Blockchain

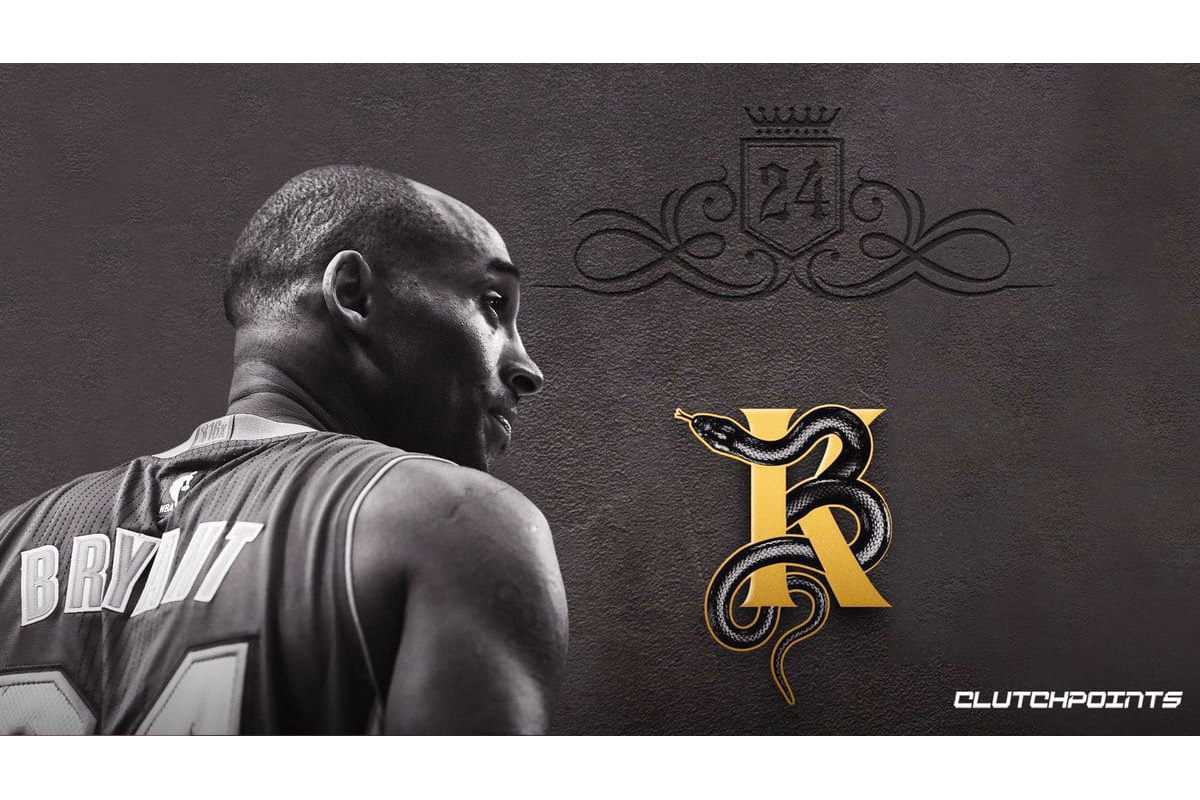

The Kobe Bryant KB24 NFT Art Collection to Donate All Proceeds to Mamba & Mambacita Foundation

The highly anticipated KB24 NFT art collection has opened for presale reservations to the general public and it’s sure to be the hottest, largest NFT drop in history. And, it’s all for a good cause.

The team behind The KB24 NFT collection is creating a new space for Kobe Bryant fans to memorialize the legend, while also contributing to a cause in his honor — the Mamba & Mambacita Sports Foundation, which was created by the Bryant family to honor Kobe and his daughter Gianna following their untimely death.

KB24.com was once Kobe Bryant’s official website, which he used to communicate directly with fans, to share news and thoughts on the game, to drop exclusive merchandise, and to hold a forum that brought fans together. It also allowed fans to sign up for Kobe Basketball Academy, his official camp.

For the last 4 years, the site had been taken and redirected to a malicious website, until the team behind The KB24 NFT purchased it a few months ago in an aftermarket sale for an undisclosed price.

“Without hesitation, we knew we had to take over the website and make something great out of it. We saw the opportunity to restore the integrity of Kobe’s official website and benefit his foundation forever.”

The KB24 Team’s goal for this project is solely for charitable purposes, as 100% of all proceeds and revenue from the sale of The KB24 NFT will be donated to the Mamba & Mambacita Sports Foundation. In addition, all residual fees on The KB24 NFT will be donated, such that if a fan ever sells their art, all of the residual fees of the sale price will automatically be donated to the foundation as well — something not possible with traditional charitable sales. KB24.com will make available a one-of-a-kind, limited edition NFT drop — The KB24 NFT — and will donate 100% of all proceeds to Mamba & Mambacita Sports Foundation, the nonprofit founded in memory of Kobe and Gianna Bryant.

The Mamba & Mambacita Sports Foundation is dedicated to creating a positive impact for underserved athletes by providing funding and sports programming to enable participation in school and/or league sports that enrich socio-economic and physical development. The foundation is also dedicated to Kobe and Gigi’s vision of creating a world where young women have equal opportunity to pursue their dreams through sports and life. The foundation honors their legacy by funding programs that support their vision. And KB24 seeks to aid in that mission.

Watching Kobe Bryant play was what his fans looked forward to most. His character, his love for the game, and his commitment to the craft inspired millions and millions of fans around the world. Kobe was their idol. Fans mimicked his work ethic, and even attempted to follow his biphasic sleep cycle. He inspired his fans to achieve their goals and aspirations, and to have the same resilience he did throughout his career. Now, through the KB24 NFT, fans can have a digital piece of that inspiration to hold onto forever.

“The NFT digital art market has exploded in the last year as crypto investors look to enter the space,” a representative from the KB24 team says. “The possibilities are endless and we want to utilize that momentum to help fund non profit organizations working with communities to foster their love for basketball and sports in general.”

As we enter the metaverse, the NFT world is one of the most interesting spaces to be in right now. Blockchain will be opening up the door for many more interesting projects that can help communities grow in ways not previously possible. The KB24 NFT, being at the forefront of this space, allows the KB24 team to experiment and create a project that will live on forever, and will positively impact kids and families through the Mamba & Mambacita Sports Foundation.

The KB24 NFT will be made available on Opensea, a platform which enables users to buy and sell directly on the marketplace using smart contracts. Users can buy and sell non-fungible tokens and crypto collectibles, which can include art and collectibles, gaming items, and other digital assets backed by blockchain.

Successful projects, such as the Bored Ape Yacht Club, Pudgy Penguins, and Crypto Kitties, sparked a vision for the KB24 team to take the concept and apply it on a larger scale. The KB24 NFT Collection plans to take these successful ideas and projects and use the utilized key concepts to create a one of a kind experience for Kobe Bryant fans. While simultaneously honoring the late athlete and donating proceeds directly to Bryant’s Mamba & Mambacita Foundation to create positive impacts for undeserved athletes and young women in sports. The KB24 NFT project hopes to serve as an example for what’s possible when traditional non-profit and charitable organization spaces are disrupted, and instead one-time events make a perpetual impact.

Every aspect of the KB24 NFT serves to highlight Kobe’s great achievements and have fans be a part of it. Each NFT will be 100% unique, with a combination of different attributes that represent Kobe’s achievements, moments in his career, and his personality. The KB24 NFT will allow Kobe fans to capture their favorite moments of the Lakers legend, and it will allow them access to the Kobe Wall that will be hosted publicly, allowing NFT holders to upload their favorite photo or tribute and to have it be viewed forever by fans owning their own digital assets. The NFT will be a first of its kind in honoring the legacy of Kobe Bryant.

The KB24.com website is currently taking reservations for the public pre-sale for the launch of the KB24 NFT collection. To join the community and receive updates, we recommend signing up on the KB24.com website and joining the community Discord for future updates.

Blockchain

Supply Chain Finance Market Forecast to Reach $9.4 Billion by 2029: Increasing Emphasis on Sustainable Sourcing

Global Supply Chain Finance Market

Blockchain

Web3 Startups Raise Nearly $1.9B in Q1 2024 Despite Overall Downtrend in Crypto VC Interest

Venture capital funding for cryptocurrency and blockchain projects has seen a notable resurgence in the first quarter of 2024, marking its first quarterly rise since 2021. Crunchbase data released today indicates that Web3 startups secured nearly $1.9 billion in funding across 346 deals during this period. This represents a substantial 58% increase from the previous quarter, offering a glimmer of hope amidst the ongoing downward trend in overall crypto VC interest.

The recent surge in funding can be attributed to investors adopting a more long-term perspective on Web3, as opposed to the hype-driven “tourist investors” predominant in recent years. Chris Metinko, the author of the report, notes that investors are shifting their focus to the AI sector, indicating a change in investment strategy. There is a growing interest in supporting the foundational infrastructure of the decentralized internet, rather than solely concentrating on crypto wallets and lending platforms, which attracted significant investments during the peak period of 2021 to 2022.

While large funding rounds were relatively uncommon in Q1, several notable investments stood out. Exohood Labs, a company integrating AI, quantum computing, and blockchain, secured a remarkable $112 million seed round at a valuation of $1.4 billion. EigenLabs, an Ether token “restaking” platform, raised $100 million in a Series B round led by a16z crypto. Additionally, Freechat, a decentralized social network leveraging blockchain technology, secured $80 million in a Series A round. These investments, among others, contributed to the increase in valuations and the emergence of four new Web3 unicorns in Q1.

Despite the recent progress, the future trajectory of Web3 remains uncertain. Metinko suggests that the next few quarters will be pivotal in determining the industry’s direction. While investors anticipate a rebound in investment as the decentralized internet evolves, it may take another year for venture capital activity to stabilize after the exuberance of 2021. Factors such as the approval of U.S. spot Bitcoin exchange-traded funds and the upcoming Bitcoin halving could also influence the market, given the rising prices of Bitcoin and Ether.

A noteworthy example of significant funding in the Web3 space is Monad Labs’ recent successful funding round, which secured $225 million led by Paradigm. Monad Labs is a layer-1 blockchain compatible with Ethereum, offering faster transaction processing. This funding round harkens back to the golden era of crypto funding in 2021-2022, when L1 solutions attracted substantial investments.

Earlier this year, Balance, a digital asset custodian based in Canada, announced that it had once again reached $2 billion in assets under custody (AUC) amidst the recent market recovery. Similarly, Korea Digital Asset (KODA), the largest institutional crypto custody service in South Korea, has experienced remarkable growth in crypto assets under its custody, expanding by nearly 248% in the second half of 2023.

Analysts at Bernstein Research project that crypto funds could reach an impressive $500 billion to $650 billion within the next five years, representing a significant leap from the current valuation of approximately $50 billion. This forecast underscores the growing optimism and potential for substantial growth within the crypto industry in the coming years.

Source: cryptonews.com

The post Web3 Startups Raise Nearly $1.9B in Q1 2024 Despite Overall Downtrend in Crypto VC Interest appeared first on HIPTHER Alerts.

Blockchain

ASIC cracks down on blockchain mining firms

Three blockchain mining companies – NGS Crypto, NGS Digital, and NGS Group – along with their directors, Brett Mendham, Ryan Brown, and Mark Ten Caten, are facing legal action from the Australian Securities and Investments Commission (ASIC) for allegedly operating without a license, in violation of Australia’s Corporations Act. ASIC initiated legal proceedings against these entities on April 9, citing concerns about their non-compliance with financial regulations and their solicitation of Australian investors.

According to ASIC, the NGS companies promoted blockchain mining packages with fixed-rate returns to Australian investors, encouraging the transfer of funds from regulated superannuation funds to self-managed superannuation funds (SMSFs) for conversion into cryptocurrency. Approximately 450 Australians invested a total of around USD 41 million in these packages, raising concerns about potential financial losses.

The legal action filed by ASIC alleges that the companies violated section 911A of the Corporations Act, which prohibits companies from providing financial services without a valid Australian Financial Services Licence (AFSL). ASIC is seeking interim and final court orders to prohibit the NGS companies from offering financial services in Australia without an AFSL.

ASIC Chair Joe Longo emphasized the importance of investors carefully considering the risks before investing in crypto-related products through their SMSFs. Longo stated that ASIC’s actions send a message to the crypto industry about the regulator’s commitment to ensuring compliance with regulations and protecting consumers.

In a separate development, the Federal Court appointed receivers for the digital currency assets associated with the NGS companies and their directors to safeguard these assets amid concerns about the risk of dissipation. Mendham was also issued a travel restriction order, preventing him from leaving Australia.

While a court date for the proceedings has not been set, ASIC’s investigation is ongoing, with the regulator continuing to gather evidence and build its case. It is worth noting that the investigated companies share a similar name with NGS Super, a legitimate Australian pensions provider, leading to potential confusion among investors. NGS Super clarified that it is not involved in selling cryptocurrency or related products and has taken legal action to protect its trademark and members’ interests.

Source: iclg.com

The post ASIC cracks down on blockchain mining firms appeared first on HIPTHER Alerts.

-

Blockchain4 days ago

Open-Source Intelligence (OSINT) Market is expected to reach a revenue of USD 64.9 Bn by 2033, at 25.6% CAGR: Dimension Market Research

-

Blockchain3 days ago

Blockchain3 days agoBlockchain Transforming Travel: Quantum Temple’s Innovative Venture

-

Blockchain Press Releases2 days ago

Blockchain Press Releases2 days agoBybit and Franck Muller Partner with Sidus Heroes to Launch Cosmic Gears: A Pioneering Web3 Game with a $250,000 Prize Pool and Exclusive Watch Collection

-

Blockchain3 days ago

Blockchain3 days agoBybit and World Leaders Forge Major Alliance to Direct Web3 for Social Good

-

Blockchain1 day ago

Blockchain1 day agoElizabeth Warren Urges Treasury Secretary Yellen to Implement Strong AML/CFT Measures for Stablecoins

-

Blockchain3 days ago

Blockchain3 days agoEvolution of the Blockchain World: Doric Blockchain Drives Education and Adoption of Blockchain Technology and Tokenization in Latin America

-

Blockchain1 day ago

Blockchain1 day agoQuantum eMotion Files a Patent for Quantum-based Blockchain Wallet Under the Patent Cooperation Treaty (PCT)

-

Blockchain Press Releases1 day ago

Blockchain Press Releases1 day agoCanaan Shines at Blockchain Life 2024 in Dubai