Blockchain

CONFIDENTIAL CREATIVE AND NC LABS ANNOUNCE ANIMATED SERIES, “BLOCKCHAIN BUDDIES” — PIONEERING DECENTRALIZED ENTERTAINMENT WITH A LINE OF INTERACTIVE NFT PROJECTS

Confidential Creative has partnered with NC Labs to produce an animated NFT project called “Blockchain Buddies,” the first in a line of original intellectual properties under a soon to be announced decentralized entertainment studio. The project will be a first of its kind interactive animated project, with NFT holding community members empowered to shape the future of the creative universe.

Confidential Creative is co-founded by Andrew Seth Cohen and Ryan Kieffer. NC Labs is co-founded by serial entrepreneurs Francisco Lopes, Harrison Shulman and Francisco Schmidberger.

Other launch partners include lead developer João Abrantes, writer Brandon F. Johnson, and A-list entertainment lawyer Jason Liberman. Advisors on the project also include NFT influencers and analysts, including iAmFuture, Preston Johnson (aka SportsCheetah formerly of ESPN and co-creator of PUNKS Comic), and members of The Last Slice collective.

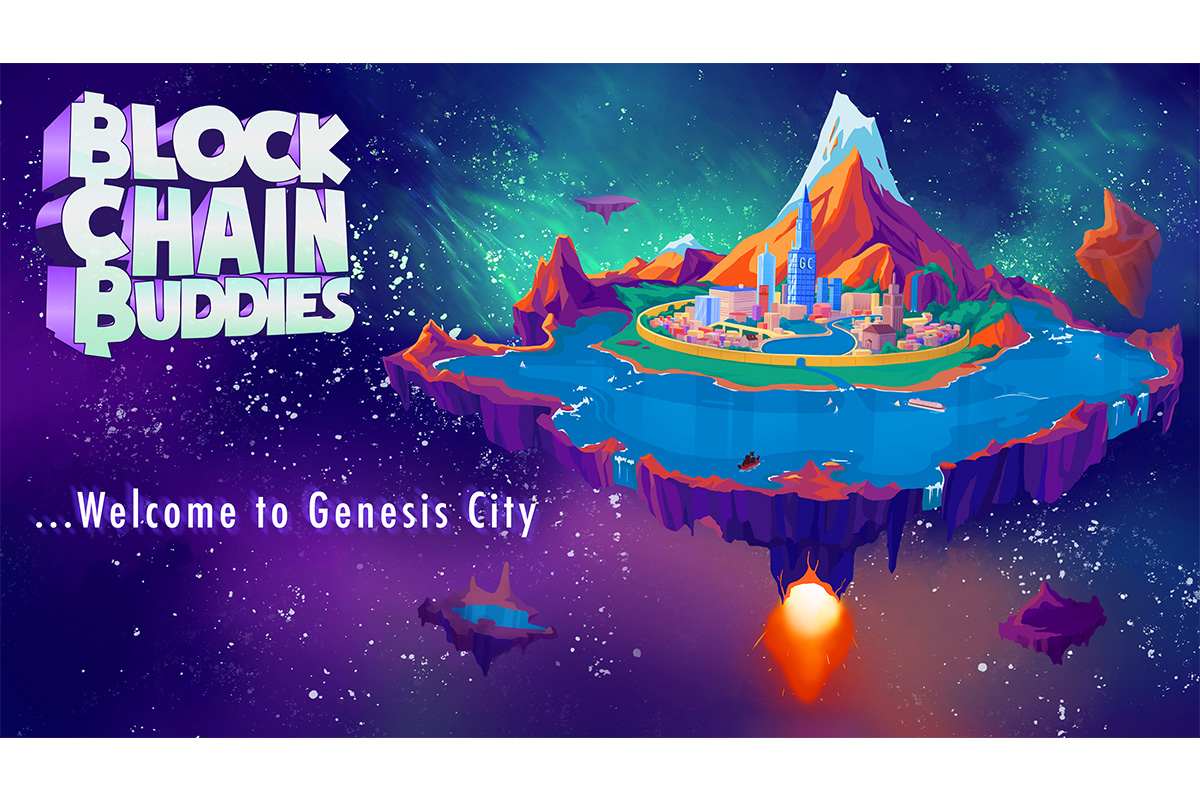

As part of the announcement, the Blockchain Buddies team has shared its first piece of concept art, showing the world of Genesis City where characters and other kinds of IP will live. Designed by YueTong Tsen, the piece will also be later auctioned off as a 1/1 NFT. The project launches with a discord channel led by veteran moderator Peachy. Additional details on the project will be released on social media via Twitter @BCB_NFT and discord (join here: https://discord.gg/A7QbDvUmtd) with an incentive structure for reveals. To start, the first Character Design illustration, done by Ashton Holmes, will be revealed as newcomers join the Blockchain Buddies Discord community. Additional reveals and updates will be forthcoming as the community grows–with giveaways, competitions, live events and more to come.

Lopes and Shulman previously created the first NFT marketplace with legal licensing and patent-pending smart contracts. Lopes is also the co-founder of LINK Agency, a TikTok-focused marketing firm that has generated over 3 billion organic impressions for its clients, while Shulman previously led go-to-market strategies for Sony PlayStation while a consultant at EY. Lopes graduated from Stanford’s MBA program and Masters in Physics Engineer from Tecnico, University of Lisbon, and Shulman has attended Columbia’s MBA program and graduated from Cornell University.

Cohen and Kieffer founded Confidential Creative in 2018 as a creative agency and production company specializing in animation. Positioned at the intersection of the music, television, video game, eSports, and film industries, the company develops, produces and promotes strategic animated content. Current and past clients include Journey, Maroon 5, NBCUniversal, Peacock Kids/DreamWorks TV, Jada Pinkett Smith’s “Red Table Talk” series, Interscope Records, P. Diddy’s Revolt TV, A&E/History Channel, eSports teams SK Gaming and Alliance, Kesha, Louis the Child, Brownies & Lemonade, lovelytheband and more. Their core team of artists come from across the world, which gives their content international flavor and maximizes its impact.

Abrantes was pursuing a PhD in Robotics and Artificial Intelligence at EPFL before switching paths to found Optimal Labs, a company on a mission to grow safer, healthier food by deploying fully autonomous indoor farms outside every city on earth. Optimal is backed by leading tech VCs, including Founders Fund, who backed companies such as SpaceX, Palantir and Square from the start. He has a Masters in Physics from Tecnico, University of Lisbon.

Liberman is an attorney and partner at The Corporate Practice based in Los Angeles. Known for his work representing A-list musical artists, he specializes in corporate and business transaction law, estate planning and employment law. Johnson is a screenwriter, animation director and experiential story creative developing slates of projects alongside talent, executives and production groups for streaming, film and interactive mediums. Johnson also operates as a Team Lead for Fiverr’s Community Growth Program, hosting events and fostering relationships between sponsors, freelancers and supporters of the Gig Economy.

Cohen and Kieffer are also known for their work with BEAR NFT, a full service NFT agency and Metavere PR and event production company, that they co-founded with Blake Berlinger and Joseph Schwartz. BEAR NFT spearheaded the first ever multi-artist live performance music and arts festival in Decentraland, “TO THE MOON,” which drew over 700 attedees in early July 2021 and featured performances and curated NFTs by Ookay, Win and Woo, Autograf, SNBRN, Fred Thurst (as Dr. Fresch). They also recently organized the premiere Decentraland Halloween party and concert, “NFTS ARE DEAD,” which drew over 1,000 attendees and featured a custom Hell-themed venue build and horror maze designed in conjunction with The Last Slice. BEAR NFT also handled marketing and press promotion for Banquet Labs’ noted Apollo 11-themed virtual activation in Decetraland, produced in partnership with the Aldrin Family Foundation, which featured the launch of a new spaced themed-fashion brand, including virtual wearables, by noted fashion designer Nick Graham.

Additional information on the Blockchain Buddies project can be found on their website or discord. Interested community members can also follow on social media on Twitter at @BCB_NFT for regular updates and announcements.

Blockchain

Halving weakness sees $206 million exit crypto funds, Bitcoin miners pivot to AI

Leading up to Friday’s Bitcoin (BTC) halving, investors opted to remain on the sidelines rather than increase their exposure to cryptocurrencies. CoinShares’ latest report on digital asset fund flows reveals that crypto funds experienced $206 million in outflows last week, while trading volumes for Exchange-Traded Products (ETPs) dropped to $18 billion.

James Butterfill, head of research at CoinShares, noted, “These volumes represent a lower percentage of total Bitcoin volumes (which continue to rise) at 28%, compared to 55% a month ago.” He attributed this decline in investor appetite to expectations that the Federal Reserve would maintain interest rates at elevated levels for a longer duration.

In terms of regional flows, the United States led the outflows with $244 million exiting incumbent ETFs by the week ending April 19. Butterfill highlighted that newly issued ETFs still received inflows, albeit at lower levels compared to previous weeks. Germany and Sweden saw outflows of $8.3 million and $6.7 million, respectively, while Canada experienced inflows of $29.9 million. Switzerland, Brazil, and Australia also witnessed inflows of $7.8 million, $5.5 million, and $2.2 million, respectively.

Butterfill observed that although Bitcoin saw outflows of $192 million, there were minimal flows into short-Bitcoin positions. Ethereum (ETH) experienced outflows of $34 million for the sixth consecutive week. However, multi-asset funds saw improved sentiment, attracting $8.6 million in inflows. Additionally, Litecoin (LTC) and Chainlink (LINK) received inflows of $3.2 million and $1.7 million, respectively.

The report highlighted that blockchain equities sustained their 11th consecutive week of outflows, totaling $9 million, as investors remained concerned about the halving’s impact on mining companies.

In a separate analysis of the post-halving crypto mining industry, CoinShares analysts suggested that many miners might transition to serving the artificial intelligence (AI) sector, which has become more lucrative. They anticipated a shift towards AI in energy-secure locations, potentially leading to Bitcoin mining operations relocating to stranded energy sites.

The analysts projected a 10% decline in the Bitcoin network’s hash rate after the halving as miners deactivate unprofitable ASICs. However, they expected the hash rate to reach 700 exahash (EH/s) by 2025. As of the current data, the Bitcoin hash rate stands at 596.22 EH/s.

The report also noted that substantial cost increases are anticipated due to the halving, with electricity and production costs nearly doubling. Mitigation strategies include optimizing energy costs, enhancing mining efficiency, and securing favorable hardware procurement terms. Miners are actively managing financial liabilities, with some utilizing excess cash to significantly reduce debt.

Source: kitco.com

The post Halving weakness sees $206 million exit crypto funds, Bitcoin miners pivot to AI appeared first on HIPTHER Alerts.

Blockchain

NYSE gauges interest in 24/7 stock trading like crypto

According to reports, the New York Stock Exchange (NYSE) is exploring the possibility of introducing round-the-clock trading, a model akin to that of cryptocurrency markets. In a bid to gauge market sentiment, NYSE’s data analytics team has circulated a survey among market participants. The survey seeks feedback on whether there is support for 24/7 or extended weekday trading hours and, if so, what measures should be implemented to safeguard traders against overnight price fluctuations. As of now, NYSE, alongside Nasdaq and the Chicago Board Options Exchange, operates from Monday to Friday, spanning from 9:30 am to 4:00 pm Eastern Time.

In the United States, assets like cryptocurrencies, United States Treasurys, foreign exchange, and major stock index futures are already tradable 24/7. Certain brokerages, such as Robinhood and Interactive Brokers, provide access to U.S. stocks throughout the week via a “dark pool” trading venue, catering to international retail investors during their local trading hours.

However, recent reports indicated that Robinhood suspended its 24-hour trading services amidst heightened tensions between Israel and Iran, prompting concerns among investors regarding the sustainability of continuous trading.

Effectively managing liquidity in a 24/7 trading environment has proven challenging for trading platforms within the cryptocurrency industry.

According to cryptocurrency research firm Kaiko, there’s often a mismatch between the operating hours of traditional financial institutions and the needs of major crypto traders and market makers. Traders frequently find themselves losing sleep during periods of extreme market volatility.

While the results of NYSE’s survey haven’t been revealed, Tom Hearden, a senior trader at Skylands Capital, conducted his own poll among his 19,300 followers, asking if they would support NYSE transitioning to 24/7 trading hours. Interestingly, over 70% of the 1,459 respondents voted “No.”

NYSE’s survey coincides with the efforts of startup firm 24X National Exchange, which is seeking approval from the Securities and Exchange Commission (SEC) to launch the first exchange in the country operating round-the-clock.

The FT said, citing two persons familiar with the subject, that the SEC has “months” to study the proposed rule change, and other relevant issues, such who should shoulder expenses and the function of clearing houses, are already being considered by other stakeholders.

“How loud they will be playing in the middle of the night is unknown to me. However, the decision of whether something is commercially feasible or not actually shouldn’t be made by the SEC, James Angel, a Georgetown University finance professor, told FT.

“I support letting the market make the decision. We’re all better off if it succeeds, and the exchange’s stockholders lose out if it fails.

After the company withdrew an application in March 2023, alleging operational and technological concerns, it is the second attempt to receive SEC clearance.

Source: cointelegraph.com

The post NYSE gauges interest in 24/7 stock trading like crypto appeared first on HIPTHER Alerts.

Blockchain

Online Banking Market to Grow at CAGR of 14.20% through 2033, Key Takeaways of Digital Banking, Banking Ecosystem, Financial Giants & Disruptive Startups

-

Blockchain Press Releases6 days ago

Blockchain Press Releases6 days agoCanaan Shines at Blockchain Life 2024 in Dubai

-

Blockchain6 days ago

Blockchain6 days agoQuantum eMotion Files a Patent for Quantum-based Blockchain Wallet Under the Patent Cooperation Treaty (PCT)

-

Blockchain Press Releases6 days ago

Blockchain Press Releases6 days agoBybit Institutional Report 2024: Institutions Become Bullish and Eye Challenger Chains, while VC Funding Resurges for Infrastructure, Gaming, and AI

-

Blockchain5 days ago

Blockchain5 days agoPhoenix Group Engages BHM Capital as Liquidity Provider to Boost ADX Liquidity and Enhance Market Dynamics

-

Blockchain6 days ago

Blockchain6 days agoElizabeth Warren Urges Treasury Secretary Yellen to Implement Strong AML/CFT Measures for Stablecoins

-

Blockchain Press Releases7 days ago

Blockchain Press Releases7 days agoBybit and Franck Muller Partner with Sidus Heroes to Launch Cosmic Gears: A Pioneering Web3 Game with a $250,000 Prize Pool and Exclusive Watch Collection

-

Blockchain5 days ago

Blockchain5 days agoCrypto fans count down to bitcoin’s ‘halving’

-

Blockchain5 days ago

Blockchain5 days agoTether USDT stablecoin goes live on TON blockchain