Blockchain Press Releases

Artmarket.com: Artprice looks at 2023’s NFT auction market, and the 50 most successful digital artists, a promising future with the record for cryptocurrencies in ETFs on Wall Street

PARIS, March 12, 2024 /PRNewswire/ — The year 2023 started with the first acquisitions of NFTs by museums and ended with another bull run on the stock markets and the main cryptocurrencies.

The major event in cryptocurrencies is notably BlackRock’s (the largest asset manager in the world) and Fidelity’s introduction of ETFs directly invested in Bitcoin (Bitcoin spot ETFs) authorized by the SEC on 11 January 2024. This is a real consecration for Bitcoin which on 11 March 2024 was quoted at around 72,000 dollars, while Ethereum was at $4,000 (ETH ETFs are expected very soon).

BlackRock and Fidelity have achieved the best ETF launches in 30 years thanks to Bitcoin. In their first month of trading, the “IBIT” and “FBTC” funds raised $6.5 billion, which is more than any of the 5,500 other index funds launched before them (according to Les Échos of 10 January 2024: “Bitcoin ETF: the SEC opens the doors of Wall Street wide to Bitcoin”.

This is a new record for Bitcoin. Of the 5,535 ETFs launched over the last thirty years, none have gotten off to such a strong start as BlackRock’s ‘IBIT’ and Fidelity’s ‘FBTC’, said Bloomberg expert Eric Balchunas.

This Monday, March 11, 2024, a Bloomberg report (by Tom Metcalf & Emily Nicolle) announces “The London Stock Exchange said it will start accepting applications for the admission of exchange traded notes backed by Bitcoin and Ether” in the second quarter, confirming London as the capital of cryptocurrencies on the European continent.

This allows retail and professional investors to gain exposure to the largest cryptocurrency by market capitalization, without having to directly hold the asset.

Via cryptocurrencies, new collectors and art enthusiasts have been attracted to the art market, often younger than their predecessors. Not averse to speculation and the excitement of taking risks, these art enthusiasts and collectors solidly welded to their crypto-universe of Web 3.0.

The near future of Artprice by Artmarket is the meeting place between Web 3.0. (Metaverse and NFT) and Artprice’s artificial intelligence, its Intuitive Artmarket ® AI.

The 2023 period in NFT auctions, significantly less speculative than the two previous years, allowed Digital Art to finally settle peacefully in the international cultural and economic environment. As the NFT market consolidates, Artprice draws up a summary of the transactions on NFTs hammered in auction rooms in 2023, dominated by Sotheby’s, but which finished with Christie’s “Next Wave” sale on the sidelines of the Art Basel Miami Beach fair.

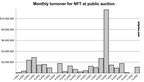

Monthly evolution of proceeds from public NFT auctions

Infographic – https://mma.prnewswire.com/media/2360542/NFT_auctions_1_Infographic.jpg

“Artprice by Artmarket.com recognizes in Digital Art – whether via NFTs or Artificial Intelligence – a revolution that it would be infinitely better to support and accompany than to reject or denigrate“, affirms thierry Ehrmann, CEO of Artmarket.com and Founder of Artprice.

“Artprice subscriptions will soon be able to be paid in ETH and BTC, and our databases have already been adapted to accommodate these two cryptocurrencies. We are very proud to support digital artists with the opening of our Standardized Marketplace to NFTs. Furthermore, we acquired and presented the works Flow (2023) by digital artist Josh Pierce on the cover of our latest Annual Report of the Contemporary Art Market in 2023 and the NFT work Chaos under the pure light by artist 1dontknows for our Annual 2023 Art Market report published in 2024.”

Annual Report of the Contemporary Art Market in 2023:

https://imgpublic.artprice.com/pdf/le-marche-de-lart-contemporain-2023.pdf

https://imgpublic.artprice.com/pdf/the-contemporary-art-market-report-2023.pdf

Annual 2023 Art Market report published in 2024:

https://imgpublic.artprice.com/pdf/le-marche-de-lart-en-2023.pdf

https://imgpublic.artprice.com/pdf/the-art-market-in-2023.pdf

This NFT paradigm shift is well explained in the ARTE documentary, recently released in 5 languages: “NFT, Chaos in the art world”

https://www.youtube.com/watch?v=_08d_1oY-Lo

Throughout this documentary, thierry Ehrmann, visual artist, NFT artist and Founding CEO of Artprice.com, delivers his analysis accompanied by other artists, experts and international players in the world of Art NFTs.

Any attempt to understand the significance of NFTs in Art History requires an appreciation of the digital and cultural revolution that they represent and some kind of prediction regarding their role and impact over the short and medium term.

According to thierry Ehrmann “In its various annual reports on the Art Market and the regulated information it publishes as a listed company, Artprice by Artmarket.com has always said with regard to NFTs that it is impossible to apprehend this new market without a true understanding of Blockchain, crypto-currencies and their cultural origins among the Cypherpunks (period of PGP-type data encryption at the beginning of the 1990s).”

Bearing in mind all the underlying parameters and data required, Artprice by Artmarket is the only organization on the global art market to be able to truly respond to the certification of primary issues of Art NFTs in an environment of cryptocurrencies and major international currencies.

In 2024, Artprice will be uniquely positioned in its capacity as a certifier of primary issues of Art NFTs based on the fact that Artprice by Artmarket has been the Global Leader in Art Market Information for more than 27 years and is the creator and owner of its globally recognized databases. It also has the world’s largest documentary collection of art market notes, manuscripts, codices and annotated sales catalogs from 1700 to the present day, which act as a guarantee of the authenticity and historical veracity of its databases.

1. Auctions of NFTs in 2023: key figures

– 350 lots sold

– 53 unsold lots (13% of lots)

– 32 sales sessions dedicated to or including NFTs

– 259 distinct artists

– $22.7 million in turnover (including fees)

– +65% growth compared with 2022

– 0.2% of global fine art turnover

– $1.9 million worth of NFTs sold per month on average

– 6 active auction houses

– 82% of the turnover generated by Sotheby’s ($18.4 million)

– $10.9 million total from “Grails: Property from an Iconic Digital Art Collection Part II” sale at Sotheby’s on 15 June 2023

– Minimum price: $126 for Ghost Sphynx (2023) by Asa Jarju

– Average price: $64,800

– Maximum price: $6.2 million for Ringers #879 (The Goose) (2021) by Dmitri Cherniak

https://www.artprice.com/artist/1091079/asa-jarju/nft/31233678/ghost-sphynx

https://www.artprice.com/artist/1023654/dmitri-cherniak/nft/30581409/ringers-879-the-goose

Distribution of public auctions of NFT by price range and by auction house

Infographic – https://mma.prnewswire.com/media/2360541/NFT_auctions_2_Infographic.jpg

2. Seven-digit auction results and other exceptional sales

In 2023, the seven best results of the year in the NFT category were hammered for Generative Art. This self-generating and random artistic approach is at the heart of the history of NFTs, notably with the controversial Profile Pictures (PFP) series such as the Bored Apes and the CryptoKitties. However, these series have now left their place at the forefront of the Generative scene to the abstract works created by artists like Dmitri Cherniak and Tyler Hobbs. Indeed, the series Autoglyph by Larva Labs now fetches higher prices than their CryptoPunks which made the artist duo famous.

Among the most anticipated pieces last year at auction, five digital creations created by Keith Haring at the end of the 1980s were put on sale at Christie’s in September 2023 by the Keith Haring Foundation. In the form of five unique NFTs (#1/1), these experiments were carried out on the first computers equipped with digital creation software a few years after those conducted by Andy Warhol. All the works found buyers at prices between $250,000 and $350,000.

https://onlineonly.christies.com/s/keith-haring-pixel-pioneer/lots/3479?sc_lang=en

Top 20 results for NFT works sold at auction in 2023

1. Dmitri Cherniak (b. 1988) – Ringers #879 (The Goose) (2021): $6,215,100

2. Tyler Hobbs (b. 1987) – fidenza #725 (2021): $1,016,000

3. Snowfro (XX-XXI) – Chromie Squiggle #1780 (2021): $635,000

4. Tyler Hobbs (b. 1987) – Fidenza #479 (2021): $622,300

5. Tyler Hobbs (b. 1987) – fidenza #216 (2021): $609,600

6. Larva Labs (b. 2005) – Autoglyph #187 (2019): $571,500

7. Tyler Hobbs (b. 1987) – fidenza #724 (2021): $442,170

8. Keith Haring (1958-1990) – Untitled (April 14, 1987) (1987): $352,800

9. Keith Haring (1958-1990) – Untitled #1 (April 16, 1987) (1987): $352,800

10. Keith Haring (1958-1990) – untitled #2 (April 16, 1987) (1987): $352,800

11. Kjetil Golid (b. 1991) – Archetype #397 (2021): $330,200

12. Larva Labs (b. 2005) – autoglyph #218 (2019): $330,200

13. Tyler Hobbs (b. 1987) – Fidenza #290 (2021): $279,400

14. Tyler Hobbs (b. 1987) – Fidenza #871 (2021): $279,400

15. Keith Haring (1958-1990) – untitled (feb 2, 1987) (1987): $277,200

16. XCOPY (b. 1981) – Loading New Conflict… Redux 6 (2018): $254,000

17. Larva Labs (b. 2005) – CryptoPunk#4153 (2017): $254,000

18. Keith Haring (1958-1990) – untitled (Feb 3, 1987) (1987): $252,000

19. Tyler Hobbs (b. 1987) – Fidenza #370 (2021): $241,300

20. Tyler Hobbs (b. 1987) – Fidenza #861 (2021): $241,300

3. Both in auction rooms and on the Metaverse

Sotheby’s now stands out as the most active auction house on the NFT market, regularly hosting sessions dedicated to this new medium. On 15 June 2023, Part II of its sale Grails: Property from an Iconic Digital Art Collection totaled $10.9 million in New York. But apart from these sales dedicated to NFTs, Sotheby’s now also includes NFTs in general sessions: at its day sale of Contemporary Art on 19 May 2023 in New York, Tyler Hobbs’ Fidenza #725 (2021) fetched over a million dollars (including fees), against an estimated range of $120,000 – $180,000.

https://www.artprice.com/artist/1062390/tyler-hobbs/nft/30222588/fidenza-725

Under Patrick Drahi’s leadership, Sotheby’s has also deployed a brand new platform called Metaverse, entirely dedicated to Web3: https://metaverse.sothebys.com. In 2023, it hosted the sale of 5,000 photographs by Sebastião Salgado in the form of NFTs, then a session entitled Snow Crash curated by artist Tony Sheeder, and lastly, a sale of 500 unique works generated by the pioneer Vera Molnar (who sadly passed away shortly after on 7 December 2023).

The projects carried out by Sotheby’s on its Metaverse platform, however, deviate somewhat from public sales in terms of transparency and communication of results and are undoubtedly more similar to private sales. Several important NFT works are still visible today on the sothebys-grails.eth wallet and are – according to Michael Bouhanna (VP, Contemporary Art Specialist & Head of Digital Art and NFTs at Sotheby’s) – available for private sale:

CryptoPunk #6669:

https://opensea.io/assets/ethereum/0xb47e3cd837ddf8e4c57f05d70ab865de6e193bbb/6669

Fidenza #526:

https://opensea.io/assets/ethereum/0xa7d8d9ef8d8ce8992df33d8b8cf4aebabd5bd270/78000526

Bored Ape #8552:

https://opensea.io/assets/ethereum/0xbc4ca0eda7647a8ab7c2061c2e118a18a936f13d/8552

4. ‘On-chain’ versus ‘off-chain’ transactions

The majority of NFT artworks publicly auctioned by Sotheby’s have so far gone through its main website, not through its Metaverse, and the transactions have therefore taken place outside the Blockchain. In other words, they were concluded “off-chain”; the hammer prices do not appear in the history of the NFT, where only a double transfer of ownership of the work is visible: from the seller’s portfolio (of the artist or collector) to that of Sotheby’s, and then from Sotheby’s to the buyer’s wallet, once payment is complete.

These “off-chain” transactions allow the auction house to maintain greater control over the transactions, in particular to collect payment before transferring the work to its new owner. This allows Sotheby’s to collect a commission by adding the usual fees. For its part, Christie’s, which carries out “on-chain” transactions via its Christie’s 3.0 platform https://nft.christies.com, does without a commission. Its FAQ specifies that “ Christie’s 3.0 does not add Buyer’s Premium to the hammer price” and that “You will need to pay a gas fee when you place a bid and, if applicable, when you pay sales tax and collect your NFT, Gas fees are not included in the final purchase price”. But these gas fees only concern the operating costs of the Blockchain and are not collected by the auction house.

5. The entry of NFTs into museum collections

The year 2023 saw the first acquisitions of NFTs by several museums, starting with the most prestigious, the LACMA, the MoMA, the Pompidou Center, and the Granet Museum in Aix-en-Provence. Unlike the ambiguous situation of 2021 which saw several institutions put digital duplicates of their masterpieces on sale, it is now a matter of acquisitions of NFTs by museums, directly from artists or via their collectors.

- CryptoPunks #110 acquired by the Center Pompidou and

- CryptoPunks #3831 acquired by LACMA

The reluctance of auction houses regarding “on-chain” transactions is shared by museums, which are subject to strict regulations regarding the acquisition of works. The procedures they must follow sometimes conflict with the principles of transparency and decentralization of Web3. Public institutions therefore prefer for the moment to acquire “off-chain” works and avoid placing all their NFT artworks in a single wallet.

The Los Angeles County Museum of Art (LACMA), which received a donation of 22 NFTs in February 2023 from anonymous collector Cozomo de’ Medici, has only 8 pieces on its e-wallet. Several NFTs, like Fragments of an Infinite Field #972 by Monica Rizzolli, have not yet been delivered and are still on the Cozomo de’ Medici wallet. As for the famous CryptoPunk #3831, the work has been placed in an independent portfolio.

Official announcement of the 22 NFTs acquired by LACMA:

https://unframed.lacma.org/2023/02/24/new-acquisition-cozomo-de-medici-collection

LACMA Collection on Opensea:

https://opensea.io/0x9482B7FEF251Ebb81CeF01108c5512C27520003D

Fragments of an Infinite Field #972 de Monica Rizzolli :

https://opensea.io/assets/ethereum/0xa7d8d9ef8d8ce8992df33d8b8cf4aebabd5bd270/159000972

CryptoPunk #3831 by Larva Labs :

https://opensea.io/0x0f7f63BA74681EfC4eab9777a463E2aF45916EDf

Marcella Lista, Head Curator at the Centre Pompidou explains the procedure followed by the French museum to make its first NFT acquisitions:

“The Center Pompidou has opened a digital wallet exclusively dedicated to the reception and conservation of tokens, knowing that the files of the works have been uploaded in parallel to be stored on the conservation servers of the Pompidou Center as is the case with any digital work in the collection. The works were acquired via a classic acquisition and distribution authorization contract, following the museum’s usual practice, and were paid in euros.

“The various states of visibility of these works on NFT platforms and on the Pompidou Center database can be explained by the long contractualization procedure, their registration on our inventory, and their entry into the database. Works that have not yet appeared are being processed in this administrative, accounting and technical chain.”

The Centre Pompidou NFT collection on Opensea:

https://opensea.io/Centre_Pompidou_MNAM

CryptoPunk #110 from the Centre Pompidou:

https://cryptopunks.app/cryptopunks/details/110

6. A reassuring start to 2024

Auction houses Christie’s and Sotheby’s have started 2024 with one and two sales respectively dedicated to NFTs. Patrick Drahi’s company has already taken the lead this year, generating 92% of the segment’s turnover.

Sotheby’s sessions GRAILS: Starry Night and Natively Digital: An Ordinals Curated Sale totaled over $1 million each, with 19 and 18 lots sold respectively, and no unsold lots. One of the best results was hammered for Genesis Cat, for Taproot Wizards (2024) by digital artist FAR. It was generally believed that the NFT market was now focused on more ‘serious’ creations, but this off-beat work – reminiscent of CryptoKitties – fetched the best NFT result at the start of 2024: $254,000 versus an estimated range of $15,000 to $20,000 (January 22 at Sotheby’s in New York).

Auction results exceeding $100,000 for Satoshi Nakamoto, Xcopy, Beeple and Des Lucréce continue to show that the success of these digital artists is not just anecdotal. In 2024 we will probably see a consolidation of the prices of works by these key signatures on the NFT market. And the rising values of Bitcoin and Ethereum will no doubt contribute to this progression.

7. Top 50 Artists by NFT public auction turnover in 2023

1. Dmitri Cherniak (b. 1988): $7,880,898 (14 lots sold)

2. Tyler Hobbs (b. 1987): $4,919,950 (15 lots sold)

3. Larva Labs (b. 2005): $1,811,675 (9 lots sold)

4. Keith Haring (1958-1990): $1,587,600 (5 lots sold)

5. Snowfro (XX-XXI): $743,529 (3 lots sold)

6. Kjetil Golid (b. 1991): $453,390 (7 lots sold)

7. Refik Anadol (b.1985-): $386,796 (4 lots sold)

8. Shroomtoshi (XX-XXI): $342,900 (2 lots sold)

9. 0xDEAFBEEF (XX-XXI): $325,120 (3 lots sold)

10. Des Lucréce (xx-xxi): $289,599 (10 lots sold)

11. Xcopy (b. 1981): $254,000 (1 lot sold)

12. Six N. Five (b. 1985): $210,321 (1 lot sold)

13. Seerlight (b. 1993): $165,100 (2 lots sold)

14. Andrea Bonaceto (b. 1989): $157,947 (1 lot sold)

15. Jack Butcher (xx-xxi): $144,534 (4 lots sold)

16. Ripcache (XX-XXI): $121,611 (2 lots sold)

17. Deekay Kwon (b. 1989): $115,597 (1 lot sold)

18. Grant Riven Yun (xx-xxi): $107,100 (1 lot sold)

19. Beeple & Madonna (XX-XXI): $100,800 (1 lot sold)

20. luxpris (xx-xxi): $90,170 (4 lots sold)

21. Pindar Van Arman (b. 1974): $82,786 (3 lots sold)

22. Ryan Koopmans (b. 1986): $78,315 (2 lots sold)

23. Matt Deslauriers (XX-XXI): $62,611 (6 lots sold)

24. Hideki Tsukamoto (b. 1973): $62,230 (4 lots sold)

25. Helena Sarin (XX-XXI)$61,355 (3 lots sold)

26. Anyma (b. 1988): $54,658 (1 lot sold)

27. Terrell Jones (b. 1997): $54,052 (3 lots sold)

28. Jack Kaido (xx-xxi): $49,638 (2 lots sold)

29. Mad Dog Jones (b. 1985): $48,165 (1 lot sold)

30. Sam Spratt (XX-XXI): $48,165 (1 lot sold)

31. Alpha Centauri Kid (b. 1986): $45,139 (2 lots sold)

32. Elman Mansimov (XX-XXI): $41,314 (1 lot sold)

33. GMUNK (b. 1975): $38,559 (1 lot sold)

34. Sofia Crespo (b. 1991): $36,915 (2 lots sold)

35. Laura El (b. 1991): $35,645 (2 lots sold)

36. William Mapan (b. 1988): $34,984 (1 lot sold)

37. Pop Wonder (b. 1982): $34,925 (2 lots sold)

38. 0xdgb (XX-XXI)$33,020 (1 lot sold)

39. neurocolor (XX-XXI): $30,480 (2 lots sold)

40. omentejovem (XX-XXI): $30,462 (1 lot sold)

41. Casey Reas (b. 1972): $28,669 (3 lots sold)

42. Samantha Cavet (b. 1997): $28,389 (2 lots sold)

43. Bryan Brinkman (b. 1985): $28,236 (3 lots sold)

44. Luke Shannon (b. 2000): $27,988 (1 lot sold)

45. Isaac Wright (xx-xxi): $27,940 (1 lot sold)

46. Yatreda ያጥሬዳ (XXI): $27,543 (1 lot sold)

47. Ryan Talbot (b. 1997): $27,329 (1 lot sold)

48. Guido Di Salle (b. 1979): $26,308 (1 lot sold)

49. Tyler Hobbs & Dandelios Wist (xx-xxi): $25,400 (1 lot sold)

50. Carlos Marcial (b. 1984): $24,596 (1 lot sold)

Images:

Copyright 1987-2024 thierry Ehrmann www.artprice.com – www.artmarket.com

- Don’t hesitate to contact our Econometrics Department for your requirements regarding statistics and personalized studies: [email protected]

- Try our services (free demo): https://www.artprice.com/demo

- Subscribe to our services: https://www.artprice.com/subscription

Artmarket.com is listed on Eurolist by Euronext Paris, and Euroclear: 7478 – Bloomberg: PRC – Reuters: ARTF.

Discover Artmarket and its Artprice department on video: www.artprice.com/video

Artmarket and its Artprice department was founded in 1997 by its CEO, thierry Ehrmann. Artmarket and its Artprice department is controlled by Groupe Serveur, created in 1987.

See certified biography in Who’s who ©:

Artmarket is a global player in the Art Market with, among other structures, its Artprice department, world leader in the accumulation, management and exploitation of historical and current art market information (the original documentary archives, codex manuscripts, annotated books and auction catalogs acquired over the years ) in databanks containing over 30 million indices and auction results, covering more than 835,800 artists.

Artprice by Artmarket, the world leader in information on the art market, has set itself the ambition through its Global Standardized Marketplace to be the world’s leading Fine Art NFT platform.

Artprice Images® allows unlimited access to the largest Art Market image bank in the world: no less than 180 million digital images of photographs or engraved reproductions of artworks from 1700 to the present day, commented by our art historians.

Artmarket with its Artprice department accumulates data on a permanent basis from 7200 Auction Houses and produces key Art Market information for the main press and media agencies (7,200 publications). Its 7.2 million (‘members log in’+social media) users have access to ads posted by other members, a network that today represents the leading Global Standardized Marketplace® to buy and sell artworks at a fixed or bid price (auctions regulated by paragraphs 2 and 3 of Article L 321.3 of France’s Commercial Code).

The Art Market’s future is now brighter than ever with Artprice’s Artmarket® Intuitive AI

Artmarket, with its Artprice department, has twice been awarded the State label “Innovative Company” by the Public Investment Bank (BPI), which has supported the company in its project to consolidate its position as a global player in the art market.

Artprice by Artmarket’s Global Art Market Report, “The Art Market in 2023”, published in March 2024:

https://www.artprice.com/artprice-reports/the-art-market-in-2023

Artprice by Artmarket publishes its 2023 Contemporary Art Market Report:

https://www.artprice.com/artprice-reports/the-contemporary-art-market-report-2023

Index of press releases posted by Artmarket with its Artprice department:

https://serveur.serveur.com/artmarket/press-release/en/

Follow all the Art Market news in real time with Artmarket and its Artprice department on Facebook and Twitter:

www.facebook.com/artpricedotcom/ (over 6.5 million followers)

Discover the alchemy and universe of Artmarket and its artprice department https://www.artprice.com/video headquartered at the famous Organe Contemporary Art Museum “The Abode of Chaos” (dixit The New York Times): https://issuu.com/demeureduchaos/docs/demeureduchaos-abodeofchaos-opus-ix-1999-2013

La Demeure du Chaos / Abode of Chaos

GESAMTKUNSTWERK & SINGULAR ARCHITECTURE

Confidential bilingual work now public:

https://ftp1.serveur.com/abodeofchaos_singular_architecture.pdf

• L’Obs – The Museum of the Future: https://youtu.be/29LXBPJrs-o

• www.facebook.com/la.demeure.du.chaos.theabodeofchaos999 (over 4 million followers)

Contact Artmarket.com and its Artprice department – Contact: Thierry Ehrmann, [email protected]

Logo – https://mma.prnewswire.com/media/2260897/Artmarket_logo.jpg

Blockchain Press Releases

Bybit P2P: Three Ways to Win Rewards for Block Traders

DUBAI, UAE, May 9, 2025 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, is pleased to renew its 10,000 USDT giveaway for P2P block trading users. The fresh round of Bybit P2P Block Trade Giveaway starts on May 8 until July 11, 2025 and comes with three tasks for specific user groups.

Exclusive on Bybit P2P, eligible users may register for the event, start their block trading journey, or become a P2P advertiser to unlock three prize pools.

Event period: May 8, 2025, 8AM UTC – Jul. 11, 2025, 11:59PM UTC

- New Users Exclusive: The first 20 new users will get to claim 175 USDT instantly by completing their first block trade.

- Existing Users: Users who trade 20,000 USDT or more in Block Trade (except existing Block Trade Advertisers) will get to share in a 3,500 USDT prize pool, with up to 100 USDT each in prizes up for grabs.

- Block Trade Advertisers Exclusive: A 3,000 USDT prize pool is reserved for Block Trade Advertisers—the first 20 eligible Block Trade Advertisers stand to earn 150 USDT when they trade at least 50,000 USDT.

Bybit’s P2P Block Trading platform enables private transactions of substantial volumes through Bybit’s intuitive interface. Customized for large digital asset purchases sales, the service streamlines regular order placements into a single order for bulk transactions, minimizing slippage and typically offering reduced fees on top of Bybit’s enterprise-grade security.

The marketplace presents earning potential for users with diverse cryptoholdings. With generous transaction limits ranging from 10,000 to 200,000 USDT per order, Bybit P2P Block Trading serves as a reliable solution for traders looking to scale up their P2P trading.

Rewards are on a first-come, first-served basis. Restrictions apply. For the detailed terms and conditions, users may visit: Bybit P2P Block Trade

#Bybit / #TheCryptoArk

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: [email protected]

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Photo – https://mma.prnewswire.com/media/2683373/Bybit_P2P_Three_Ways_Win_Rewards_Block_Traders.jpg

Logo – https://mma.prnewswire.com/media/2267288/Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/bybit-p2p-three-ways-to-win-rewards-for-block-traders-302450952.html

View original content:https://www.prnewswire.co.uk/news-releases/bybit-p2p-three-ways-to-win-rewards-for-block-traders-302450952.html

Blockchain

Blocks & Headlines: Today in Blockchain – May 9, 2025 | Robinhood, Solana, Tether, China, Women in Web3

Today’s blockchain landscape pulses with innovation, expansion and strategic jockeying. From established trading platforms laying the groundwork for international tokenized US asset markets to fresh efforts empowering women in Web3, the industry is evolving at frantic pace. Solana-based tokenization pathways, China’s state-driven blockchain masterplan and Tether’s push onto new Layer-1 rails further underscore diversification. In this daily op-ed, we unpack five major developments—examining what they mean for DeFi growth, NFT marketplaces, regulatory contours and the ongoing quest for greater inclusivity in crypto.

1. Robinhood’s European Blockchain Trading Ambitions

News Summary

Robinhood Markets Inc. is reportedly constructing its own blockchain infrastructure to facilitate trading of U.S. equities and other assets in European markets. Insiders suggest the project seeks to leverage distributed-ledger technology for settlement efficiency, near-real-time clearing and reduced reliance on legacy central counterparties. The move signals Robinhood’s ambition to transcend its domestic brokerage roots and capture European retail and institutional order flow.

Key Details

-

Infrastructure Build: A private, permissioned ledger governed by Robinhood and selected counterparties.

-

Asset Scope: U.S. equities, ETFs and potentially tokenized debt instruments.

-

Regulatory Interface: Engagements with the U.K. Financial Conduct Authority (FCA) and European Securities and Markets Authority (ESMA) to align on custody and market-making rules.

-

Timeline: Internal pilots slated for Q4 2025, with public rollout in mid-2026.

Analysis & Opinion

Robinhood’s pivot underscores a broader industry trend: exchanges and brokerages striving to “own the rails” rather than simply interface with existing clearinghouses. By internalizing settlement on a bespoke blockchain, Robinhood hopes to slash settlement times from T+2 to near-instant, a boon for liquidity providers and high-frequency traders. However, risks include the complexity of cross-border regulatory compliance and the operational challenge of maintaining robust on-chain and off-chain reconciliations.

From a DeFi convergence standpoint, Robinhood’s ledger could bridge traditional and decentralized finance, enabling tokenized margin lending and programmable corporate actions directly on-chain. Should Robinhood open permission to DeFi protocols, we may witness new hybrid liquidity pools that blend CEX order books with AMM liquidity. This would mark a milestone in mainstream DeFi adoption—and potentially pressure incumbents like Nasdaq to innovate their own on-chain settlement layers.

Source: Bloomberg

2. Women in Web3: Cultivating Greater Gender Diversity

News Summary

A recent deep-dive from Cointelegraph spotlights the persistent gender gap in blockchain and crypto. Despite Web3’s ethos of decentralization, women represent less than 20 percent of crypto investors and under 10 percent of core development teams. The article outlines initiatives—from targeted grants and incubation programs to mentorship networks—aimed at lowering barriers and attracting more female talent.

Key Details

-

Current Statistics: Women account for approximately 17 percent of crypto traders globally; in development, the share dips below 8 percent.

-

Notable Initiatives:

-

Women in Blockchain Fund: USD 50 million allocated for early-stage female founders.

-

Global Web3 Sisters Network: Mentorship platform pairing novices with veteran executives.

-

University Partnerships: Scholarships for women studying blockchain engineering and cryptography.

-

Analysis & Opinion

Web3’s promise of equal-opportunity innovation rings hollow if half the population remains sidelined. Heightened grant funding and mentorship can help, but systemic change requires cultural shifts within DAOs, core teams and investor circles. Projects and protocols must adopt policies—like blind code reviews, diversity hiring quotas and inclusive governance frameworks—to ensure sustainable participation.

Moreover, as the industry grapples with regulatory scrutiny, diverse leadership can foster better risk management and community trust. Women leaders have often been at the forefront of compliance, ethics and consumer protection—even in traditional finance—qualities sorely needed in crypto’s maturing phase. Token projects that embed gender-diverse advisory boards may see stronger reputational profiles and wider community buy-in.

Source: Cointelegraph

3. SOL Strategies: Tokenizing Shares on Solana

News Summary

SOL Strategies, a financial-services startup, is exploring a pathway to tokenize private and publicly traded shares on the Solana blockchain. Their recently filed whitepaper proposes a framework where equity is represented as SPL tokens, enabling fractional ownership, 24/7 trading and programmable dividend distributions.

Key Details

-

Token Standard: Extension of Solana Program Library (SPL) with “Equity Token” schema.

-

Custody Model: Licensed custodian holds underlying shares; token holders have legal claim via smart-contract link.

-

Compliance Layer: On-chain KYC/AML middleware to restrict token transfers to approved wallets.

-

Pilot Partners: Early engagements with two mid-cap European tech firms eyeing capital-raising via tokenization.

Analysis & Opinion

Tokenized equity stands to revolutionize capital markets by lowering minimum investment thresholds and unlocking global liquidity. On Solana, with its sub-second finality and low fees, fractional shares could trade seamlessly—outpacing Ethereum’s scalability challenges. Yet the critical hurdle lies in regulatory acceptance: will securities regulators view these tokens as bona fide equity or as unregistered securities?

SOL Strategies’ integrated custody approach could mollify regulators, replicating existing T+2 standards while enabling T+0 settlement on-chain. Should they secure regulatory sandbox approvals in the U.K. or Singapore, other blockchains—like Stellar and Polkadot—may race to develop similar tokenization toolkits. For DeFi protocols, tokenized equities could become collateral in lending pools, further intertwining traditional and decentralized finance.

Source: Newsfile Corp.

4. China’s Blockchain Playbook: Infrastructure, Influence & New Frontiers

News Summary

The Center for Strategic and International Studies (CSIS) published an extensive analysis of China’s state-driven blockchain strategy. Beyond its digital yuan rollout, Beijing is investing in cross-border infrastructure, influencing global standards bodies and forging Belt and Road blockchain corridors across Asia, Africa and Latin America.

Key Details

-

Key Initiatives:

-

BSN 2.0: Blueprint for national and international consortium chains.

-

International Standards: Active lobbying in ISO/TC 307 for governance models favoring state-actors.

-

Tech Diplomacy: Blockchain MOUs with Pakistan, Indonesia and several African union members.

-

-

Strategic Goals: Extend digital yuan acceptance, export Chinese ledger tech, shape global governance.

Analysis & Opinion

China’s multi-pronged approach signals blockchain’s emergence as a theater of geopolitical competition. By undercutting SWIFT dependency and offering turnkey consortium-chain solutions, Beijing enhances its financial influence in Belt and Road countries. Western governments and multinationals must navigate this blockchain bifurcation—between open public rails and permissioned state-backed consortia.

For crypto projects, the CSIS report offers both caution and opportunity. While the digital yuan may corner state-aligned corridors, decentralized networks remain resilient by design. Projects focusing on interoperability—such as Polkadot bridges and Cosmos IBC—can link fragmented chains and preserve open value transfer. Investors should monitor on-chain metrics in emerging markets, as Chinese-backed consortium chains gain traction in cross-border trade finance.

Source: CSIS

5. Tether Expands Stablecoin Reach to 196 Million Users via Kaia

News Summary

Tether has launched USDT on the Kaia blockchain, bringing its flagship stablecoin to Kaia’s user base of approximately 196 million. Kaia, a burgeoning Layer-1 optimized for high-throughput mobile applications, opens new corridors for USDT in gaming, remittances and micro-trading in emerging markets.

Key Details

-

Technical Integration: USDT issued as a native Kaia token, supported by Tether’s reserve-backing audit framework.

-

User Impact: Near-zero fees for micro-transactions; sub-second confirmation times even on mobile networks.

-

Partnership Scope: Integration with Kaia’s wallet SDK and gaming marketplace; joint launch of an educational DApp for fiat-on-ramp literacy.

Analysis & Opinion

By deploying on Kaia, Tether diversifies its blockchain footprint beyond Ethereum, Tron and Solana, underscoring a multi-chain thesis for stablecoin ubiquity. Emerging-market users—often plagued by volatile local currencies—stand to benefit immensely from a mobile-first, low-cost remittance rail. Moreover, Kaia’s developer incentives may spawn DeFi lending dApps collateralized by USDT, fueling localized credit markets.

Yet healthy competition among blockchains for stablecoin volume could concentrate risk: reserve transparency, network stability and regulatory compliance will differentiate winners. Tether’s public attestations and reserve audits are critical, but as US regulators intensify scrutiny on stablecoin giants, projects deploying on smaller chains may face fresh legal complexities around money-transmission licensing.

Source: Bitcoin.com

Conclusion & Key Takeaways

-

Institutional On-ramp Acceleration: Robinhood’s European chain signals major brokerages view blockchain as core infrastructure—not mere gadget.

-

Inclusivity Imperative: Women’s underrepresentation remains a blindspot; targeted grants and cultural reforms are needed for equal Web3 participation.

-

Tokenization Tide: Solana’s high-speed rails may host the next wave of equity tokens, bridging capital markets and DeFi.

-

Geopolitical Battlegrounds: China’s consortium chains and digital-yuan corridors illustrate how blockchain is reshaping global influence.

-

Stablecoin Multichain Strategy: Tether’s Kaia integration reflects the logic of diversifying rails to reach underserved, mobile-first users.

As blockchain advances, the interplay between technological innovation, regulatory frameworks and social inclusion will define whether the next chapter of crypto fulfills its vision of open, equitable finance—or replicates old hierarchies in digital garb. Today’s headlines underscore that the path forward lies in cross-chain interoperability, proactive policy-shaping, and a relentless focus on broadening the community that stewards and benefits from these transformative networks.

The post Blocks & Headlines: Today in Blockchain – May 9, 2025 | Robinhood, Solana, Tether, China, Women in Web3 appeared first on News, Events, Advertising Options.

Blockchain Press Releases

MEXC Lists USD1, Accelerating Global Stablecoin Innovation with World Liberty Financial

VICTORIA, Seychelles, May 8, 2025 /PRNewswire/ — MEXC, a leading global cryptocurrency exchange, announced that it will list World Liberty Financial USD (USD1) in the Innovation Zone on May 9, 2025 (UTC). The USD1/USDT trading pair will also open at 08:00 on May 8, 2025 (UTC), and the MEXC Convert feature will be available from 09:00 on May 8, 2025 (UTC), offering users a seamless asset conversion experience. This listing expands the range of digital assets on the platform and further demonstrates MEXC’s commitment to advancing the global stablecoin ecosystem.

USD1: A New Era in Stablecoins and Financial Transparency

USD1 is World Liberty Financial (WLFI)’s stablecoin that provides secure and transparent digital asset services for global users. The stablecoin is backed 1:1 by the US dollar, with its reserve assets custodied by BitGo, held and subject to regular audits by third-party accounting firms to ensure transparency and stability. Currently, USD1 is deployed on both Ethereum and BNB Chain, with plans to expand to additional blockchains in the future to enhance interoperability.

Furthermore, USD1 has made significant strides in the decentralized finance (DeFi) ecosystem. For example, ListaDAO has launched a USD1 lending vault on BNB Chain, providing liquidity support for 20 million USD1. Renowned market maker DWF Labs has also deployed USD1 liquidity across multiple platforms, further enhancing its availability and market depth. According to the data from CoinMarketCap, USD1’s market capitalization has surpassed USD 2.12 billion, demonstrating strong market demand.

Special Promotion to Celebrate the Listing

To celebrate the successful listing of USD1, MEXC is launching a series of special offers to thank its users for their support. Starting May 8, 2025, at 08:00 (UTC), users can enjoy the following benefits:

- Zero Trading Fees: The USD1/USDT spot trading pair will have 0 trading fees.

- Zero Withdrawal Fees: Users will enjoy 0 withdrawal fees when withdrawing USD1.

MEXC Drives the Evolution of Stablecoins Through Ecosystem Empowerment

As a leading global cryptocurrency exchange, MEXC has earned the trust of 36 million users across 170+ countries worldwide, thanks to its fast token listing process, diverse asset offerings, deep liquidity, and robust security. At the same time, MEXC continues to empower quality projects and partners, actively promoting the healthy development of the global digital asset and stablecoin ecosystem.

Looking Ahead: A Shared Vision for the Future of Stablecoins

MEXC’s listing partnership with World Liberty Financial further drives innovation in the development of stablecoins. Looking ahead, MEXC will continue to strengthen its support for stablecoin projects, promoting the widespread adoption of stablecoins globally. At the same time, the platform will keep iterating its products and services to provide users with a more secure and seamless trading experience.

About MEXC

Founded in 2018, MEXC is committed to being “Your Easiest Way to Crypto.” Serving over 36 million users across 170+ countries, MEXC is known for its broad selection of trending tokens, everyday airdrop opportunities, and low trading fees. Our user-friendly platform is designed to support both new traders and experienced investors, offering secure and efficient access to digital assets. MEXC prioritizes simplicity and innovation, making crypto trading more accessible and rewarding.

MEXC Official Website| X | Telegram |How to Sign Up on MEXC

Risk Disclaimer:

The information provided in this article regarding cryptocurrencies does not constitute investment advice. Given the highly volatile nature of the cryptocurrency market, investors are encouraged to carefully assess market fluctuations, the fundamentals of projects, and potential financial risks before making any trading decisions.

Photo – https://mma.prnewswire.com/media/2682552/1920×1080.jpg

Logo – https://mma.prnewswire.com/media/2668118/MEXC_new_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/mexc-lists-usd1-accelerating-global-stablecoin-innovation-with-world-liberty-financial-302450296.html

View original content:https://www.prnewswire.co.uk/news-releases/mexc-lists-usd1-accelerating-global-stablecoin-innovation-with-world-liberty-financial-302450296.html

-

Blockchain7 days ago

HODL 2025: Blockchain’s Brightest Minds. All in Dubai

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days agoInterlace Debuts at Token2049 to Accelerate Web2-Web3 Integration Across MENA

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days agoFrom Exchange to Ecosystem Builder: MEXC Celebrates 7th Anniversary at TOKEN2049 Dubai with $300M Ecosystem Development Fund Launch

-

Blockchain Press Releases3 days ago

Blockchain Press Releases3 days agoHTX Premieres USD1 Stablecoin Globally, Partnering with World Liberty Financial to Forge a New Era of Decentralized Economy

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days agoBybit and St. Paul American Scholars School Furthers Partnership Commitment in Bybit’s HQ Visit

-

Blockchain6 days ago

Blockchain6 days agoUnitedStaking.com Launches Advanced Crypto Staking Platform with Global Reach and Real-World Impact

-

Blockchain Press Releases3 days ago

Blockchain Press Releases3 days agoJuCoin made a global impact at TOKEN2049 Dubai, advancing its ecosystem with the “Peak Experience” vision and JuChain’s robust tech.

-

Blockchain2 days ago

Colb Asset SA Raises $7.3 Million in Oversubscribed Round to Bring Pre-IPO Giants to Blockchain