGULAR ARCHITECTURE

Confidential bilingual work now public:

https://ftp1.serveur.com/abodeofchaos_singular_architecture.pdf

• L’Obs – The Museum of the Future: https://youtu.be/29LXBPJrs-o

• www.facebook.com/la.demeure.du.chaos.theabodeofchaos999 (over 4 million followers)

Contact Artmarket.com and its Artprice department – Contact: Thierry Ehrmann, [email protected]

Logo – https://mma.prnewswire.com/media/2260897/Artmarket_logo.jpg

Blockchain Press Releases

Bybit Surpasses 70 Million Users, Reinforces Commitment to Transparency and Institutional Growth

DUBAI, UAE, May 9, 2025 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, today announced it has surpassed 70 million registered users, a milestone that highlights the platform’s sustained global growth and deepening trust among both retail and institutional clients. This achievement underscores Bybit’s robust market presence and its steadfast commitment to security, compliance, and product innovation.

“Reaching 70 million users is more than a number—it’s a testament to the trust our global community places in us,” said Ben Zhou, co-founder and CEO of Bybit. “We are doubling down on compliance, institutional-grade infrastructure, and user-centric innovation to ensure everyone—from first-time traders to global institutions—can access the future of finance with confidence.”

Strengthening Global Compliance and Regulatory Engagement

Bybit continues to expand its global compliance framework, working closely with regulators around the world. Most recently, Bybit held strategic discussions with Vietnam’s Ministry of Finance, contributing to the country’s regulatory sandbox initiative by sharing expertise in KYC, AML, and international best practices.

Bybit has also made key progress in major jurisdictions, including the United Arab Emirates, further demonstrating its commitment to regulatory alignment and operational transparency.

Accelerating Institutional Growth

Bybit is seeing rapid growth among institutional clients, driven by high-performance trading infrastructure, advanced risk controls, and strategic partnerships. The integration with Zodia Custody—a leading provider of institutional-grade custody and off-venue settlement solutions—reflects Bybit’s ongoing efforts to meet the needs of sophisticated investors with robust, compliant offerings.

Pioneering Web3 Integration and Real-World Utility

Bybit continues to lead in practical Web3 innovation. The Bybit Card, now used by nearly 2 million people, enables everyday crypto spending, while Bybit Pay streamlines on-chain and off-chain transactions for both users and merchants.

In line with its user-first philosophy, Bybit is also leveraging artificial intelligence to enhance trading, research, and support services. CryptoLens, an in-house AI analytics tool, offers users deep insights into token fundamentals, community activity, social trends, and tokenomics—even for projects not listed on the platform. TradeGPT, an AI agent trained on Bybit’s proprietary data, delivers rapid price action summaries and technical analysis, helping traders make smarter decisions. Complementing these innovations, an AI Support Agent enhances customer service by improving response efficiency and user experience across the platform.

Bridging Traditional Finance and the Future of Digital Assets

Bybit remains committed to its role as #TheCryptoArk—a safe, trusted bridge from traditional finance into the world of Web3. Through intuitive products, regulatory collaboration, and cutting-edge technology, Bybit empowers users of all levels to navigate and thrive in the digital asset ecosystem.

“We’re building the infrastructure for the next era of finance,” Ben added. “By championing regulation, professionalism, and a relentless user-first approach, we’re shaping a safer, more inclusive, and more empowering financial future for all.”

#Bybit / #TheCryptoArk

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 70 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open, and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: [email protected]

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Logo – https://mma.prnewswire.com/media/2267288/Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/bybit-surpasses-70-million-users-reinforces-commitment-to-transparency-and-institutional-growth-302451104.html

View original content:https://www.prnewswire.co.uk/news-releases/bybit-surpasses-70-million-users-reinforces-commitment-to-transparency-and-institutional-growth-302451104.html

Blockchain Press Releases

Unleashing the Power of Futures Combo Bots on Bybit: Leveling up Futures Trading with More Rewards

DUBAI, UAE, May 9, 2025 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, Futures Combo Carnival, a month-long trading event rewarding both new and experienced Futures Combo traders with multiple rewards tracks. Trading thresholds start at 300 USDT with rewards of up to 500 USDT in prizes weekly.

The largest Futures Combo campaign on Bybit to date, the Carnival gives traders even more reasons to make their futures trading journey hassle-free and more rewarding. Bot-enabled automated trading is becoming the norm among strategic traders in a turbulent market, where no traders can afford manmade mistakes or delays in execution.

Bybit’s Futures Combo Bot is a powerful tool for streamlining users’ futures trading experience, empowering them to build portfolios and rebalance positions across multiple futures contracts. The innovative solution allows traders to set up a Bot within minutes, minimizing manual management of complex trading strategies, and achieving both efficiency and flexibility when managing combos of futures contracts.

From now to Jun. 9, 2025, eligible Bybit users may take part in two events with a welcome bonus for first-time users:

- The Combo Battle offers newcomers who achieve a trading volume of 300 USDT an immediate 5 USDT Bot Bonus on a first-come, first-served basis, while experienced traders can earn lucky draw tickets by reaching volume milestones of 1,000 USDT and 2,500 USDT respectively using Bybit’s Futures Combo Bot.

- The Combo Challenge invites Mandarin-speaking Key Opinion Leaders to create and share their trading strategies on social media using the hashtag #ComboChallenge, with three weekly winners receiving 500 USDT each.

Bybit is committed to making futures trading more accessible to users looking to diversify their trading strategies. With rewards designed for both newcomers and experienced traders, this event strengthens community engagement while supporting users wherever they are on their trading journey. For more details and terms and conditions, users may visit: Bybit Futures Combo Carnival

#Bybit / #TheCryptoArk

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: [email protected]

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Logo – https://mma.prnewswire.com/media/2267288/Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/unleashing-the-power-of-futures-combo-bots-on-bybit-leveling-up-futures-trading-with-more-rewards-302451105.html

View original content:https://www.prnewswire.co.uk/news-releases/unleashing-the-power-of-futures-combo-bots-on-bybit-leveling-up-futures-trading-with-more-rewards-302451105.html

Blockchain Press Releases

Bybit Unifies Loan Products to Enhance Capital Efficiency for Crypto Traders

DUBAI, UAE, May 9, 2025 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, is enhancing the user experience and capital efficiency of its lending products by integrating Crypto Loans (flexible loans) and Fixed Rate Loans into a single, streamlined interface.

The integration introduces a unified platform for both loan types, enabling users to compare, manage, and optimize their borrowing strategies with greater ease. All loan products are now accessible under the Crypto Loans page, with a redesigned layout that prioritizes usability and transparency.

“Our goal is to simplify how users interact with our lending products while enhancing their capital flexibility,” said Emily Bao, Head of Spot at Bybit. “By consolidating management tools and aligning risk models, we’re giving our users more control and clarity over their borrowing activity.”

Key upgrades include:

- Unified Cross Margin Model: Both flexible and fixed-term loans will now operate under a shared cross-margin system, allowing users to benefit from consolidated Loan-to-Value (LTV) ratios — set at 80% (initial), 85% (margin call), and 92% (liquidation).

- Shared Collateral: Collateral can now be used interchangeably across both loan types, enabling more agile capital deployment.

- Tiered Collateral Ratios: All supported assets will follow a tiered collateral system, reflecting each asset’s risk profile — consistent with the structure previously applied to Fixed Rate Loans.

- Updated Interest Calculation: Interest will be calculated hourly using a compounding method: total debt (principal + accrued interest) multiplied by the hourly interest rate.

Existing loan orders will remain unaffected, continuing under their original terms and conditions. For users seeking further information, detailed guides on both Fixed Rate Loans and Crypto Loans are available via the Bybit Help Center.

This strategic move reaffirms Bybit’s commitment to innovation and user empowerment in the evolving digital asset economy.

#Bybit / #TheCryptoArk

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: [email protected]

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Photo – https://mma.prnewswire.com/media/2683407/Bybit_Unifies_Loan_Products_Enhance_Capital_Efficiency_Crypto_Traders.jpg

Logo – https://mma.prnewswire.com/media/2267288/5310253/Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/bybit-unifies-loan-products-to-enhance-capital-efficiency-for-crypto-traders-302451043.html

View original content:https://www.prnewswire.co.uk/news-releases/bybit-unifies-loan-products-to-enhance-capital-efficiency-for-crypto-traders-302451043.html

-

Blockchain Press Releases3 days ago

Blockchain Press Releases3 days agoHTX Premieres USD1 Stablecoin Globally, Partnering with World Liberty Financial to Forge a New Era of Decentralized Economy

-

Blockchain6 days ago

Blockchain6 days agoUnitedStaking.com Launches Advanced Crypto Staking Platform with Global Reach and Real-World Impact

-

Blockchain2 days ago

Colb Asset SA Raises $7.3 Million in Oversubscribed Round to Bring Pre-IPO Giants to Blockchain

-

Blockchain Press Releases3 days ago

Blockchain Press Releases3 days agoJuCoin made a global impact at TOKEN2049 Dubai, advancing its ecosystem with the “Peak Experience” vision and JuChain’s robust tech.

-

Blockchain2 days ago

Blockchain2 days agoBlocks & Headlines: Today in Blockchain – May 7, 2025 | Coinbase, Riot Games, Curve DAO, Litecoin, AR.IO

-

Blockchain Press Releases2 days ago

Blockchain Press Releases2 days agoGRVT Launches Biggest Ever Trading Competition for Retail Traders, Offering Up to 175,000 USDT in Prizes

-

Blockchain4 days ago

Blockchain4 days agoBlocks & Headlines: Today in Blockchain – May 5, 2025 – Arkham, Blockchair, Worldcoin, Maldives

-

Blockchain Press Releases2 days ago

Blockchain Press Releases2 days agoCango Inc. Maintains Strong Mining Efficiency and Expands Bitcoin Holdings Amidst April Production Shift