Blockchain

BIT Mining Limited Announces Unaudited Financial Results for the Third Quarter ended September 30, 2021

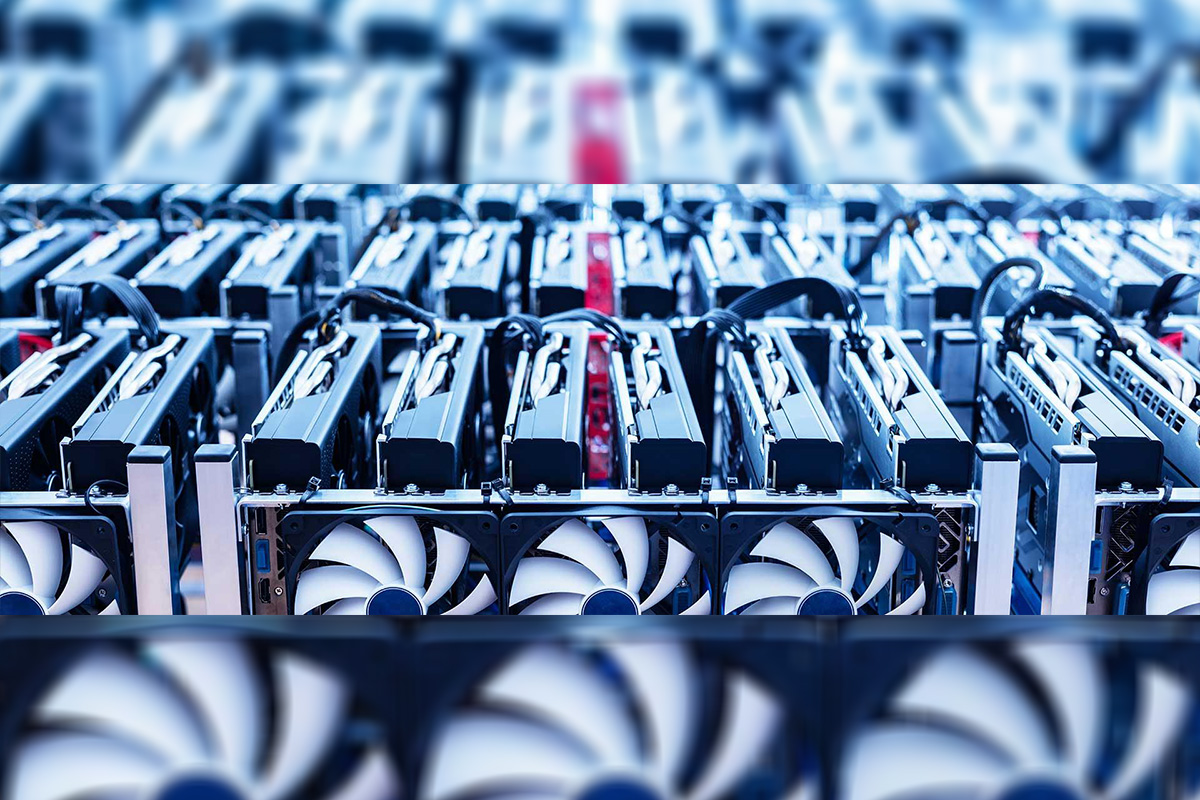

BIT Mining Limited (NYSE: BTCM) (“BIT Mining,” “the Company,” “we,” “us,” or “our company”), a leading technology-driven cryptocurrency mining company, today reported its unaudited financial results for the third quarter ended September 30, 2021.

Cryptocurrency Business Progress

BIT Mining has completed the transition of its business to an enterprise that covers cryptocurrency mining, data center operation and mining pool. The Company has adopted a development strategy to focus on the migration and expansion of cryptocurrency mining operations globally.

The Company has commenced ethereum mining operations with a theoretical maximum total hash rate capacity of 3,451 GH/s deployed as of today. Ethereum mining machines with a total theoretical maximum hash rate capacity of 4,800 GH/s are expected to be deployed by the end of November 2021. For the three months ended September 30, 2021, we produced 779 ethereum from our ethereum cryptocurrency mining operations, and recognized revenue of approximately US$2.5 million. As of today, we produced 52 ethereum per day, and have produced 2,300 ethereum in aggregate. Based on the current total network hash rate of ethereum and price1 of ethereum, we expect to produce approximately 80 ethereum per day theoretically, starting in December 2021. Based on the current ethereum price1 of US$4,279, and the current bitcoin price1 of US$60,366, we expect to produce approximately 2,400 ethereum monthly, which are equivalent to approximately 170 bitcoin and worth approximately US$10.3 million in aggregate.

As of today, the theoretical maximum total hash rate capacity of our bitcoin mining machines is approximately 800 PH/s. To increase the cost efficiency of its mining business, the Company sold some low-end mining machines with a total hash rate capacity of 610.7 PH/s. As of today, we have completed the migration of all of our bitcoin mining machines to the U.S. and Kazakhstan. In the U.S., we have bitcoin mining machines with a total hash rate capacity of 507.3 PH/s, of which 119.7 PH/s have been deployed in data centers and the remainder have been fine-tuned and are waiting to be deployed. In Kazakhstan, we have bitcoin mining machines with a total hash rate capacity of 292.7 PH/s, of which109.4 PH/s have been deployed in data centers and the remainder have been fine-tuned and are waiting to be deployed. For the three months ended September 30, 2021, we produced 79 bitcoins from our cryptocurrency mining business, and recognized revenue of approximately US$3.4 million.

In terms of our data center business, in September 2021 we entered into a Membership Interest Purchase Agreement and certain other auxiliary agreements (the “Ohio Mining Site Agreements”) with Viking Data Centers, LLC (“Viking Data Centers”) to jointly invest in the development of a cryptocurrency mining data center in Ohio (the “Ohio Mining Site”) with power capacity of up to 85 megawatts. In October 2021, we increased our investment in the Ohio Mining Site and brought its total planned power capacity up to 150 megawatts. We currently expect to complete the Ohio Mining Site in March 2022. As of today, we have finished the construction of plant and substantion of power capacity of 50 megawatts, of which 11 megawatts has started to operate. We are also constructing new data centers in Hong Kong and Kazakhstan. The new data center in Hong Kong, with a maximum processing capacity of approximately 1.4 megawatts, has been operational since October 2021. Moreover, we will construct and operate a data center in Kazakhstan which is located in Uralsk region of West Kazakhstan with a maximum processing capacity of approximately 40 megawatts, which is expected to be completed in the first quarter of 2022.

On October 14, 2021, the Company announced that its mining pool subsidiary, BTC.com, would completely exit the China market, cease registering new users from China and start to retire accounts of existing users from China. Due to BTC.com’s discontinuation of service to users in China, the Company expects to see a decrease of 10% to 20% in revenues for the three months ending December 31, 2021. The Company is working on solutions with its existing users in China, such as migrating such users’ mining machines to overseas markets, so that they may have access to our services in a compliant manner. In addition, the Company expects that its continued growth in international markets will help offset the loss of business in China. For the three months ended September 30, 2021, the mining pool business generated revenue of approximately US$397.8 million.

Removal of VIE Structure and Disposal of Chinese Lottery Business

We previously conducted a lottery business in China through a series of contractual arrangements with the lottery business-related VIEs. In July 2021, the Company announced its decision to dispose of its Chinese lottery-related business and the Company terminated all of its lottery business-related VIE contracts for nil consideration and recognized a disposal loss of US$6.7 million. The lottery business-related VIE subsidiaries were deconsolidated and their financial results were not included in the Company’s financial results in the third quarter of 2021 as a result of eliminating the VIE structure. The condensed consolidated statements of comprehensive loss for the three months ended September 30, 2021, June 30, 2021 and September 30, 2020 have been reclassified to reflect the disposal of the VIE subsidiaries’ business segment as a discontinued operation.

Termination of the Online Lottery Business in Europe

The Company is in the process of terminating its online lottery business in Europe being operated under The Multi Group (“TMG”), which the Company acquired in July 2017. We expect to terminate all business operations under the Malta e-Gaming license by the end of November 2021, all business operations under the Sweden e-Gaming license by the end of December 2021, and all business operations under the Curacao e-Gaming license by the end of January 2022. The termination of TMG’s online lottery business in Europe is expected to be completed in the first quarter of 2022. TMG contributed US$0.6 million, or 0.1%, of the Company’s total revenue and net loss of US$0.2 million for the three months ended September 30, 2021. Due to the expansion of the Company’s cryptocurrency mining business, the Company does not expect the termination of its online lottery business in Europe to have a material impact on its operational results or financial position.

Conversion of Reporting Currency

Starting from the third quarter of 2021, the Company has changed its reporting currency from the Renminbi (“RMB”) to the U.S. Dollar (“USD”), to reduce the impact of increased volatility of the USD to RMB exchange rate on the Company’s reported operating results. The alignment of the reporting currency with underlying operations will better depict the Company’s results of operations for each period. The related financial statements prior to July 1, 2021 have been recast to USD as if the financial statements originally had been presented in USD since the earliest periods presented.

“We are glad to announce our third quarter 2021 financial results, as we continue to execute our strategy to create value within the cryptocurrency ecosystem,” said Mr. Xianfeng Yang, CEO of BIT Mining. “Over the past six months we completed the migration of our mining machines to overseas markets and have made significant progress in the construction of our US data centers, which provide critical operational efficiencies for our business. Additionally, we saw the potential value ethereum has as the fundamental currency for applications such as nonfungible tokens (NFTs), decentralized finance (DeFi), and the metaverse. We foresaw the growth of ethereum mining as a result and have deployed massive ethereum computing power in advance which have generated relatively positive returns. Looking forward, we plan to continue to enhance our value proposition and strengthen our technology on mining techniques.”

1 The ethereum price is based on the price on November 18, 2021, at UTC 0:00, published on https://coinmarketcap.com;the bitcoin price is based on the average of the prices on November 18, 2021, at UTC 0:00, published on https://www.bitfinex.com and https://www.bitstamp.net.

Third Quarter 2021 Highlights for Continuing Operations

- Revenues were US$404.3 million in the third quarter of 2021, representing a decrease of US$40.6 million from US$444.9 million for the second quarter of 2021, and a sharp increase of US$403.8 million from US$0.5 million for the third quarter of 2020. Revenues during the third quarter of 2021 primarily consisted of US$397.8 million in revenue contribution from our mining pool business that we consolidated from April 2021.

- Operating loss was US$35.0 million in the third quarter of 2021, representing an increase of US$20.1 million from US$14.9 million for the second quarter of 2021, and an increase of US$30.1 million from US$4.9 million for the third quarter of 2020. The increase in operating loss was mainly due to a migration that resulted in the decrease of the revenue and the impairment of cryptocurrencies.

- Non-GAAP operating loss2 was US$22.7 million in the third quarter of 2021, as compared with non-GAAP operating income of US$1.8 million for the second quarter of 2021, and non-GAAP operating loss of US$3.1 million for the third quarter of 2020.

- Net loss attributable to BIT Mining was US$29.6 million in the third quarter of 2021, as compared with net loss attributable to BIT Mining of US$14.5 million for the second quarter of 2021, and net loss attributable to BIT Mining of US$4.5 million for the third quarter of 2020.

- Non-GAAP net loss2 attributable to BIT Mining was US$17.3 million in the third quarter of 2021, as compared with non-GAAP net income attributable to BIT Mining of US$2.2 million for the second quarter of 2021, and non-GAAP net loss attributable to BIT Mining of US$2.7 million for the third quarter of 2020.

- Basic and diluted loss per American Depositary Share (“ADS”) attributable to BIT Mining Limited for the third quarter of 2021 were US$0.43.

- Non-GAAP basic and diluted loss per ADS2 attributable to BIT Mining Limited for the third quarter of 2021 were US$0.25.

2 Non-GAAP financial measures exclude the impact of share-based compensation expenses, impairment of property and equipment, impairment of cryptocurrencies, net gain or loss on disposal of cryptocurrencies and changes in fair value of derivative instrument. Reconciliations of non-GAAP financial measures to U.S. GAAP financial measures are set forth in the table at the end of this release.

Third Quarter 2021 Financial Results for Continuing Operations

Revenues

Revenues were US$404.3 million for the third quarter of 2021, representing a sharp increase of US$403.8 million from US$0.5 million for the third quarter of 2020 and a decrease of US$40.6 million from US$444.9 million for the second quarter of 2021. The year-over-year increase was mainly attributable to our mining pool business that we consolidated from April 2021. The sequential decrease was mainly attributable to a decrease of US$11.4 million in data center business due to the suspension of data centers in Sichuan, China and a decrease of US$25.4 million in revenues from the mining pool business. Revenues were mainly comprised of revenues from the mining pool business of US$397.8 million and the cryptocurrency mining business of US$5.9 million.

Operating Costs and Expenses

Operating costs and expenses were US$425.5 million for the third quarter of 2021, representing an increase of US$420.1 million from US$5.4 million for the third quarter of 2020, and a decrease of US$17.3 million or 3.9% from US$442.8 million for the second quarter of 2021. The year-over-year increase was mainly due to a significant increase of US$406.3 million in cost for the allocation to pool participants associated with the mining pool business and an increase of US$6.2 million in depreciation and amortization expense. The sequential decrease was mainly due to a decrease of US$8.6 million in service expense associated with data center business and a decrease of US$8.5 million in cost for the allocation to pool participants associated with the mining pool business, which was partially offset by an increase of US$3.0 million in share-based compensation expenses associated with share options granted to the Company’s directors and employees.

Cost of revenue was US$416.1 million for the third quarter of 2021, representing an increase of US$415.7 million from US$0.4 million for the third quarter of 2020, and a decrease of US$19.5 million or 4.5% from US$435.6 million for the second quarter of 2021. The year-over-year increase was mainly attributable to a significant increase of US$406.3 million in cost for the allocation to pool participants associated with the mining pool business and an increase of US$6.2 million in depreciation and amortization expense. The sequential decrease was mainly due to a decrease of US$8.6 million in service expense associated with data center business and a decrease of US$8.5 million in cost for the allocation to pool participants associated with the mining pool business. Cost of revenue was comprised of the direct cost of revenue of US$409.0 million and depreciation and amortization of US$7.1 million. The direct cost of revenue mainly included direct costs relating to the mining pool business of US$406.3 million and the cryptocurrency mining business of US$1.3 million.

Sales and marketing expenses were US$0.2 million for the third quarter of 2021, representing a decrease of US$0.2 million or 50.0% from US$0.4 million for the third quarter of 2020, and a decrease of US$0.1 million or 33.3% from US$0.3 million for the second quarter of 2021.

General and administrative expenses were US$8.1 million for the third quarter of 2021, representing an increase of US$4.2 million or 107.7% from US$3.9 million for the third quarter of 2020, and an increase of US$2.0 million or 32.8% from US$6.1 million for the second quarter of 2021. The year-over-year increase was mainly due to an increase of US$2.3 million in consulting expenses and an increase of US$1.2 million in expenses for employees mainly due to consolidations of Loto Interactive Limited and the mining pool business. The sequential increase was mainly due to an increase of US$2.0 million in share-based compensation expenses associated with share options granted to the Company’s directors and employees.

Service development expenses were US$1.1 million for the third quarter of 2021, representing an increase of US$0.5 million or 83.3% from US$0.6 million for the third quarter of 2020, and an increase of US$0.3 million or 37.5% from US$0.8 million for the second quarter of 2021.

Net Gain (Loss) on Disposal of Cryptocurrencies

Net gain on disposal of cryptocurrencies was US$11.2 million for the third quarter of 2021, related to the increasing market prices for cryptocurrencies by using first-in-first-out (“FIFO”) to calculate the cost of disposition during the third quarter of 2021. Net loss on disposal of cryptocurrencies was US$8.6 million for the second quarter of 2021 and there was no such net loss or gain for the third quarter of 2020. The sequential change was mainly due to the general increasing trend of market prices for cryptocurrencies.

Impairment of Cryptocurrencies

Impairment of cryptocurrencies was US$13.6 million for the third quarter of 2021, representing an increase of US$4.7 million from US$8.9 million for the second quarter of 2021, mainly due to impairment provided for cryptocurrency assets held in mining pool business, including cryptocurrencies payable to pool participants as a result of the price fluctuation of cryptocurrencies. There was no such impairment for the third quarter of 2020.

Impairment of Property and Equipment

Impairment of property and equipment was US$9.8 million for the third quarter of 2021, mainly due to the closure and demolition of big data centers in Sichuan, China.

Operating Loss

Operating loss was US$35.0 million for the third quarter of 2021, compared with operating loss of US$4.9 million for the third quarter of 2020, and operating loss of US$14.9 million for the second quarter of 2021.

Non-GAAP operating loss was US$22.7 million for the third quarter of 2021, compared with non-GAAP operating loss of US$3.1 million for the third quarter of 2020, and non-GAAP operating income of US$1.8 million for the second quarter of 2021. The year-over-year increase in non-GAAP operating loss was mainly due to increases in revenue and costs of revenue for the mining pool business as mentioned above. The sequential increase in non-GAAP operating loss was mainly due to the decrease in revenue of the mining pool business for the third quarter of 2021 and the suspension of data center business in China since June 2021.

Net Loss Attributable to BIT Mining

Net loss attributable to BIT Mining was US$29.6 million for the third quarter of 2021, compared with net loss attributable to BIT Mining of US$4.5 million for the third quarter of 2020, and net loss attributable to BIT Mining of US$14.5 million for the second quarter of 2021.

Non-GAAP net loss attributable to BIT Mining was US$17.3 million for the third quarter of 2021, compared with non-GAAP net loss attributable to BIT Mining of US$2.7 million for the third quarter of 2020, and non-GAAP net income attributable to BIT Mining of US$2.2 million for the second quarter of 2021. The year-over-year increase in non-GAAP operating loss was mainly due to the inclusion of revenue and the costs of revenue for the mining pool business as mentioned above. The sequential increase in non-GAAP operating loss was mainly due to the decrease in revenue of the mining pool business for the third quarter of 2021 and the suspension of data center business in China from June 2021.

Third Quarter 2021 Financial Results for Discontinued Operations

Net Loss from Discontinued Operations, Net of Taxes

Net loss from discontinued operations, net of taxes was US$6.7 million for the third quarter of 2021, compared with net loss from discontinued operations, net of taxes of US$1.8 million for the third quarter of 2020, and net loss from discontinued operations, net of taxes of US$0.9 million for the second quarter of 2021. The year-over-year increase and the sequential increase are results from an increase of US$6.7 million in disposal loss from discontinued operations, net of taxes. The Company disposed of its Chinese lottery-related business and terminated all of its lottery business-related VIE contracts in July 2021. The comparative financial information for the three months ended June 30, 2021 and September 30, 2020 have been reclassified to reflect the disposal of VIE subsidiaries as a discontinued operation.

Cash and Cash Equivalents and Restricted Cash

As of September 30, 2021, the Company had cash and cash equivalents of US$34.4 million and restricted cash3 of US$0.2 million, compared with cash and cash equivalents of US$10.1 million and restricted cash of US$44.1 million as of June 30, 2021.

Cryptocurrency Assets

As of September 30, 2021, the Company had cryptocurrency assets of US$56.8 million, the equivalent of 860 bitcoins, 2,024 ethereum, and various other cryptocurrency assets, including those of the mining pool business from April 2021 and those generated from the cryptocurrency mining business initiated at the end of February 2021.

3 Restricted cash represent deposits in merchant banks yet to be withdrawn.

Blockchain

Alpha Transform Holdings Releases March Report on ASC AI Index

Blockchain

Elizabeth Warren Urges Treasury Secretary Yellen to Implement Strong AML/CFT Measures for Stablecoins

In a recent communication directed to Treasury Secretary Janet Yellen, US Senator Elizabeth Warren has strongly advocated for the incorporation of robust Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT) measures specifically tailored for stablecoins. Senator Warren’s correspondence underscores the critical importance of adopting the full array of AML tools outlined by the Treasury Department in a prior November 2023 communication to Congress.

Senator Warren has underscored the burgeoning threat posed by cryptocurrencies, particularly stablecoins, to national security. She has specifically drawn attention to instances where entities like Iran and Hamas have turned to cryptocurrencies as a means to raise funds and support terrorist activities. To effectively address this evolving threat landscape, Senator Warren asserts that any forthcoming crypto legislation must encompass comprehensive AML/CFT authorities as requested by the Treasury Department.

Moreover, Senator Warren has made reference to the testimony provided by Deputy Secretary Adewale O. ‘Wally’ Adeyemo before the Senate Committee on Banking, Housing, and Urban Affairs. In this testimony, Adeyemo emphasized the critical need for additional AML authorities to combat the growing menace posed by cryptocurrencies. Senator Warren has pointed out that the exclusion of crucial actors within the digital asset ecosystem, such as miners and validators, from AML/CFT requirements could potentially enable nefarious actors to exploit the increased crypto trading facilitated by stablecoin legislation.

Senator Warren’s steadfast stance on the regulation and oversight of cryptocurrencies is aligned with her prior efforts aimed at curbing illicit activities and safeguarding consumers, the financial system, and national security interests. She has persistently advocated for the closure of loopholes in AML regulations that allow sanctioned entities like Iran to derive revenue through crypto transactions. Furthermore, Senator Warren has consistently voiced concerns regarding the exploitation of cryptocurrencies in terrorist financing schemes and has called for the implementation of stronger regulatory frameworks to protect both consumers and national security interests within the realm of stablecoin-related legislation.

Source: blockchain.news

The post Elizabeth Warren Urges Treasury Secretary Yellen to Implement Strong AML/CFT Measures for Stablecoins appeared first on HIPTHER Alerts.

Blockchain

Binance Launches Megadrop: A Token Launch Platform with Airdrops and Web3 Quests

Binance has rolled out Binance Megadrop, a novel token launch platform that blends airdrops with Web3 quests. This platform enables users to engage in BNB Locked Products subscriptions and complete tasks within their Web3 Wallet to earn early rewards from chosen Web3 projects, even before their tokens hit the Binance Exchange.

The inaugural project featured on Binance Megadrop is BounceBit (BB), a BTC restaking chain. Here are the token specifics for BounceBit: Max Token Supply: 2,100,000,000 BB, Megadrop Token Rewards: 168,000,000 BB (8% of max token supply), Initial Circulating Supply: 409,500,000 BB (19.5% of max token supply).

To kickstart their journey with Binance Megadrop, users must log into their Binance account and ensure they possess an active Binance Web3 Wallet. From there, they can subscribe to BNB Locked Products and/or fulfill Web3 Quests to accumulate scores. These scores dictate the rewards received through the Megadrop program.

The scoring mechanism for Megadrop relies on the Locked BNB Score, determined by the quantity of BNB subscribed and the subscription period’s duration. Users also earn a Web3 Quest Bonus and a Web3 Quest Multiplier upon completion of designated Web3 Quests. The total score is computed by applying the Web3 Quest Multiplier to the Locked BNB Score and adding the Web3 Quest Bonus.

Importantly, only wallets created within the Binance Web3 Wallet and not external wallets will count towards Megadrop participation. Megadrop rewards will be airdropped to users’ Binance Spot Wallets.

Users must undergo identity verification and maintain at least one active Binance Web3 Wallet to qualify for Megadrop rewards. Additionally, certain jurisdiction-based eligibility criteria apply. Users from Australia, Canada, Cuba, Crimea Region, Hong Kong, Iran, Japan, New Zealand, Netherlands, North Korea, Russia, Singapore, Syria, United Kingdom, United States of America, and its territories are presently ineligible to participate in BB Megadrop.

Binance Megadrop is aimed at offering users an interactive and rewarding experience within the crypto realm. Further details regarding the Megadrop amount, Web3 Quests, and the comprehensive listing plan will be disclosed separately.

Source: blockchain.news

The post Binance Launches Megadrop: A Token Launch Platform with Airdrops and Web3 Quests appeared first on HIPTHER Alerts.

-

Blockchain7 days ago

THXLAB and IZUTSUYA Announce Strategic Partnership

-

Blockchain3 days ago

Open-Source Intelligence (OSINT) Market is expected to reach a revenue of USD 64.9 Bn by 2033, at 25.6% CAGR: Dimension Market Research

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days agoBitget to Take Center Stage at Blockchain Life and Token2049 Dubai

-

Blockchain Press Releases2 days ago

Blockchain Press Releases2 days agoBybit and Franck Muller Partner with Sidus Heroes to Launch Cosmic Gears: A Pioneering Web3 Game with a $250,000 Prize Pool and Exclusive Watch Collection

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days agoBitrue Gears Up for 2024 Bitcoin Halving with Trading Competition

-

Blockchain2 days ago

Blockchain2 days agoBlockchain Transforming Travel: Quantum Temple’s Innovative Venture

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days agoaelf Leads the Fusion of AI and Blockchain to Shape the Future of Technology

-

Blockchain2 days ago

Blockchain2 days agoEvolution of the Blockchain World: Doric Blockchain Drives Education and Adoption of Blockchain Technology and Tokenization in Latin America